This can be a section from the Empire e-newsletter. To learn full editions, subscribe.

After I discuss to of us about success tales in crypto, Hyperliquid is commonly the frequent reply.

“Over the previous three months, the platform has averaged $6.4 billion in day by day buying and selling quantity, which sits simply above 50% of the day by day buying and selling volumes of Bybit and OKX,” Blockworks Analysis’s Boccaccio wrote in a current report.

“As of right this moment, the BTC OI [open interest] on Hyperliquid sits at $1.4B, which is 15% of Binance ($9.2B), 46% of OKX ($3B) and 25% of Bybit ($5.6B),” Boccaccio wrote.

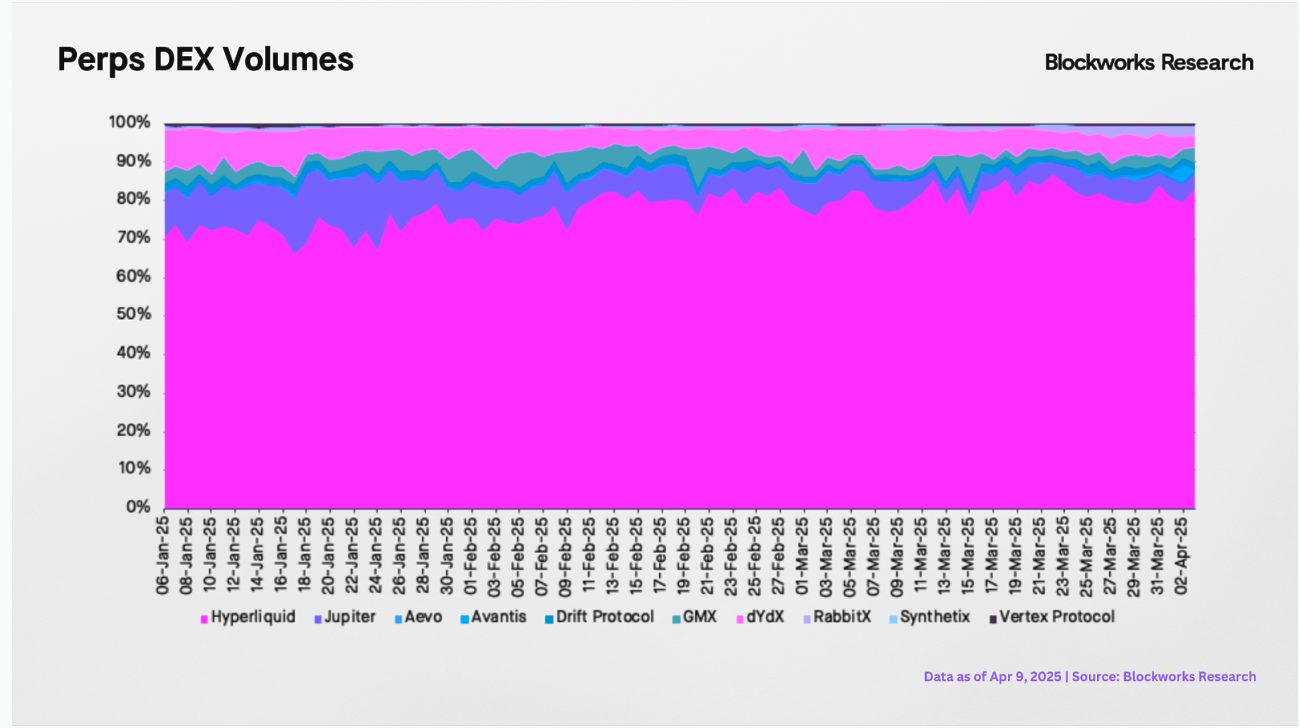

To place that into perspective, Jupiter Perps — the closest competitor to Hyperliquid — averages $704 million in day by day buying and selling quantity, 88% decrease than Hyperliquid.

A take a look at perps DEX volumes throughout the board.

Boccaccio additionally famous that Hyperliquid’s UX and skill to checklist standard tokens shortly have helped enhance its recognition.

Hyperliquid’s core companies are HyperCore (the order guide trade) and HyperEVM (the EVM community). Proper now, HyperCore is the dominant enterprise, with a valuation of $11.2 billion to HyperEVM’s $61 million.