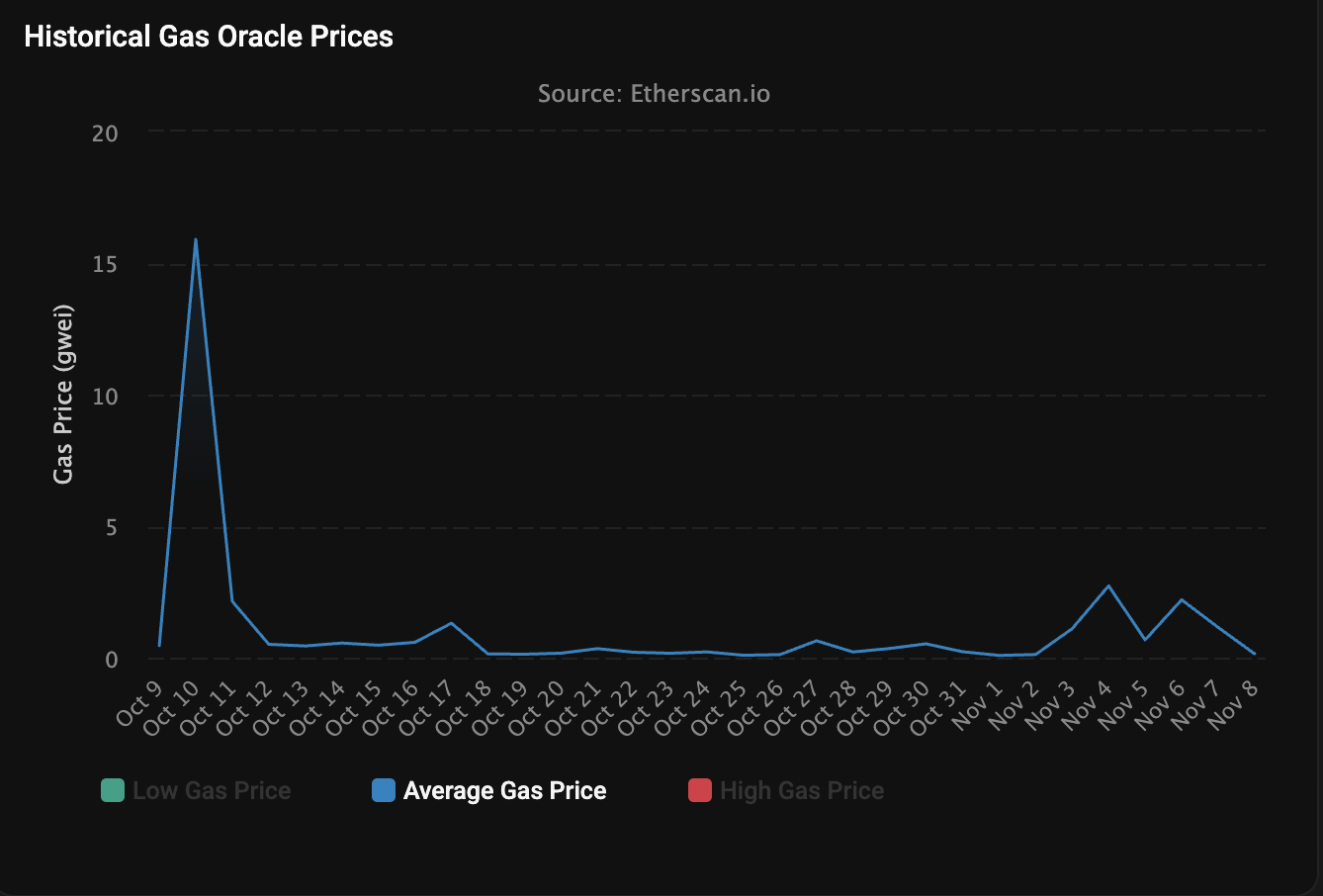

Fuel charges on the Ethereum layer-1 blockchain dropped to only 0.067 Gwei on Sunday, amid a lull within the crypto markets sparked by October’s historic market crash.

The common worth for executing a swap on Ethereum is simply $0.11, non-fungible token (NFT) gross sales carry a price of $0.19, bridging a digital asset to a different blockchain community will value customers $0.04, and onchain borrowing prices $0.09 on the time of this writing, in keeping with Etherscan.

Ethereum community transaction charges hit a latest excessive of 15.9 Gwei on October 10, the day of the market flash crash that brought about some altcoins to shed over 90% of their worth inside 24 hours.

Nonetheless, by October 12, charges dropped again down to only 0.5 Gwei and principally remained nicely under 1 all through October and November.

