Ethereum has cracked beneath a key assist stage of $2,200, reinforcing the bearish temper and triggering warnings of a possible drop to $1,250.

Ali Martinez, a well known analyst, highlights that Ethereum’s breakdown from a parallel channel alerts a possible decline to $1,250 if downward momentum persists.

Following Ethereum’s fall to $1,840, analysts have recognized essential assist zones at $1,640 and $1,250. If the promoting stress doesn’t let up, ETH might plummet additional towards that $1,250 goal, a stage that aligns with historic assist and Fibonacci retracement ranges.

#Ethereum $ETH targets $1,250 after breaking out from this parallel channel! pic.twitter.com/XS3N9p8Unr

— Ali (@ali_charts) March 14, 2025

Is There a Worth Flooring in Sight?

Based on Glassnode, Ethereum’s Price Foundation Distribution (CBD) has elevated from 1.6 million to 1.9 million ETH on the $1,886 stage. This rise in provide at a particular worth level suggests potential accumulation by traders.

Including to the combined alerts, a customized Capitulation Metric, which integrates CBD and Realized Loss information, highlights rising capitulation stress available in the market. These indicators recommend that ETH might discover non permanent assist round $1,886 earlier than deciding its subsequent transfer.

Associated: ETH Plunges 13.40%, Then Whipsaws: $330M in Liquidations—Worth Evaluation

Shopping for Alternative for Lengthy-Time period Holders

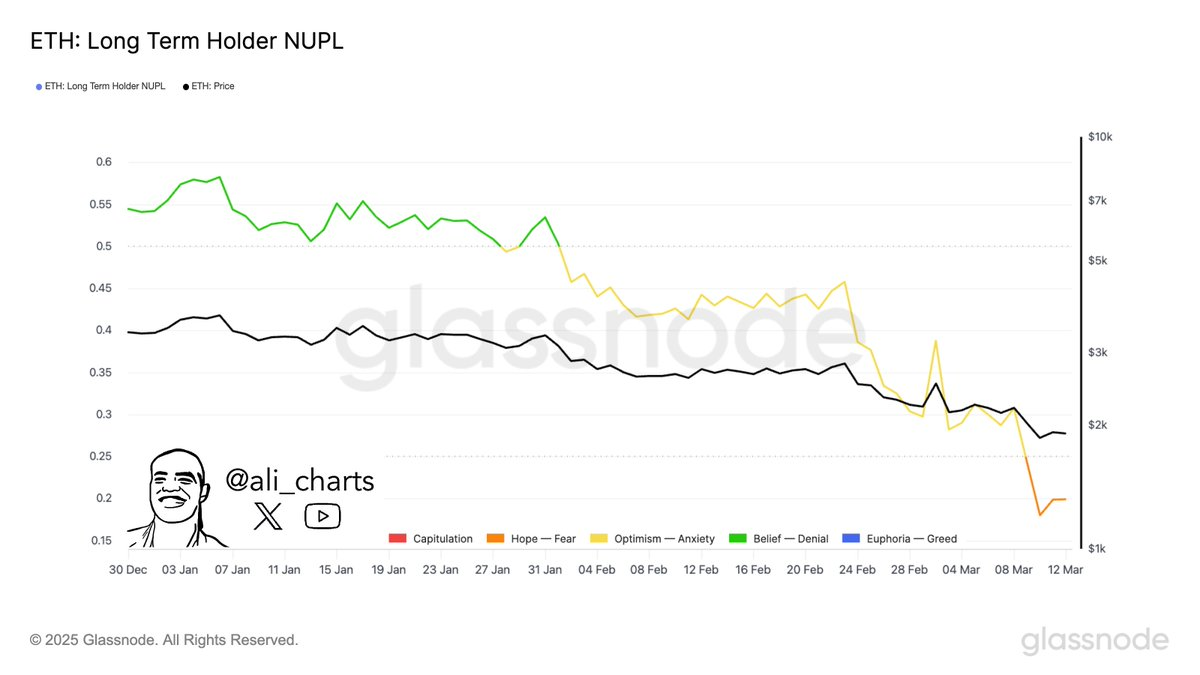

Ali Martinez additionally factors to the Ethereum Lengthy-Time period Holder Internet Unrealized Revenue/Loss (NUPL) metric, which is now within the worry zone. This displays long-term traders dumping their holdings as ETH declines beneath $2,000.

Supply: X

Traditionally, such fear-driven sell-offs have created prime accumulation alternatives. When investor sentiment shifts, Ethereum might expertise a powerful rebound, mirroring previous restoration patterns. The query is: will sufficient consumers step in to cease the bleeding?

Technical Indicators Verify Bearish Development

ETH/USD each day worth chart, Supply: TradingView

As of press time, the worth at present sits at $1,930.19, a 3.08% restoration prior to now 24 hours however an general 11.82% decline over the previous week.

The Relative Energy Index (RSI) is at 35.68, indicating that ETH is approaching oversold situations. This means potential shopping for curiosity at decrease ranges, however with out a reclaim of misplaced assist zones, short-term upside stays restricted.

Associated: Ethereum (ETH) Change Exodus: 600,000 ETH Withdrawn — Provide Squeeze Indicators Potential Worth Surge

Ethereum’s MACD (Transferring Common Convergence Divergence) stays in unfavourable territory. The MACD line sits at -209.5, beneath the sign line at -195.4, confirming the continuing bearish momentum. A constructive shift in these indicators can be essential for any reversal. Till then, merchants ought to look ahead to reactions at these key assist ranges – $1,640 and $1,250.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t accountable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.