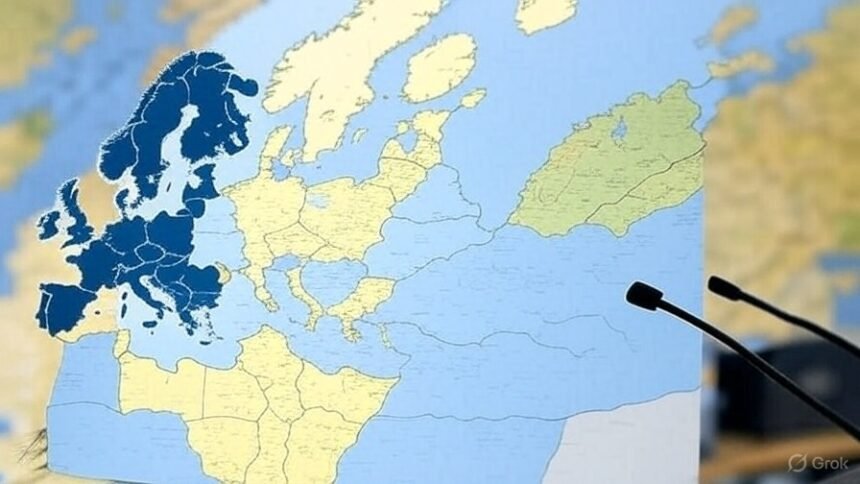

The European Fee prepares to current a brand new information to manage the Stablcoins market, based on reviews from the Monetary Occasions of individuals knowledgeable about its content material.

The initiative has generated friction with the European Central Financial institution (ECB), based on the informants. Regardless of the warnings of the financial company in regards to the attainable dangers that these property characterize for monetary stability, Brussels appears decided to maneuver ahead.

These anticipate that the European Union company plans Suggest that stablecoins emitted outdoors the eurozone might be thought of interchangeable with licensed equal variations inside the blockoffered they correspond to the identical broadcast or come from the identical operator.

The president of the ECB, Christine Lagarde, warned earlier than the European Parliament that Stablecoins anchored to the US greenback characterize a threat to the financial coverage of the euro and monetary stability international. And highlighted the significance of building strong requirements, particularly after they function at a cross -border stage, to keep away from strengthening the mastery of america foreign money.

The ECB signifies that, in excessive volatility situations, the holders of Stablecoins issued outdoors the European Union might attempt to redeem their property inside the group’s monetary system, which might exert stress on the reserves and, in the end, on the block banks.

In accordance with the rules in pressure within the European Union, Stablecoins issuers inside the territory should keep most of their reservations in European banks and make sure that customers can redeem their tokens straight for Fíat cash.

To cut back the dangers, the European Central Financial institution raised The necessity for different nations to grant authorized ensures that permit the efficient switch of reserves to the European Union in case of disaster. This measure seeks to forestall, earlier than a run on overseas stablcoins, supporting property are out of the management of European supervisors.

Nevertheless, throughout a closed door assembly this month, it was confirmed that there aren’t any bilateral or multilateral agreements between the European Union and different jurisdictions that acknowledge their rules as equal or that facilitate the implementation of mentioned ensures.

Whereas the European Union progresses within the regulation of Stablecoins, vital legislative actions are additionally registered in america. As cryptootics reported, The Senate authorised the genius legislation with broad bipartisan help.

The Genius legislation proposes to demand that Stablecoins emitters keep whole help in US {dollars} or equal liquid property, along with present process periodic audits to ensure transparency and security.

Senators Invoice Hagerty and Tim Scott, essential drivers of the legislation, spotlight that The initiative seeks to strengthen United States management within the digital monetary sector and strengthen the position of the greenback as a worldwide reserve foreign money.

In accordance with Hagerty, the mission won’t solely facilitate the large adoption of Stablecoins within the conventional financial system, but in addition might place its emitters as a number of the best holders of American treasure bonds by 2030, which might contribute to strengthening the nation’s fiscal resilience.

(Tagstotranslate) cryptocurrencies