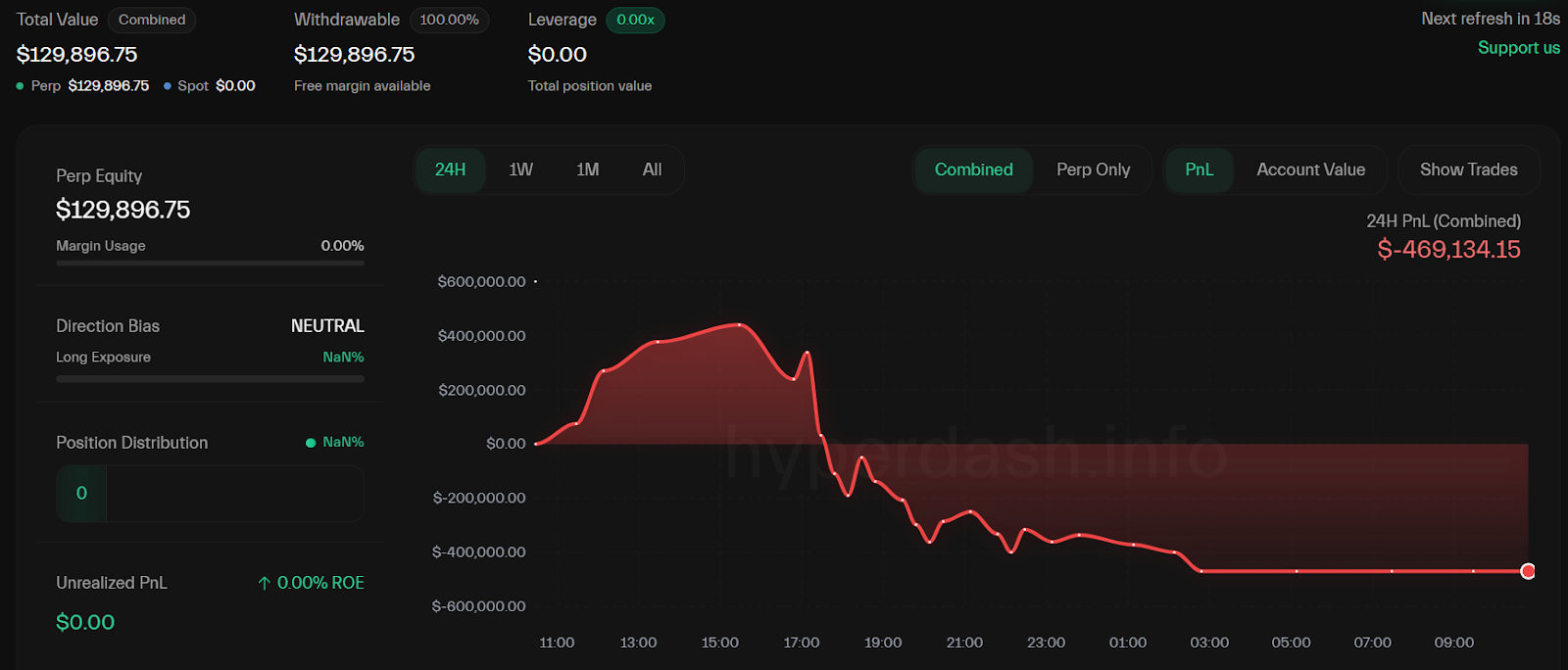

A cryptocurrency dealer who just lately elevated their account from $125,000 to greater than $43 million was virtually liquidated on Wednesday for $6.2 million after Ether briefly fell close to the $4,000 degree.

The liquidation came about on the decentralized change Hyperliquid as Ether (ETH) dipped near $4,000 amid a broader market correction, highlighting the volatility that may catch even seasoned merchants off guard.

It got here two days after the dealer had turned an preliminary funding of $125,000 into greater than $43 million at its peak, earlier than locking in almost $7 million value of revenue on Monday, Cointelegraph reported.

“This legendary dealer went lengthy on $ETH once more however was liquidated available in the market crash, dropping $6.22M,” mentioned blockchain knowledge platform Lookonchain in a Wednesday X submit. “Now solely $771K stays—4 months of beneficial properties almost worn out in simply 2 days.”

