- Ethereum worth plunged 7%, buying and selling as little as $2,327 on Thursday after shedding the $2,500 psychological help.

- Ethereum bulls document $99 million LONG Liquidation losses, outpacing quick liquidations by 40%.

- With a demise cross now in play forward of Trump’s tariffs commencing on March 1, ETH worth dangers additional losses.

Ethereum worth tumbled 17% within the final 48 hours. With bear merchants assert dominance amid Bybit hack decision and looming U.S. tariffs, ETH faces additional draw back dangers.

Ethereum tumbles 5% after shedding important $2,500 help

Ethereum got here beneath intense promoting strain this week, because the lack of its $2,500 psychological help triggered a cascade of liquidations.

ETH slid as little as $2,327 on Thursday, wiping out current positive aspects and intensifying bearish sentiment.

This drop follows the decision of the Bybit hack, by which attackers—allegedly linked to North Korea’s Lazarus Group—stole over 400,000 ETH.

Initially, Ethereum held agency above $2,800 because the crypto group debated potential resolutions and their market implications.

Bybit responded swiftly, absolutely reimbursing buyer funds and returning over 100,000 ETH to companion exchanges like Binance and Bitget, which had offered emergency liquidity.

Nevertheless, Ethereum builders firmly rejected a rollback answer, leaving restoration efforts within the fingers of authorized authorities.

Additional dampening investor sentiment, on-chain information revealed that parts of the stolen ETH had been laundered via Solana-based memecoins.

This raised considerations {that a} full restoration of the hacked property may very well be complicated and drawn out, additional pressuring ETH’s worth.

Macroeconomic headwinds additionally contributed to Ethereum’s downturn. On Monday, U.S. President Donald Trump introduced new tariffs on Canadian and Mexican imports, fueling inflationary fears.

The mixture of rising uncertainty surrounding the Bybit hack and a risk-off sentiment pushed by U.S. commerce coverage offered a twin catalyst for Ethereum’s sharp breakdown.

Ethereum Value Evaluation | ETHUSDT, Feb 27

After falling from $2,800 on Monday, ETH/USD quickly plummeted by one other 7% on Wednesday after it misplaced the $2,500 help, touching $2,225 on Binance.

Zooming out this brings Ethereum’s losses to 17% within the final 48 hours.

At press time on Friday, ETH had opened buying and selling at $2,336, its lowest each day opening worth in over 150 days—courting again to October 2024.

With bearish strain persisting, merchants are watching carefully to see whether or not ETH can reclaim misplaced floor or if additional draw back awaits.

Brief merchants achieve higher hand as Ethereum liquidations cross $124 million

At press time, Ethereum seems to have stabilized round $2,300, however market uncertainty stays excessive.

The looming March 1 implementation of U.S. commerce tariffs might immediate additional risk-off conduct amongst traders.

Moreover, considerations persist over the potential affect of the Bybit hack proceeds on market liquidity, because the stolen ETH continues to flow into via laundering channels.

In derivatives markets, quick merchants are capitalizing on Ethereum’s current droop.

