Ethereum (ETH) worth is struggling to reclaim the $3,000 degree as bearish momentum continues to weigh on its restoration. The RSI stays impartial, failing to interrupt above 50 since February 1, indicating that purchasing stress has but to strengthen considerably.

In the meantime, the Directional Motion Index (DMI) reveals that ETH continues to be in a downtrend, although promoting stress has began to ease barely. With short-term EMAs nonetheless beneath long-term ones, ETH stays susceptible to additional declines except momentum shifts in favor of the bulls.

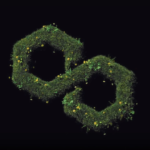

ETH RSI Did not Break Above 50 Since February 1

Ethereum’s Relative Power Index (RSI) is presently at 44.7, sustaining a impartial stance since February 3 after briefly plunging to 16.7 on February 2. The RSI is a momentum oscillator that measures the energy and pace of worth actions on a scale from 0 to 100.

Sometimes, an RSI above 70 indicators overbought circumstances, suggesting a possible worth correction, whereas an RSI beneath 30 signifies oversold ranges, usually related to shopping for alternatives.

A studying between 30 and 70 is taken into account impartial, that means the market lacks a transparent bullish or bearish development.

ETH RSI. Supply: TradingView.

With ETH RSI at 44.7, it stays in impartial territory however continues to wrestle to interrupt above 50, a degree it has failed to achieve since February 1. This means that whereas bearish stress has eased for the reason that excessive oversold circumstances of early February, shopping for momentum stays weak.

If ETH can push its RSI above 50, it will point out a shift towards bullish management, probably resulting in a stronger worth restoration.

Nevertheless, failure to take action could sign extended consolidation and even renewed promoting stress, holding ETH in a uneven buying and selling vary till stronger demand emerges.

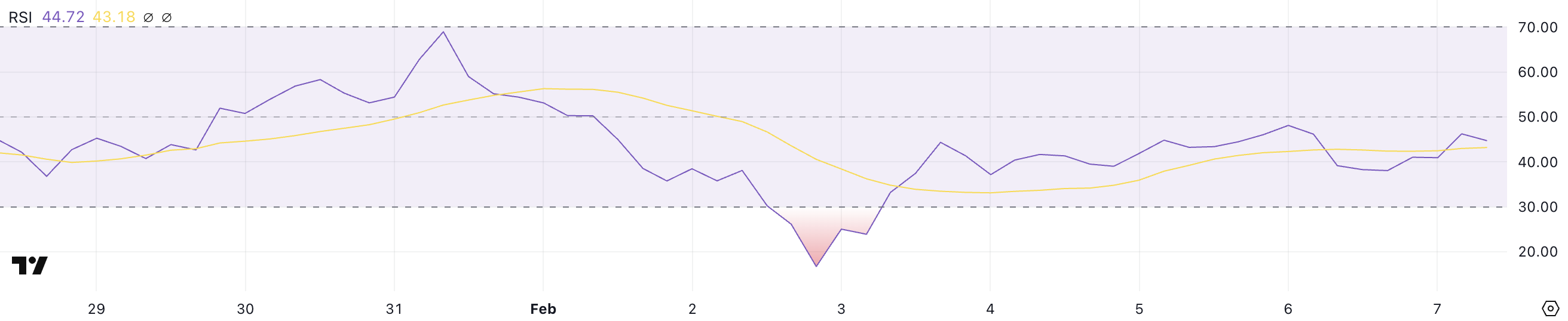

Ethereum DMI Reveals The Present Pattern Is Nonetheless Bearish

Ethereum’s Directional Motion Index (DMI) chart reveals that its Common Directional Index (ADX) is presently at 34.2, down from 40 simply two days in the past. The ADX measures development energy, with values above 25 typically indicating a robust development and values beneath 20 suggesting weak or range-bound worth motion.

A studying of 34.2 confirms that ETH worth continues to be in a well-defined development, although the slight decline in ADX means that development energy is weakening.

ETH DMI. Supply: TradingView.

ETH’s +DI is presently at 16.7 and has been fluctuating between 14 and 18 over the previous 4 days. That signifies a weak bullish momentum. In the meantime, the -DI has dropped from 33.8 yesterday to twenty-eight.9, suggesting that promoting stress could possibly be easing.

Regardless of this, Ethereum stays in a downtrend, because the -DI continues to be considerably greater than the +DI. If the +DI begins to rise whereas the -DI continues to say no, it might recommend an early shift in momentum towards a possible development reversal.

Nevertheless, so long as the -DI stays dominant and ADX holds above 25, ETH might proceed dealing with draw back dangers earlier than any important restoration materializes.

ETH Worth Prediction: Will Ethereum Return To $3,000 In The Subsequent Days?

Ethereum Exponential Shifting Common (EMA) strains proceed to point a bearish development, with short-term EMAs nonetheless positioned beneath long-term ones. This alignment means that downward stress stays dominant, holding ETH susceptible to additional declines.

If this bearish momentum persists, Ethereum worth might take a look at the help degree at $2,356, and a failure to carry this zone might result in a deeper drop towards $2,163.

The present EMA construction displays a market the place sellers stay in management, and a transparent shift in development could be required to reverse the continuing decline.

ETH Worth Evaluation. Supply: TradingView.

Nevertheless, if ETH can regain constructive momentum, it might make a transfer again towards the $3,000 degree. A breakout above this psychological resistance might sign renewed bullish energy, probably pushing ETH to $3,300.

If shopping for stress stays robust past this level, ETH worth might even rally to $3,744, marking its highest worth since January 6.