For a yr, Ethereum, the second largest blockchain, has lived within the shadows of its opponents, as cryptocurrencies like bitcoin and solana jumped in value and dominated the dialog. Amid criticism from buyers and a few group members, ETH languished at ranges under $1500 as just lately as April.

However on Monday ETH was close to $3800, up 13% year-to-date, and analysts pointed to quite a few indicators of a turning level for the mission.

Some have identified that the momentum of the ecosystem has returned partially because of the explosion of stablecoins and tokenization on Ethereum.

“For establishments seeking to get publicity, Ethereum is the first on-chain possibility, main in real-world asset (RWA) tokenization with $7.8 billion in tokenized belongings, or almost 60% of the whole RWA market cap,” stated Jake Koch-Gallup, a analysis analyst at Messari, to CoinDesk.

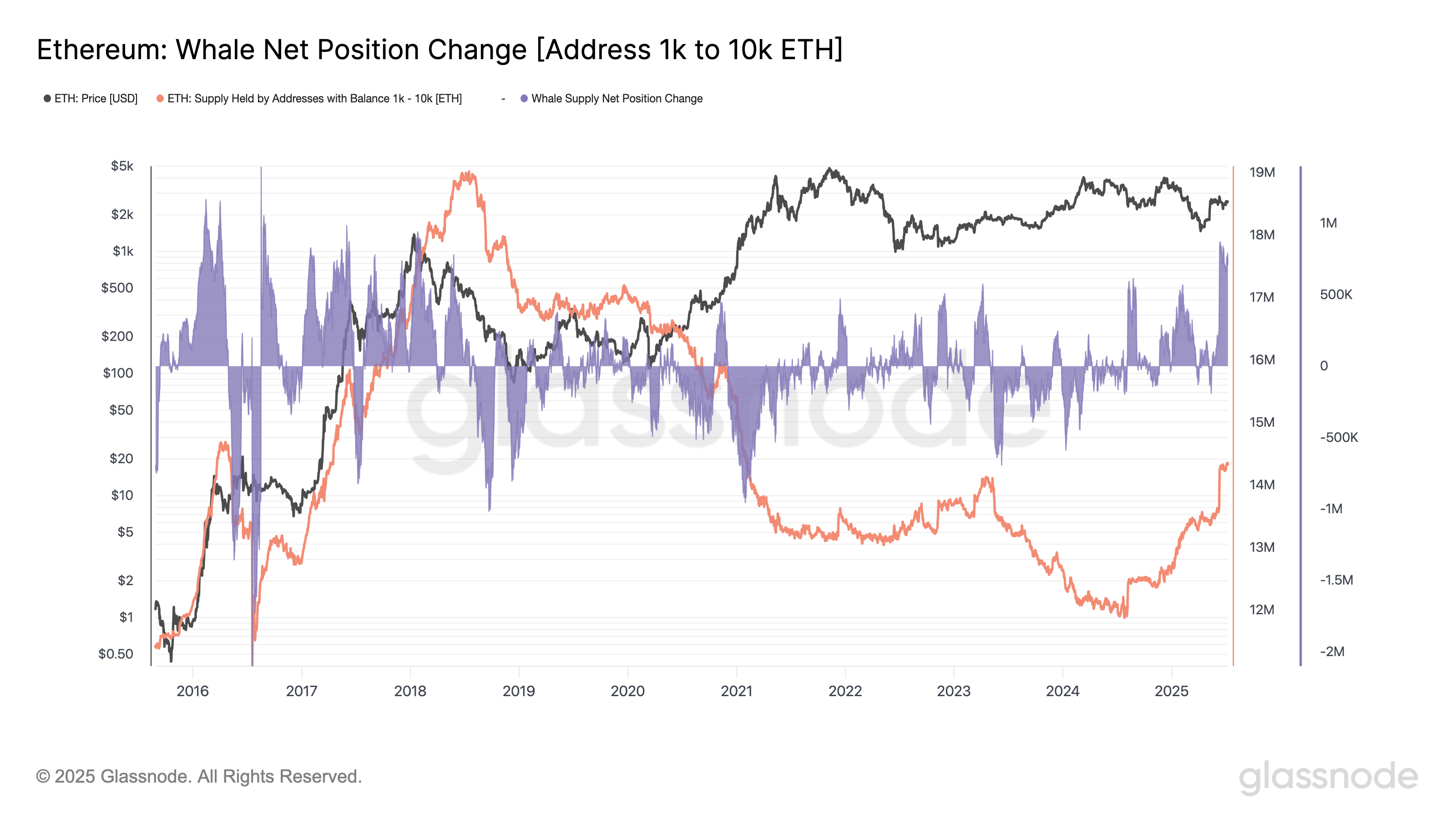

As of the start of July 2025, Whales with addresses that maintain between 1,000-10,000 in ETH have elevated their holdings of the token, in response to information from Glassnode. Collectively they maintain about 14 million ETH models, up from roughly 12 million on the finish of 2024.

Whales information of ETH holdings July 2025 (Glassnode)

Vivek Raman, who based Etherealize and spends his time talking with establishments to market ETH as an asset class, believes that ETH must be seen like BTC as “a retailer of worth,” evaluating it to “digital oil.”

The layer-2 ecosystem, that are auxiliary blockchains atop of Ethereum used to transact for sooner and cheaper, have appeared en masse over the previous few years, and establishments have began to additionally construct with them. JP Morgan just lately introduced they launched a proof-of-concept for tokenizing their deposits on Coinbase’s Base chain, whereas Robinhood, the retail buying and selling big, shared its plans to construct its personal layer-2 with the Arbitrum stack. If it really works, it might convey Ethereum’s expertise to a good broader mainstream viewers and deepen its place because the spine for a brand new era of economic purposes.

