Ethereum (ETH) has proven indicators of restoration after a pointy decline attributable to the Bybit hack, which impacted its value. Regardless of this bounce again, ETH continues to be down practically 18% over the previous 30 days, reflecting continued volatility.

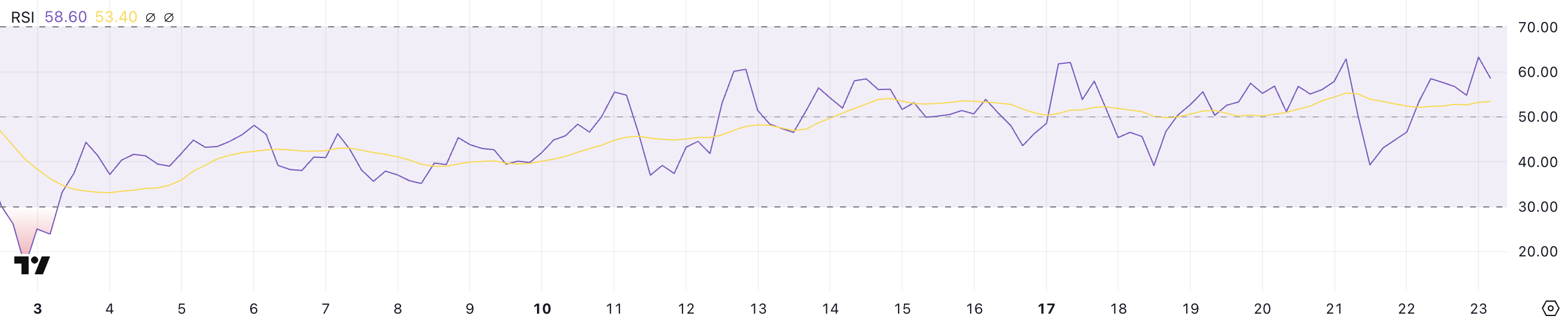

Notably, ETH’s RSI has rebounded to 58.6 from a low of 39.2 in the course of the sell-off, indicating renewed shopping for stress. This restoration in RSI means that market sentiment is step by step bettering, probably setting the stage for additional value features if momentum persists.

ETH RSI Has Recovered From the Latest Dip

ETH’s RSI is at present at 58.6, a notable improve from the 39.2 stage it reached after the Bybit hack considerably impacted its value.

The restoration in RSI displays the shopping for momentum ETH has gained for the reason that sharp decline.

This upward motion in RSI suggests that purchasing stress has returned, serving to Ethereum value stabilize and probably paving the best way for additional value features if momentum continues.

ETH RSI. Supply: TradingView.

RSI, or Relative Energy Index, is a momentum oscillator that measures the pace and alter of value actions. It ranges from 0 to 100, with thresholds at 30 and 70.

An RSI under 30 is mostly thought of oversold, indicating potential shopping for alternatives, whereas an RSI above 70 is taken into account overbought, signaling a attainable value correction.

ETH’s RSI is at present at 58.6, positioned in a impartial zone however leaning in direction of bullish momentum. This stage suggests Ethereum nonetheless has room to develop earlier than reaching overbought territory, probably resulting in continued value appreciation as shopping for curiosity stays regular.

Ethereum Whales Amassed After Bybit Hack

The variety of Ethereum whales – addresses holding a minimum of 1,000 ETH – has been rising steadily over the previous month, rising from 5,680 on January 25 to five,828 on February 22.

This marks the best stage since December 2023, signaling renewed curiosity and accumulation amongst giant holders. The rise in whale addresses means that institutional buyers or high-net-worth people are constructing positions, probably anticipating future value features, particularly between February 21 and February 22, when ETH costs decreased following the Bybit hack.

This rising accumulation may present a stable basis for ETH’s value to rise.

ETH Whales. Supply: Glassnode.

Monitoring Ethereum whales is essential as a result of their shopping for and promoting conduct can considerably impression the market.

When whales accumulate, it reduces the circulating provide, probably driving costs up as demand meets lowered availability. Conversely, after they promote, it will possibly create vital downward stress on costs.

At the moment, the rise in whale addresses signifies rising confidence and a bullish sentiment amongst giant buyers.

Though that is the best stage since December 2023, it’s nonetheless comparatively low in comparison with historic information. This implies there may be room for extra accumulation. If this pattern continues, it may result in a sustained upward motion in ETH value as demand outpaces provide.

Will Ethereum Lastly Rise Again Above $2,900?

Ethereum’s EMA strains recommend {that a} golden cross may kind quickly. A golden cross sometimes alerts a bullish pattern and potential upward momentum.

If this happens, Ethereum may first take a look at a value stage close to its long-term line (the blue line within the chart) round $2,876. Breaking this resistance may open the door for a transfer to $3,020.

If the uptrend continues with sturdy momentum, ETH may even attain as excessive as $3,442.

ETH Value Evaluation. Supply: TradingView.

Nonetheless, ETH has struggled to reclaim ranges above $2,900 in current makes an attempt, signaling attainable resistance and market hesitation.

If it fails to interrupt via as soon as extra and a downtrend begins, ETH value may take a look at the $2,551 assist stage. Dropping this assist may lead to a sharper decline, probably falling to $2,159.