Sol Methods, a Canadian inventory exchange-listed firm, has filed with the US SEC to be listed on Nasdaq. The agency goals to commerce beneath the ticker title STKE. Sol Methods has been accumulating Solana (SOL) as a treasury asset. The corporate presently holds 420,355 SOL, price round $61.13 million.

Will We See Elevated Solana Buys?

Sol Methods has beforehand ditched its Bitcoin holdings to focus extra on SOL. The newest 40-F submitting with the SEC marks one other milestone for the corporate. The transfer highlights the agency’s rising confidence within the SOL community.

If the SEC approves the 40-F submitting, we might even see a rise in Solana (SOL) publicity for the corporate. The underlying asset will seemingly see a value bump if issues go in response to plan.

Solana (SOL) additionally has a number of spot ETF functions presently awaiting approval with the SEC. In keeping with Bloomberg ETF analyst James Seyffart, there’s a 90% likelihood that the SEC will approve a spot SOL ETF this yr.

The Asset Continues To Glow Pink Regardless of Bullish Developments

Solana (SOL) has seen fairly just a few bullish developments over the previous couple of days. VanEck lately registered its SOL ETF with the Depository Belief & Clearing Company (DTCC). SOL’s value doesn’t appear to maneuver regardless of the bullish setting across the asset.

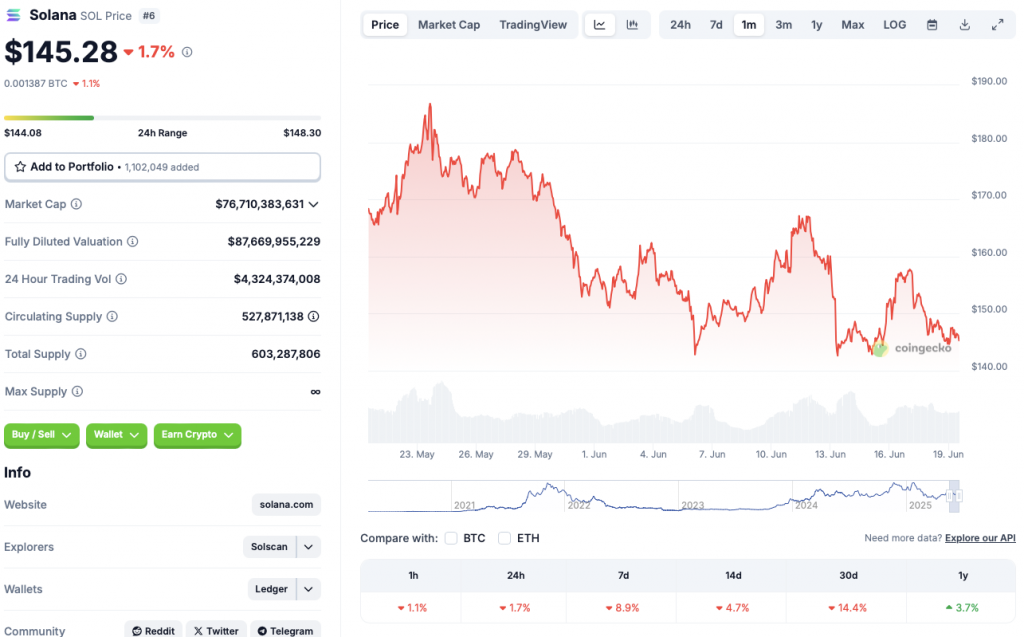

SOL is presently struggling to breach the $150 mark. The asset is down 1.7% within the every day charts, 8.9% within the weekly charts, 4.7% within the 14-day charts, and 14.4% over the earlier month.

Whereas the present dip is regarding, Solana (SOL) has confirmed to be fairly a resilient cryptocurrency over the previous couple of years. The asset’s value had fallen to under $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL has hit a number of all-time highs. The asset might get well from its present predicament if market sentiment rebounds.