Ethereum has been struggling beneath the $2,800 mark for weeks, unable to reclaim it as assist and spark a restoration rally. This important resistance degree has saved bulls at bay, leaving the value motion stagnant and fueling destructive sentiment available in the market. Analysts name for a bearish continuation, citing Ethereum’s incapability to interrupt by way of key provide zones. The broader market uncertainty and the persistent promoting strain have solely added to considerations, making traders more and more cautious about Ethereum’s short-term prospects.

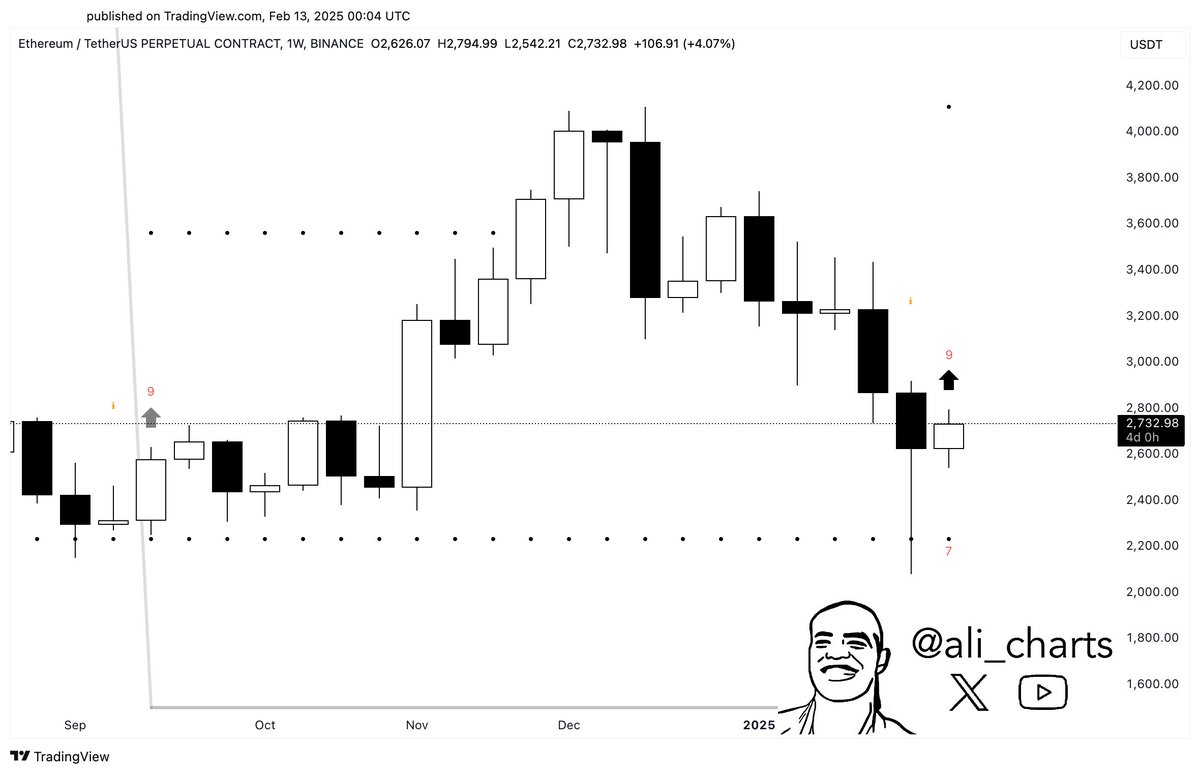

Nonetheless, not everyone seems to be bearish. Some traders stay optimistic that Ethereum may quickly enter a restoration part. High analyst Ali Martinez just lately shared a technical evaluation revealing that Ethereum may be exhibiting indicators of a possible rebound. Martinez famous that the TD Sequential indicator—a extensively used instrument for figuring out potential pattern reversals—has flashed a purchase sign on the weekly chart. This indicator, recognized for its accuracy in pinpointing moments of pattern exhaustion, means that Ethereum may very well be nearing a turning level.

As Ethereum consolidates at present ranges, the approaching weeks can be essential in figuring out its subsequent transfer. Will the purchase sign result in a rally, or will bearish sentiment dominate? For now, all eyes are on the $2,800 mark and whether or not Ethereum can reclaim it.

Ethereum Prepares For A Rebound

After final week’s dramatic sell-off, Ethereum plummeted from $3,150 to $2,150 in lower than two days, shaking the arrogance of traders and leaving the market in turmoil. Though the value has since recovered strongly, climbing again into the $2,600–$2,700 vary, Ethereum has struggled to reclaim key provide ranges, retaining bearish sentiment alive. The street to restoration stays difficult, with ETH needing to interrupt above the $3,000 mark to sign a reversal of the present bearish pattern.

High analyst Ali Martinez has offered some hope for Ethereum bulls, sharing constructive information on X that implies a possible rebound could also be on the horizon. In line with Martinez’s technical evaluation, Ethereum is exhibiting indicators of restoration because the TD Sequential indicator flashes a purchase sign on the weekly chart.

The TD Sequential, a well-respected instrument in technical evaluation, is particularly designed to establish moments of pattern exhaustion and sign potential worth reversals. A purchase sign on the weekly chart is a very sturdy indicator, suggesting that ETH may very well be nearing a important turning level.

If Ethereum manages to step above the $3,000 mark and reclaim it as assist, it might affirm a pattern reversal and will spark a rally into larger worth ranges. Nonetheless, till this key degree is breached, uncertainty stays, and bearish strain may nonetheless dominate. For now, the market is watching carefully to see if Ethereum can capitalize on these constructive alerts and regain its footing. The approaching weeks can be essential in figuring out whether or not ETH can shake off its bearish pattern and resume a path towards restoration.

ETH Worth Testing Essential Provide

Ethereum is at present buying and selling at $2,695, consolidating after days of ranging between $2,525 and $2,795. The market stays indecisive, with each bulls and bears ready for a breakout in both path. Bulls face the important problem of reclaiming the $2,800 degree as assist to realize momentum and push the value towards $3,000. A transfer above $3,000 would affirm a restoration rally and doubtlessly mark the start of a bullish part for Ethereum.

Nonetheless, the present worth ranges are essential to sustaining a restoration part. Sustaining the $2,600 assist degree is important for bulls to construct confidence and entice extra shopping for strain. Shedding this degree may disrupt the restoration momentum and spark a deeper correction, pushing ETH into decrease demand zones that might see it retest ranges beneath $2,500.

The following few days can be pivotal for Ethereum’s short-term path because it continues to hover close to key ranges. If bulls achieve reclaiming $2,800 and pushing above $3,000, it may entice renewed curiosity from patrons and gas a rally into larger provide zones. Conversely, failure to carry present ranges may give bears the higher hand, resulting in elevated promoting strain and additional worth declines. For now, Ethereum stays in a important consolidation part.

Featured picture from Dall-E, chart from TradingView