Ethereum has began this week with a minor reduction bounce after final week’s flush beneath $1,500. Whereas the worth has held help for now, momentum is weak, and on-chain sentiment nonetheless leans bearish, suggesting any upside may be restricted except the consumers reclaim key resistance ranges.

Technical Evaluation

By Edris Derakhshi

The Day by day Chart

ETH’s day by day construction stays closely bearish. The asset continues to commerce beneath the 200-day transferring common, situated across the $2,800 mark, and has printed a number of decrease highs and decrease lows over the previous two months. After breaking beneath the $1,800–$2,000 vary final week, ETH is struggling to carry onto the $1,550 help zone.

The RSI additionally stays suppressed, hovering simply above oversold ranges, and momentum indicators present no sturdy bullish divergence. A break beneath $1,550 would open the door towards the following main demand zone round $1,300–$1,400, whereas reclaiming $1,900 is required to gradual the present bearish pattern.

The 4-Hour Chart

On the 4-hour timeframe, ETH has lately bounced from the $1,550 help however now faces a serious descending trendline that has acted as dynamic resistance for over a month. The value is at present testing the $1,650–$1,700 intraday resistance vary.

A breakout above the trendline and a profitable flip of this zone might set off a short-term rally towards $1,800. Nonetheless, sellers stay lively at each bounce, and the market construction nonetheless favors decrease highs except ETH can shut above $1,700 and maintain.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

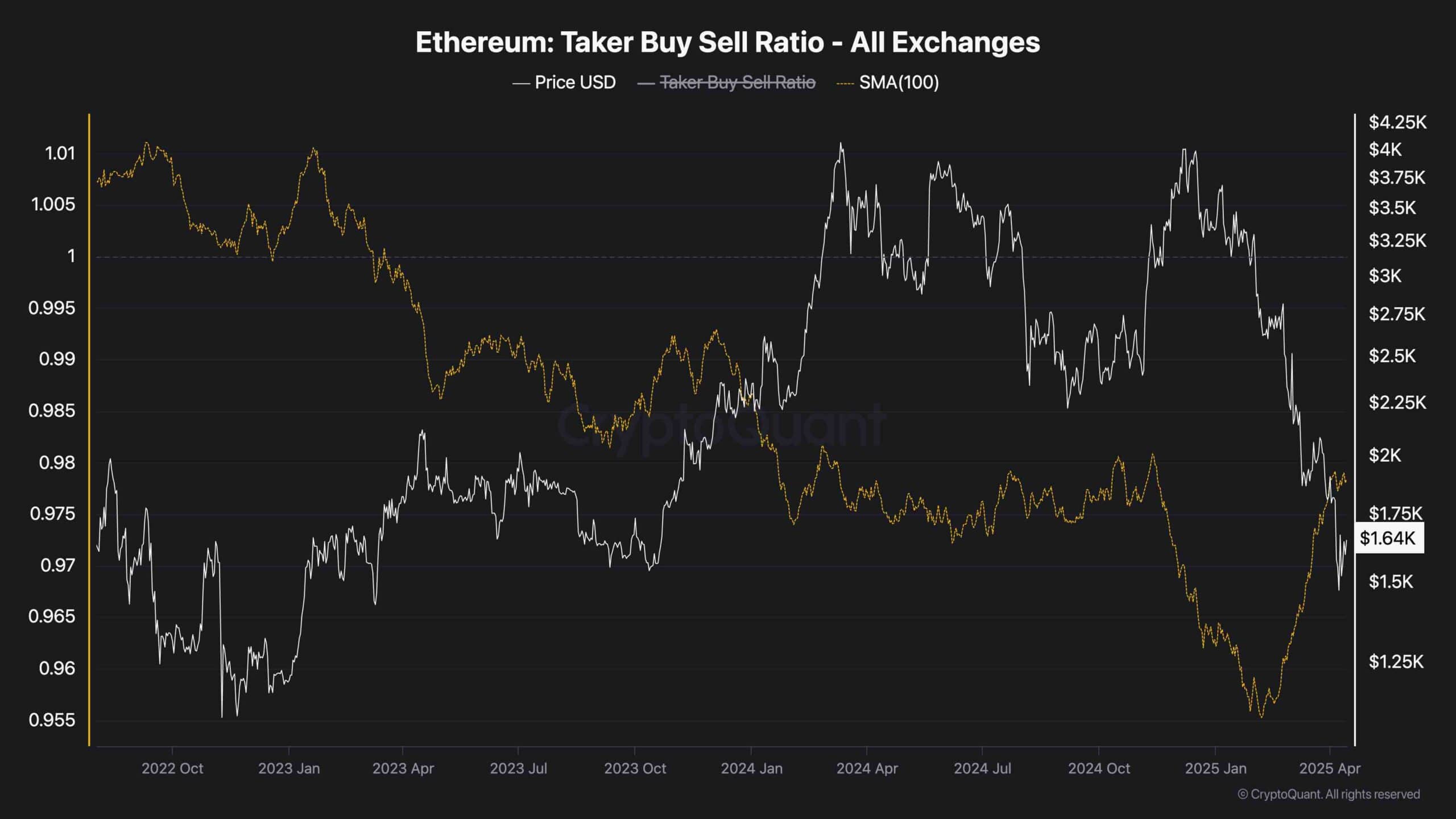

Taker Purchase-Promote Ratio

The Taker Purchase Promote Ratio for ETH developments beneath 1, signaling that market orders are predominantly sell-driven. Whereas there’s been an uptick in latest days, the general pattern stays bearish, suggesting the bounce just isn’t backed by sturdy demand. This aligns with the shortage of bullish conviction on the charts.

Till the ratio shifts decisively above 1 and sustains, purchaser aggression will seemingly stay weak. In brief, the sentiment reveals lingering worry, and the broader pattern factors towards additional draw back except the consumers can pressure a shift in construction and quantity.