Some imagine layer-2 networks have been taking away worth from the Ethereum base layer and making person expertise extra disconnected, however Raman argues that establishments view them otherwise. Based on Raman, the customizability of a layer-2 community is a plus for these establishments.

“You could be a landlord and get entry to the liquidity of Ethereum,” stated Raman in an interview. “So the validation of the L2 ecosystem is now fairly plain.”

Koch-Gallup, at Messari, believes that protocol modifications that improve the scaling of Ethereum as a base layer will place the community properly for the longer term.

“A 100-1,000x throughput soar collapses fuel charges, reopens the house for consumer-grade apps, and refutes the “L2s are consuming the L1” narrative,” he stated. “Concurrently, greater blocks and extra exercise feed again into base-fee burn, tightening ETH’s provide in periods of excessive demand.”

Ethereum can be benefitting from the company treasury pattern, with a rising variety of firms adopting ETH as a strategic treasury asset. That’s, not only for holding, however for staking to generate yield, signaling a shift from conventional treasury methods, typically restricted to money or bitcoin, to 1 that leverages Ethereum’s staking rewards, programmability, and integration into DeFi and stablecoin ecosystems.

SharpLink Gaming, a NASDAQ-listed sports activities betting agency, BitMine, and BitDigital, each crypto mining corporations, have all shifted their crypto treasury methods to this.

“SharpLink Gaming (SBET) noticed its inventory value [rise 412%] after saying its ETH treasury technique, displaying there’s a transparent market urge for food for publicly traded firms holding ETH on their stability sheets,” Koch-Gallup advised CoinDesk. The corporate is chaired by Joseph Lubin, one of many founders of Ethereum.

BitMine, which just lately noticed Wall Road persona Tom Lee be a part of, additionally shared that it holds over 300,000 ETH in its treasury.

“Collectively, these tendencies counsel a deeper institutional re-rating of Ethereum, not simply as infrastructure, however as a yield-bearing, balance-sheet-worthy asset and a directional guess on the way forward for on-chain finance,” Koch-Gallup stated.

Learn extra: The Node: Is Ether Again From the Useless?