Pockets “0x5f7.” Supply: Hyperdash

Associated: Crypto in US 401(ok) retirement plans might drive Bitcoin to $200K in 2025

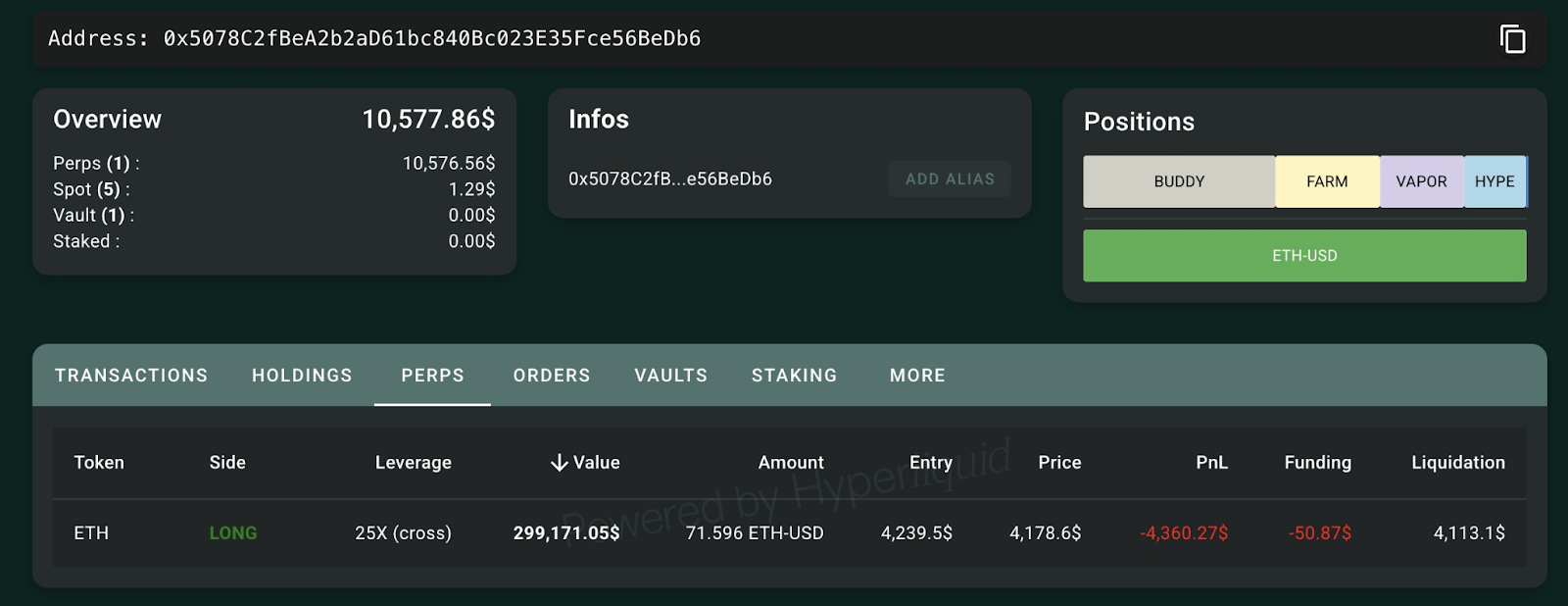

The market downturn additionally hit different distinguished merchants. Multimillionaire leverage dealer James Wynn’s lengthy Ether place was additionally partially liquidated, leaving him with a partial lengthy of simply $300,000 value of ETH, which stands to be liquidated if Ether’s value falls beneath $4,113, in response to Lookonchain’s Tuesday X submit.

Supply: Lookonchain

Wynn is among the many business’s most distinguished merchants anticipating a forthcoming altcoin season throughout the present cycle.

On Wednesday, after the partial liquidation, Wynn wrote that he was “all-in” with no extra stablecoins left to speculate, including that he shall be pressured to “drastically lower down” dwelling bills if the altcoin season doesn’t happen.

Associated: David Bailey’s KindlyMD kicks off Bitcoin treasury with huge $679M purchase

Ether whales have panicked and offered into the market downturn

Some whales have panicked and offered thousands and thousands of {dollars} of ETH throughout the present market downturn.

