The Bitcoin mining trade is on the point of a serious transformation in 2025, with the partnership between the Trump household and Hut 8 alongside Tether’s ambition to turn out to be the world’s largest mining firm by year-end.

This reshapes the Bitcoin mining sector and opens up sturdy progress prospects for 2025. Nonetheless, success will depend upon expertise, coverage, and the power to adapt to market fluctuations.

Bitcoin Mining Will Hit New Heights in 2025

Within the newest growth, Tether CEO Paolo Ardoino has declared plans to deploy 450 MW of mining capability by year-end, focusing on 1% of the worldwide hashrate. This aim is supported by the monetary basis of USDT, with a market cap of 157 billion USD. Beforehand, the corporate had deliberate to launch its Bitcoin Mining OS (MOS) as open-source software program by This fall 2025.

“Additionally plenty of small/mid sized companies that produce their electrical energy (photo voltaic, …) will quickly begin mining with the surplus. MOS will make their life simpler.” Paolo Ardoino shared.

Tether’s announcement comes as Bitcoin’s hashrate sank to an 8-month low of 684.48 EH/s, the bottom since October 2024, with mining issue anticipated to lower by 9.5% from 126.41T to 114.40T on June 29, 2025, based on CoinWarz. The disruption in Bitcoin mining coincides with US army actions in Iran.

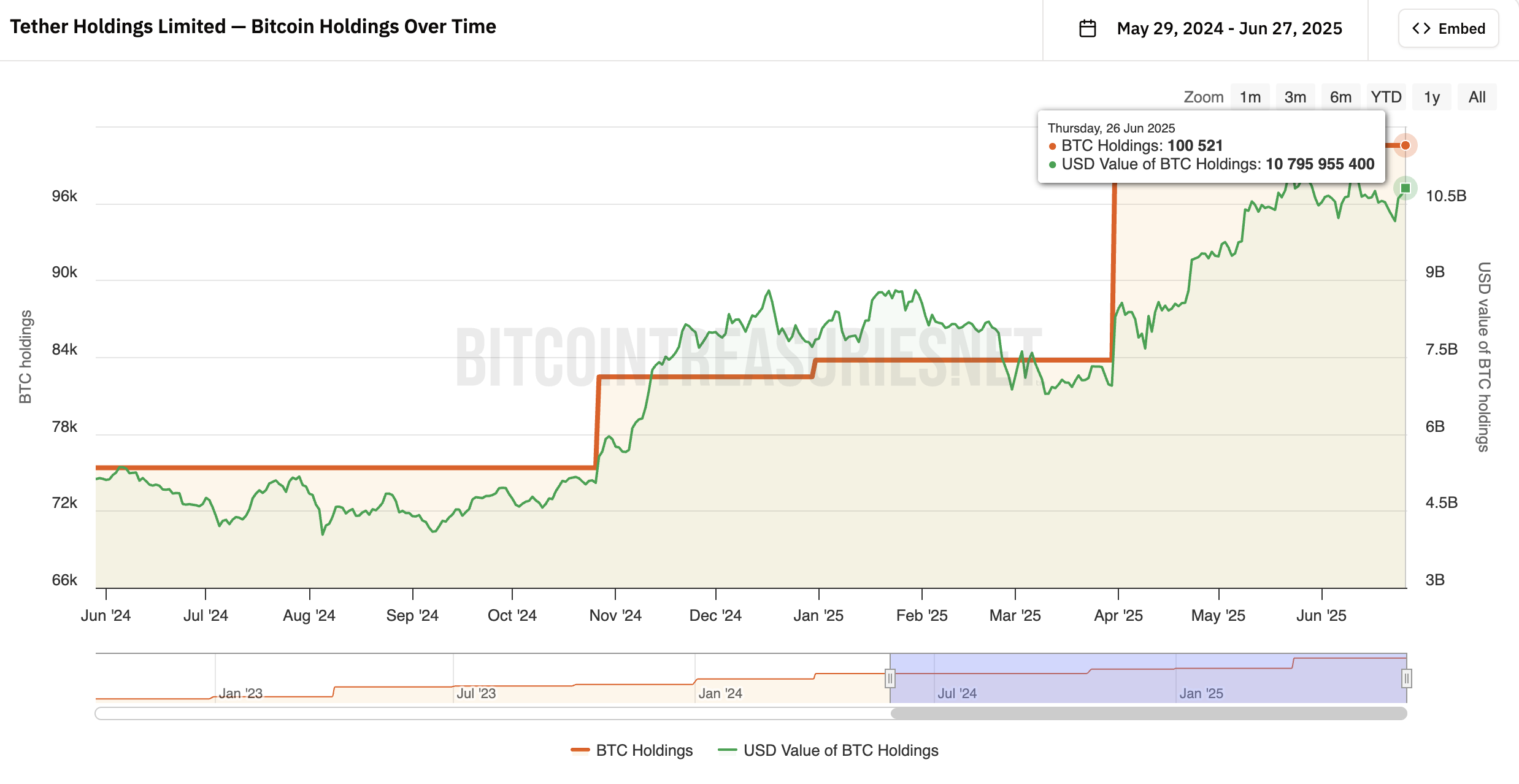

Tether’s BTC Holdings. Supply: Bitcoin Treasuries

In response to information from Bitcoin Treasuries, Tether at the moment holds over 100,000 Bitcoin (BTC), which is valued at roughly $10.8 billion. That is sparking fierce competitors, accelerating the centralization development as massive firms outpace particular person miners.

Consequently, Bitcoin miners are promoting off shares to keep up upward momentum amid rising market instability, as reported by BeInCrypto.

Earlier, on March 31, 2025, Hut 8, a number one infrastructure mining firm, partnered with American Bitcoin, co-founded by Donald Trump Jr. and Eric Trump, to leverage Donald Trump’s public assist for cryptocurrencies.

This collaboration brings new capital and expertise, probably including 5-10 EH/s to the worldwide hashrate, which is essential as mining prices have risen over 34% in Q2/2025 resulting from hovering electrical energy costs, as beforehand reported by BeInCrypto.

Benefits and Challenges

Technically, the involvement of Hut 8 and Tether may sluggish the issue discount if hashrate recovers shortly, because of superior applied sciences like Hut 8’s optimized cooling techniques that cut back power prices.

Concurrently, crypto-friendly insurance policies that Trump would possibly push if re-elected, together with tax incentives, may assist this progress. Tether can be investing $1 billion in inexperienced mining infrastructure in El Salvador, aligning with international sustainability traits.

Nonetheless, based on the EIA, challenges stay vital as industrial electrical energy demand within the US rises, which places stress on miners, benefiting large-scale operators like Hut 8 and Tether resulting from economies of scale.

With Bitcoin steady at $105,000 and the US inventory market declining, the mining trade faces a serious alternative, however success hinges on price administration and regulatory compliance.