Ethereum is struggling to reclaim momentum after a pointy 6% drop within the final 24 hours pushed the altcoin king again from the important $3,000 barrier.

The extent has acted as each psychological and technical resistance, and the newest rejection comes at a time when a few of Ethereum’s most influential holders are pulling again.

Ethereum Holders’ Provide Drops

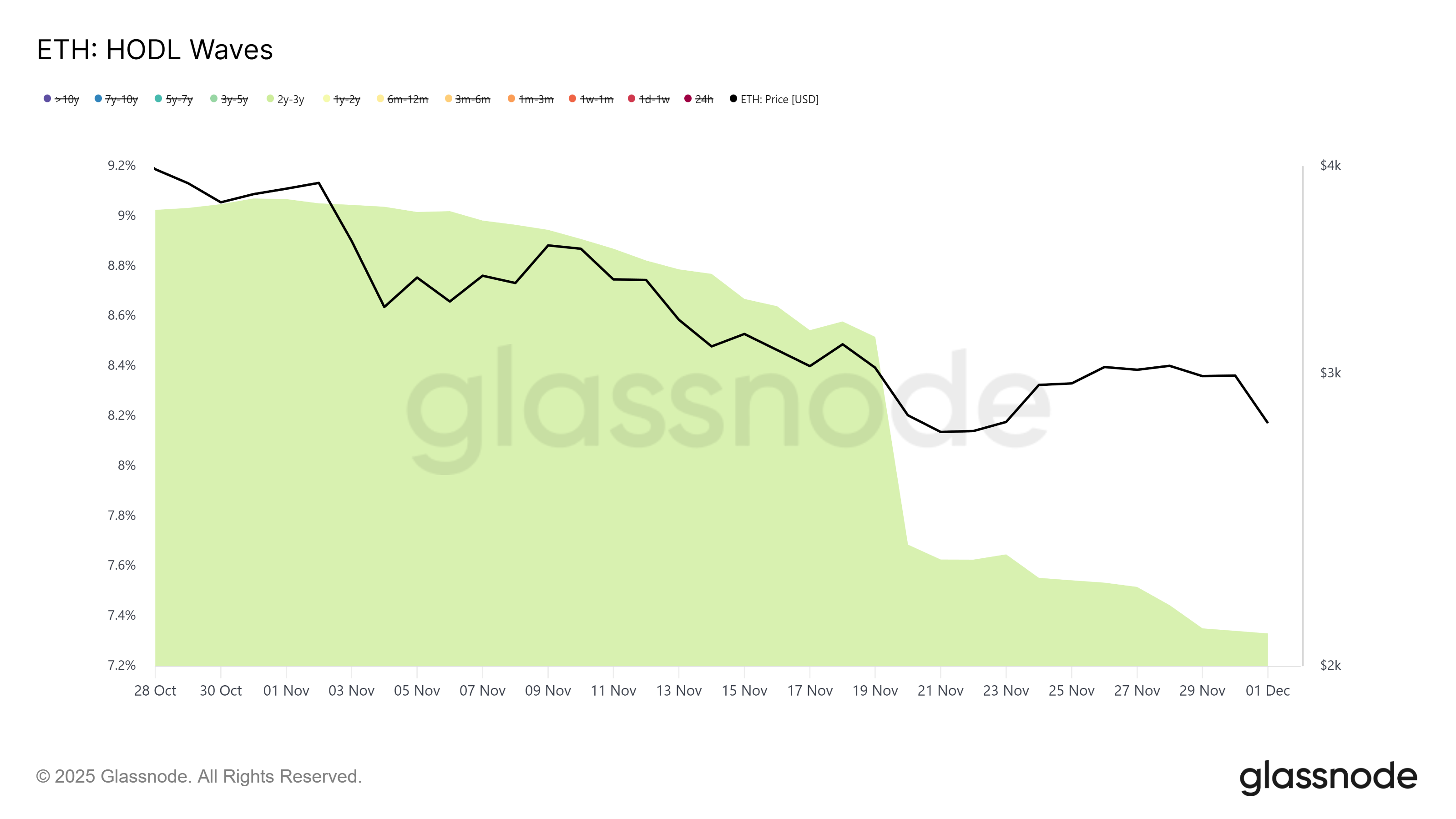

HODL Waves knowledge exhibits that Ethereum’s long-term holders (LTHs) have been offloading their property since early November. This promoting stress intensified round November 19, resulting in a significant discount within the provide managed by the 2-to-3-year cohort. Their share of the circulating provide dropped from 8.51% to 7.33%, a transparent signal that this group moved to offset losses and scale back threat publicity.

On condition that LTHs are usually probably the most secure members within the Ethereum ecosystem, their promoting has had a direct affect on value efficiency. Extra importantly, their positions haven’t recovered because the sell-off, making a provide hole that new buyers might want to fill if ETH is to regain upward momentum.

