Knowledge reveals the US Ethereum spot ETFs have simply seen their greatest day of inflows, pushed largely by demand on BlackRock and Constancy.

Ethereum Spot ETFs Have Seen A Sharp Uptick In Demand

In response to knowledge from Farside Buyers, July sixteenth was a giant day for the US Ethereum spot ETFs, with complete inflows crossing the $726 million mark, a brand new all-time excessive (ATH). The spot exchange-traded funds (ETFs) confer with funding automobiles that permit buyers to realize publicity to an asset with out having to straight personal it. Within the case of cryptocurrencies, which means that ETF holders don’t should handle digital asset wallets or navigate exchanges. For conventional buyers, this truth could make spot ETFs a handy technique to discover the market.

Ethereum spot ETFs gained approval within the US practically one yr in the past. Since then, demand has diversified, however the asset has these days been on a constructive run of inflows, with the latest numbers displaying momentum is simply accelerating.

Beneath is a desk that reveals how the netflow associated to the assorted Ethereum spot ETFs has seemed over the past couple of weeks.

Seems to be like BackRock's ETF has persistently led by way of inflows | Supply: Farside Buyers

As is seen, notable each day inflows of round $200 million or extra had been already taking place into the US Ethereum spot ETFs in the course of the previous week, indicating that demand from institutional entities was strong, however with the most recent record-breaking day, issues have clearly kicked into a fair larger gear.

BlackRock’s ETHA noticed the most important share of July sixteenth inflows at nearly $500 million. Constancy’s FETH was a distant second, buying about $133 million within the cryptocurrency on behalf of its customers.Capital has poured into the spot ETFs as Ethereum has seen a breakout above the $3,000 degree, which has to date introduced it to $3,400 for the primary time since January.

Following this rally, institutional buyers aren’t the one ones taking note of ETH, as knowledge from the analytics agency Santiment reveals a spike in retail curiosity.

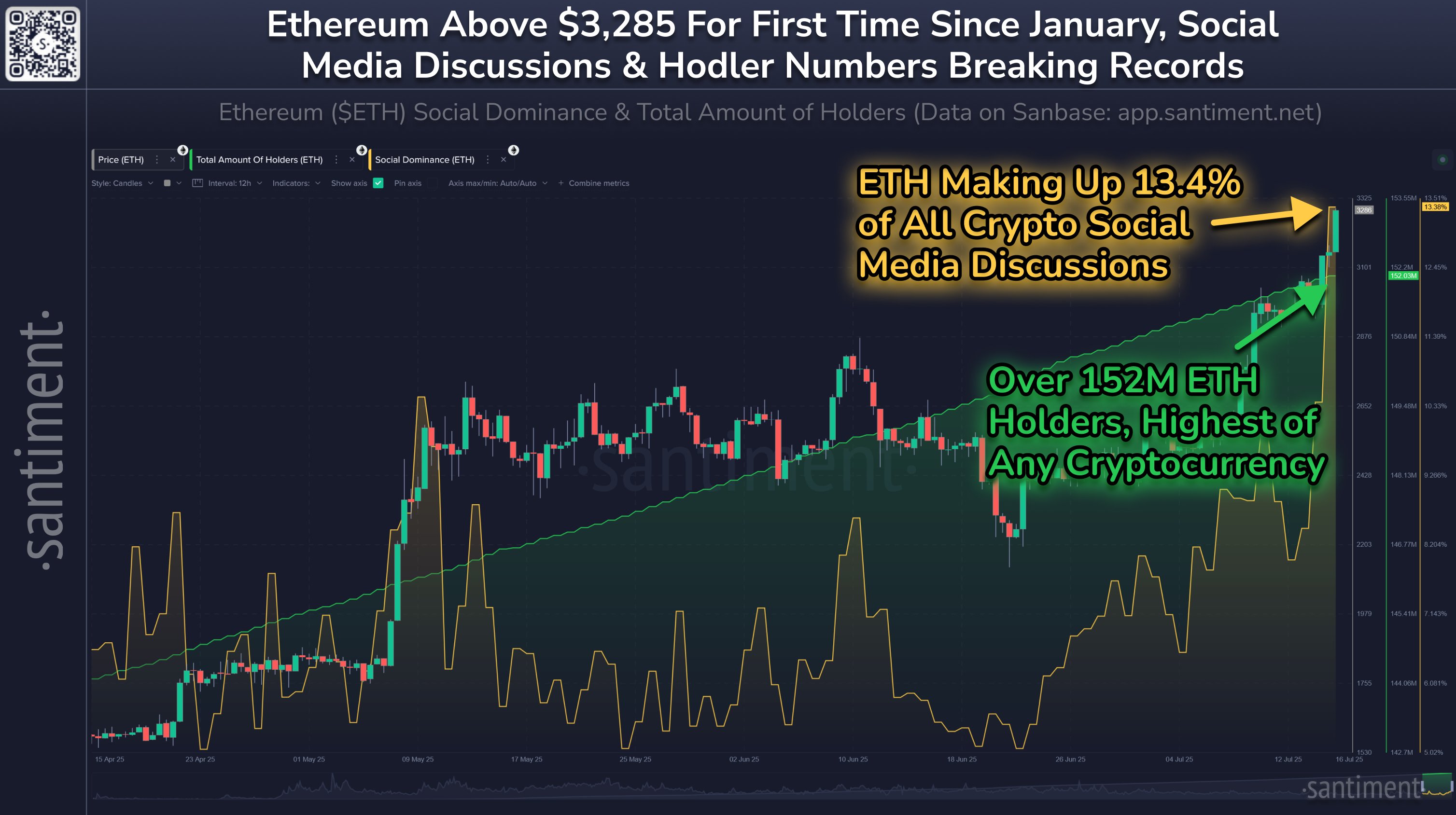

The pattern within the Social Dominance and Complete Quantity Of Holders for ETH over the previous couple of months | Supply: Santiment on X

Within the chart, Santiment has hooked up the info of the Social Dominance, an indicator that tells us concerning the dialogue share that Ethereum occupies on the main social media platforms relative to different cryptocurrencies.

Since retail buyers far outweigh the bigger holders by way of numbers, this metric finally ends up reflecting the habits of the small fingers. From the graph, it’s obvious that the ETH Social Dominance has seen an enormous spike alongside the value surge, with 13.4% of all digital asset discussions on social media now involving the coin.

Clearly, retail is being attentive to the asset now, however traditionally, overhype among the many crowd is one thing that has tended to not finish nicely for cryptocurrencies, so this pattern may very well be one to regulate.

ETH Worth

On the time of writing, Ethereum is buying and selling round $3,400, up greater than 23% during the last week.

The worth of the coin seems to have sharply been going up | Supply: ETHUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.