Ethereum layer-1 fuel costs during the last month. Supply: Etherscan

Traders and merchants could reap the benefits of the low transaction charges to execute onchain transactions on the bottom layer. Nonetheless, analysts and crypto trade executives warn that the excessively low charges may spell bother for the Ethereum ecosystem.

Associated: Ethereum charges hover close to pennies as every day transactions prime 1.6M

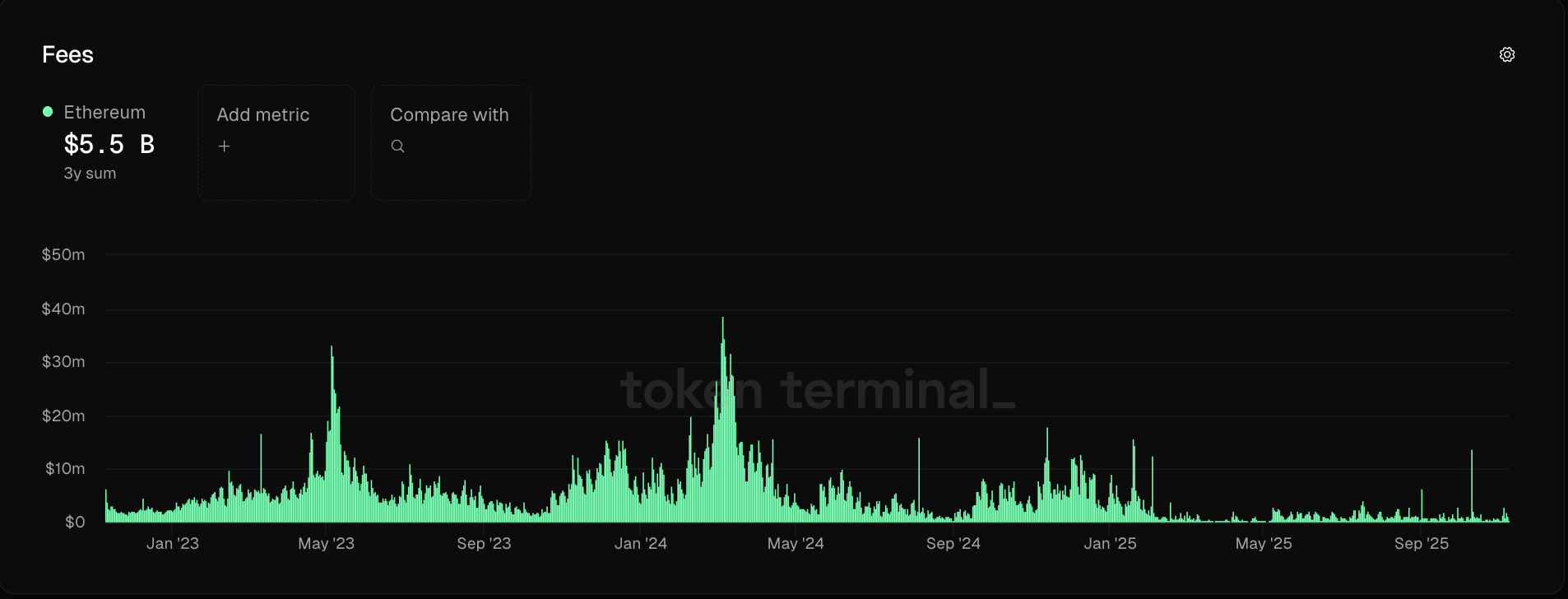

The Ethereum base layer has seen a lack of income since 2024

Through the 2021 bull run, transaction charges on the Ethereum layer-1 may value customers $150 or extra throughout instances of community congestion.

Nonetheless, following the Ethereum Dencun improve in March 2024, which lowered transaction charges for Ethereum’s layer-2 scaling networks, charges contracted considerably, inflicting Ethereum’s income to say no by 99%.

Ethereum layer-1 community charges 2023-2025. Supply: Token Terminal

Critics say the low community charges are unsustainable for any blockchain community and current each monetary and safety challenges because of the lack of income to incentivize validators or miners to course of transactions and safe the blockchain.

As a result of charges are conscious of person demand, low charges and revenues may additionally sign that customers are transferring away from a selected blockchain community.

Ethereum, specifically, has chosen a scaling technique that depends on an ecosystem of separate layer-2 networks, which represents a double-edged sword, in keeping with analysis from crypto alternate Binance.

Whereas layer-2 networks enable Ethereum to scale and compete with newer, high-throughput chains, the Layer-2 networks are additionally cannibalizing income from the bottom layer, creating further competitors for Ethereum inside its personal ecosystem.

Journal: How Ethereum treasury firms may spark ‘DeFi Summer season 2.0’