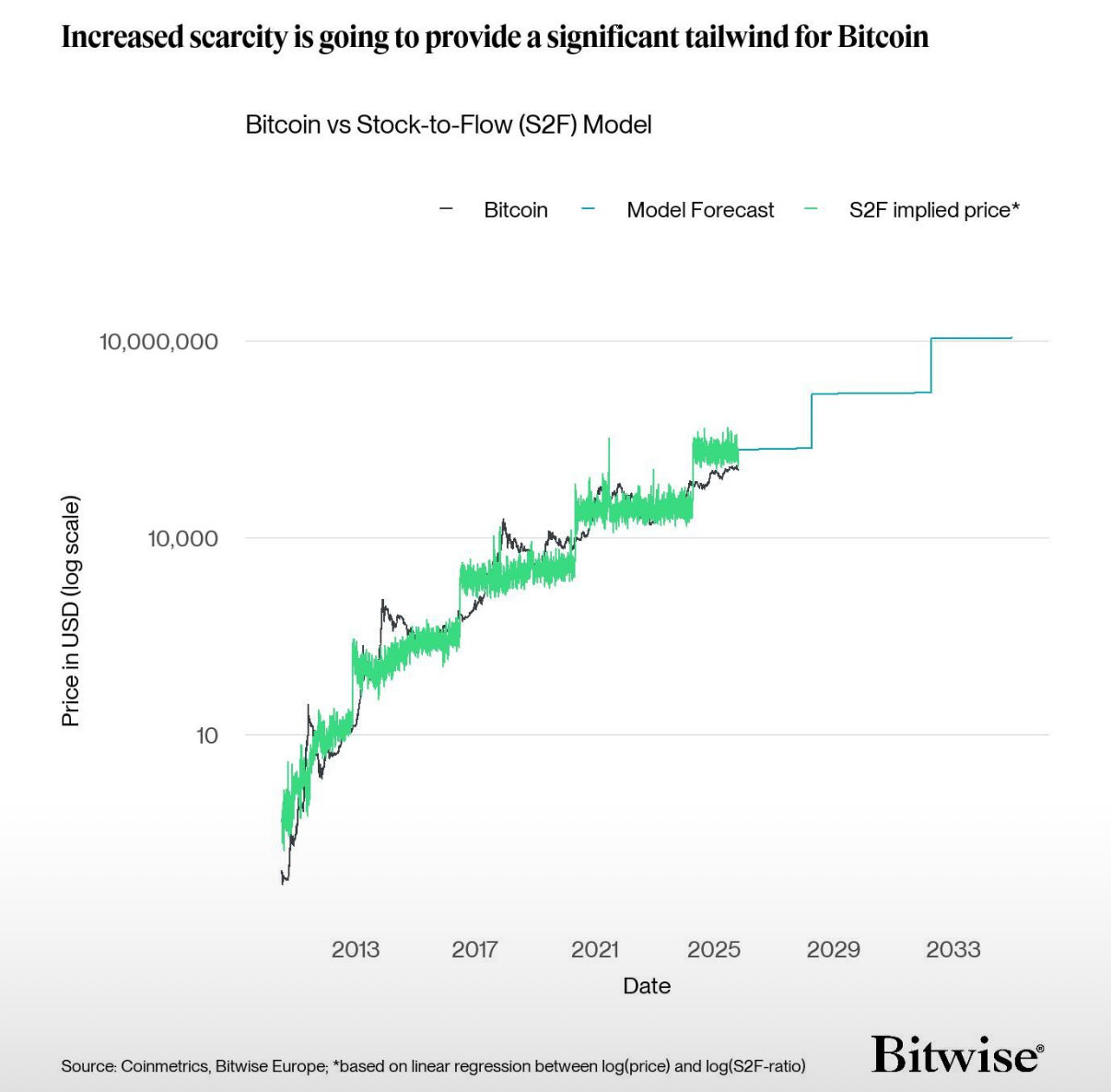

Bitcoin’s (BTC) Inventory-to-Movement (S2F) mannequin, some of the broadly cited BTC valuation frameworks, forecasts a peak value of $222,000 throughout this market cycle, however buyers ought to train warning when utilizing the mannequin, based on André Dragosch, the European head of analysis at funding agency Bitwise.

The Inventory-to-Movement mannequin doesn’t bear in mind demand-side components, and as an alternative, facilities its value modeling on Bitcoin’s halvings, which scale back the quantity of newly issued BTC by half each 4 years, Dragosch stated. He added:

“At this time, institutional demand through Bitcoin exchange-traded merchandise (ETPs) and treasury holdings outweighs the annualized provide discount from the most recent Halving by greater than seven instances.”

Precise BTC costs vs the implied value from the S2F mannequin. Supply: André Dragosch

Change-traded funds, ETPs, and different Bitcoin funding automobiles have created a value ground for BTC, supporting costs above the $100,000 degree.

Crypto Traders and analysts proceed to debate the worth of Bitcoin throughout the present market cycle and whether or not BTC has topped out, or nonetheless has room to run, because the market construction matures as a result of presence of institutional buyers.

Associated: Worst Uptober ever? Bitcoin value dangers first ‘pink’ October in years

Analysts debate how excessive BTC can go on this market cycle

Bitcoin can nonetheless attain $200,000 by the top of 2025, based on Geoff Kendrick, the worldwide head of digital belongings analysis at Commonplace Chartered, a pro-crypto financial institution.

The flash crash in October that took BTC all the way down to below $104,000 would possibly current a shopping for alternative for buyers, who may drive BTC to new highs.

Different analysts forecast a BTC value as a lot as $500,000 in 2026, pushed by an explosion of the M2 cash provide, a metric monitoring the entire quantity of US {dollars} in existence globally.

Larger M2 is seen as a bullish catalyst for BTC, because the liquidity from the elevated cash provide flows into belongings, elevating costs.

Nonetheless, crypto business executives like Tom Lee, the CEO of funding analysis agency FundStrat, and Mike Novogratz, the CEO of crypto funding firm Galaxy Digital, disagree.

Novogratz stated that $250,000 by the top of 2025 is unlikely to materialize except “loopy stuff” occurs, whereas Tom Lee warned {that a} 50% BTC drawdown can nonetheless happen regardless of institutional adoption.

Journal: Bitcoin to see ‘yet another massive thrust’ to $150K, ETH stress builds: Commerce Secrets and techniques