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

Ethereum HODL Waves. Supply: Glassnode

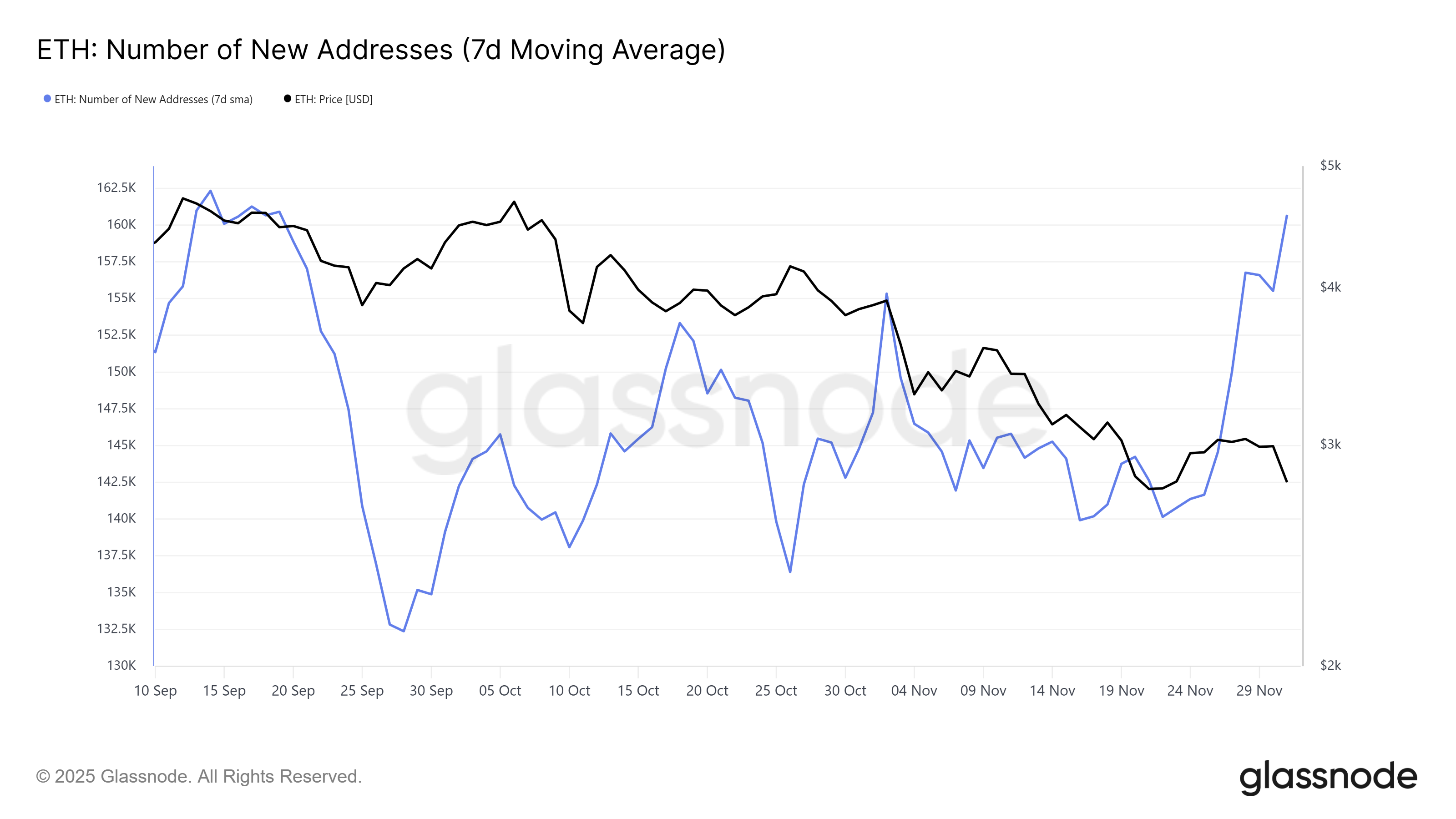

Thankfully, Ethereum is seeing encouraging indicators of recent demand. Over the previous seven days, new addresses on the community have surged 13.4%, rising from 141,650 to 160,690. This marks the strongest weekly leap in additional than two and a half months and indicators contemporary investor curiosity regardless of the current correction.

New addresses typically translate into new capital flowing into the market, which is important for Ethereum because it makes an attempt to stabilize above key assist ranges. Nevertheless, sustaining this development is important. If the inflow of recent holders slows, the market might not be capable of compensate for the lacking LTH participation.

Ethereum New Addresses. Supply: Glassnode

ETH Value Is But To Discover A Course

Ethereum is buying and selling at $2,805 on the time of writing, reflecting a 6% every day decline. The asset is sitting slightly below the $2,814 resistance degree after its newest failed try to interrupt by way of $3,000.

Based mostly on present sentiment and market construction, ETH might stabilize and try a rebound, however a robust restoration would require constant investor assist. Within the close to time period, Ethereum will seemingly fluctuate between $2,814 and $3,000 because it searches for course.

ETH Value Evaluation. Supply: TradingView

If bullish momentum strengthens and contemporary demand stays regular, Ethereum might lastly break above the $3,000 barrier. A profitable breach would pave the way in which for a transfer towards $3,131 and doubtlessly $3,287. This may invalidating the short-term bearish thesis.

The put up Ethereum Struggles Under $3,000 as Lengthy-Time period Holders Money Out appeared first on BeInCrypto.