Ethereum (ETH) is giving buyers a severe case of whiplash. After a 13.40% drop prior to now week, and with the buying and selling quantity within the final 24 hours standing at $17.64 billion, the market is clearly on edge.

Analysts are watching value patterns, technical indicators, and liquidation developments to determine Ethereum’s subsequent potential transfer. By the way in which, ETH trades at $1,893.17 as of press time.

Combined Indicators: Falling Wedge vs. Bearish Outlook

In keeping with Daan Crypto Trades, Ethereum has been consolidating following a considerable market downturn. He factors to a falling wedge sample as a potential signal of a development reversal.

This technical construction is usually thought of bullish, suggesting that if ETH can break above the resistance zone, a value restoration might be imminent. For this to occur, ETH should break and maintain above a key resistance zone earlier than even occupied with a transfer in the direction of the $2,000+ area.

$ETH Has been consolidating for the reason that huge dump.

It has fashioned this falling wedge sample which might be an honest construction for a neighborhood development reversal.

However for that to happen I would need to see the breakout and maintain above the white zone. If it might probably do this, we will begin on the lookout for… pic.twitter.com/cbDokpEv0t

— Daan Crypto Trades (@DaanCrypto) March 14, 2025

The ETH/BTC ratio stays close to multi-year lows, regardless of exhibiting slight resilience. This bounce alone isn’t robust sufficient to substantiate a development reversal. Sustained energy and a break of key resistance ranges are obligatory for a major shift in momentum.

Associated: Ethereum Retraces to $1612.81 Assist After Brief-Lived Spike

Conflicting Views: $800 on the Desk?

Including to the uncertainty, Ali Martinez presents a bearish perspective, highlighting that Ethereum is breaking out, but when momentum falters, ETH might see a transfer down towards $800.

#Ethereum $ETH is breaking out, and if momentum holds, it might be on monitor for a transfer towards $800! pic.twitter.com/rCtDDAKq8r

— Ali (@ali_charts) March 13, 2025

Leverage and Liquidations: A Recipe for Volatility

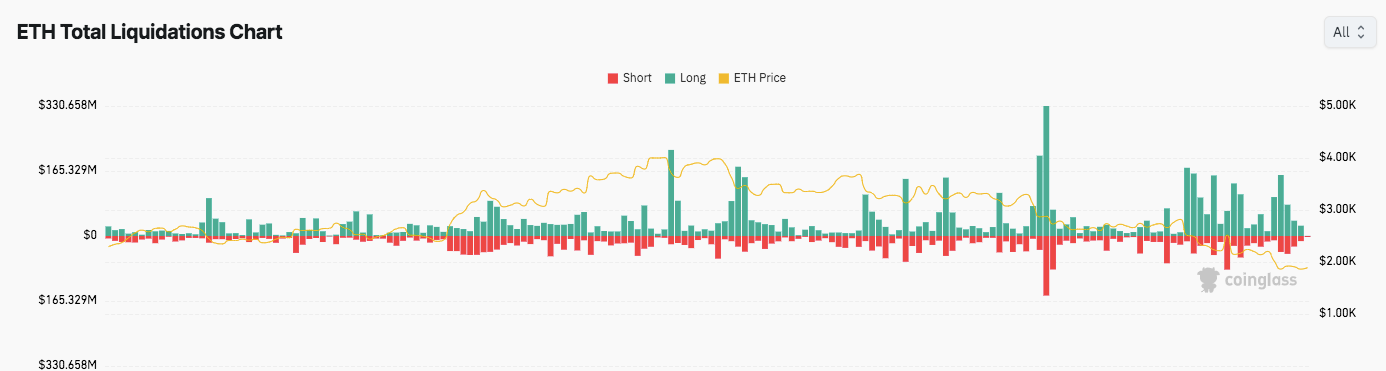

The Ethereum Whole Liquidations Chart highlights the influence of leverage buying and selling on value actions. Important liquidation spikes happen round essential value zones between $2,000 and $3,000. When ETH costs surge, lengthy liquidations enhance, whereas value declines set off quick liquidations.

Supply: Coinglass

The best liquidation ranges surpass $330 million, revealing aggressive leveraged positions getting worn out. A big lengthy liquidation spike coincided with a pointy value drop, reinforcing the high-risk nature of leveraged buying and selling. In different phrases, excessive leverage can result in large losses – quick.

Technical Indicators: RSI and MACD Evaluation

ETH/USD day by day value chart, Supply: TradingView

From a technical standpoint, ETH’s Relative Power Index (RSI) is round 33.29, nearing oversold territory. An RSI under 30 sometimes indicators that an asset is undervalued, probably setting the stage for a value rebound.

Associated: Ethereum Mining Various Ravencoin Surges Virtually 70% In 1 Week

Nonetheless, the MACD stays damaging, with each the MACD line and sign line under zero. This confirms bearish momentum, however a crossover might point out a development reversal. So, the RSI hints at a potential bounce, however the MACD continues to be flashing warning indicators.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.