Three massive whales have collectively offered $147 million value of Ether, together with $77 million offered by pockets “0x1D8d,” $57 million by pockets “0x5A8E” and over $12 million by pockets “0x3684,” in response to Lookonchain.

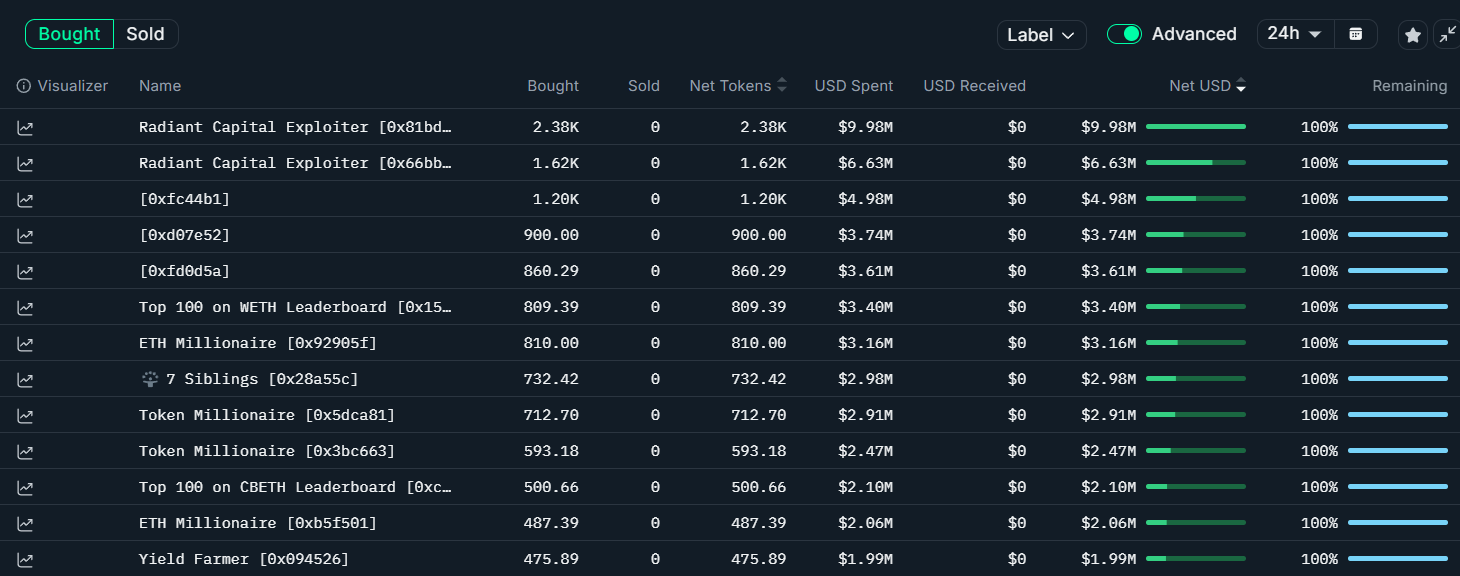

Different savvy merchants are seeing the market correction as a shopping for alternative.

On Wednesday, a pockets labelled “0x159” — a high 100 dealer tracked by Nansen — acquired $3.4 million value of Ether. Compared, ETH whale “0x929” purchased $3.16 million and whale pockets “0x5dc” acquired $2.9 million value of ETH, Nansen knowledge reveals.

Supply: Nansen

The market downturn even impressed the infamous Radiant Capital exploiter’s pockets to accumulate $16.6 million value of Ether.

In the meantime, cryptocurrency buyers are focusing their consideration on US Federal Reserve Chair Jerome Powell’s financial coverage speech at Jackson Gap on Friday, which is poised to be the week’s “defining second,” in response to Iliya Kalchev, dispatch analyst at digital asset platform Nexo.

“The subsequent transfer in crypto might hinge extra on central financial institution indicators than on charts,” the analyst instructed Cointelegraph.

Journal: Excessive conviction that ETH will surge 160%, SOL’s sentiment alternative