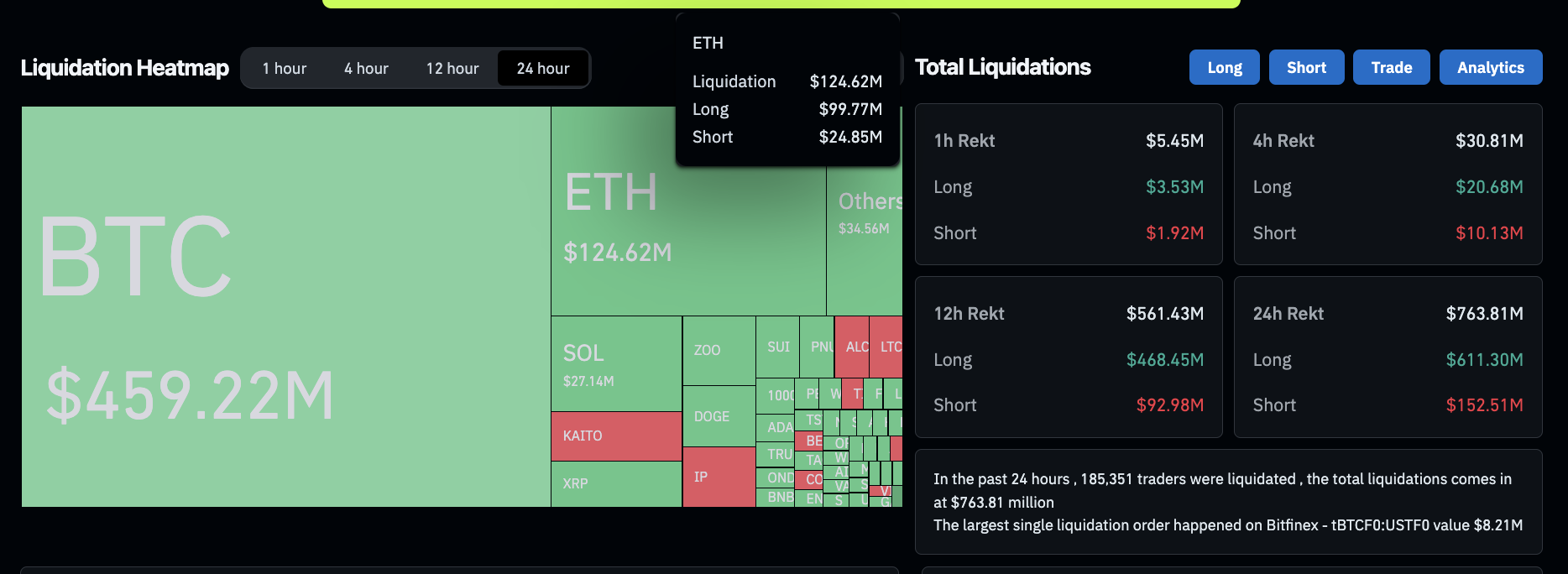

In line with Coinglass liquidation information, ETH liquidations surged to $124 million prior to now 24 hours.

Notably, lengthy merchants bore the brunt of the losses, accounting for $99.77 million in liquidations, whereas quick positions noticed simply $24.85 million liquidated.

Crypto market liquidations, Feb 27 2025 | Supply: Coinglass

Because of this lengthy liquidations outpaced quick liquidations by almost 75%, indicating that bearish merchants at present have the higher hand.

The imbalance means that many leveraged lengthy positions had been caught off guard, resulting in pressured sell-offs that exacerbated ETH’s worth decline.

With bearish sentiment nonetheless dominating the market, quick merchants might look to increase their benefit within the coming days.

If ETH fails to reclaim the $2,500 mark quickly, bears might proceed urgent their benefit, looking for additional draw back targets in pursuit of amplified income from leveraged quick positions.

Ethereum worth forecast: Bears might goal a retest of $2,100

Ethereum worth has prolonged its downward spiral, at present buying and selling at $2,326 after shedding over 18% prior to now three days.

The chart indicators a bearish continuation, with the formation of a demise cross—the place the 50-day easy transferring common (SMA) at $2,933 crosses beneath the 200-day SMA at $3,264—cementing the broader downtrend.

Traditionally, this crossover amplifies promoting strain, aligning with the current spike in quantity to three.16 million ETH, which suggests a capitulation section is underway.

Ethereum worth forecast

The selloff gained momentum after Ethereum misplaced help on the 100-day SMA, triggering a cascade of lengthy liquidations.

Consequently, ETH worth is now struggling close to $2,315, a stage that beforehand acted as a pivot in early January.

Failure to reclaim this zone might expose ETH to a retest of the $2,100 psychological threshold.

The Cash Move Index (MFI) at 37.28 signifies that promoting strain stays dominant however is not but in oversold territory, leaving room for additional draw back.

A bullish argument emerges if Ethereum manages a decisive reclaim above $2,400, invalidating the demise cross’s affect within the quick time period.

Given the historic tendency of Ethereum to pretend merchants out close to important help ranges, a pointy bounce might ensue if liquidity accumulates close to $2,300.

Nevertheless, and not using a sustained push past the 50-day SMA, any rebound dangers being a lifeless cat bounce throughout the broader bearish framework.