Ethereum (ETH) value has remained in a consolidation section, buying and selling under $3,000 since February 2. Over the previous weeks, indicators like RSI, DMI, and EMA counsel that ETH lacks robust momentum, with neither patrons nor sellers taking full management.

The narrowing hole between its EMA traces hints at a possible shift, however ETH should overcome key resistance ranges to regain bullish momentum. In the meantime, if help ranges fail to carry, a deeper correction towards $2,160 may very well be on the desk.

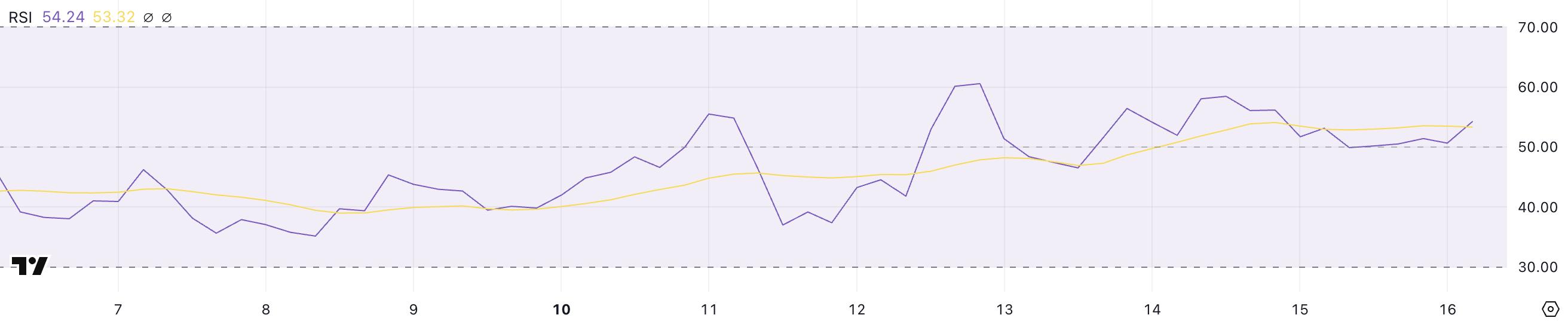

Ethereum RSI Has Been Impartial For Two Weeks

Ethereum Relative Energy Index (RSI) is at the moment at 54.2, staying impartial since February 3. RSI measures value momentum, with values between 30 and 70 indicating a balanced market.

Ethereum has remained inside this vary, suggesting neither patrons nor sellers have taken management. This implies ETH has but to enter an overbought zone above 70 or an oversold zone under 30.

ETH RSI. Supply: TradingView.

RSI ranges from 0 to 100, with key ranges at 30 and 70. A studying above 70 alerts overbought situations, whereas under 30 suggests oversold ranges. At 54.2, ETH is in impartial territory, that means value motion lacks robust momentum.

For ETH value to succeed in $3,000, the RSI would doubtless want to maneuver towards 60 or greater, indicating elevated shopping for stress. A push above 70 may sign robust bullish momentum, serving to ETH break key resistance ranges.

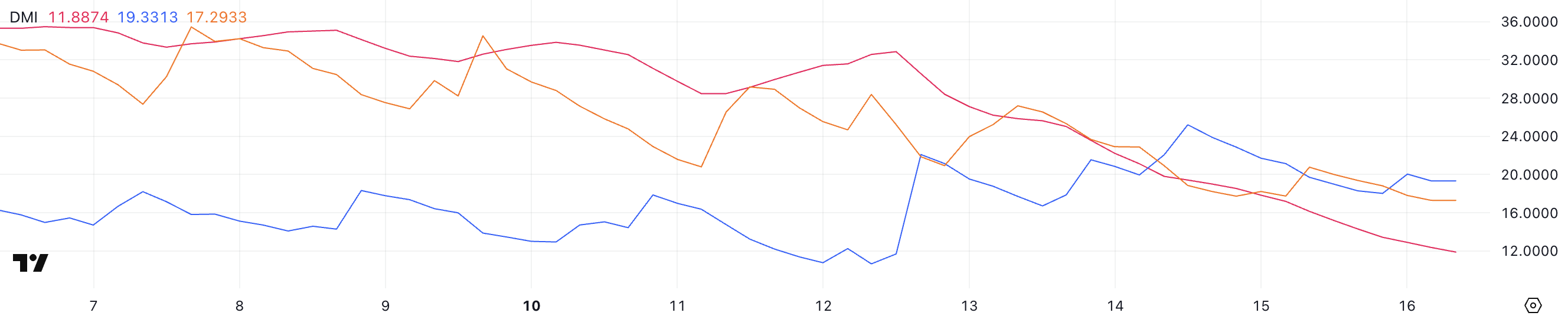

ETH DMI Exhibits the Lack of a Clear Course

Ethereum Directional Motion Index (DMI) exhibits its Common Directional Index (ADX) at 11.8, steadily declining since February 12, when it was at 32.8.

ADX measures development energy, with values above 25 indicating a powerful development and under 20 suggesting a weak or no development. The regular decline alerts fading momentum, that means ETH lacks a transparent directional push.

ETH DMI. Supply: TradingView.

ADX is a part of the DMI, which additionally consists of the +DI (optimistic directional indicator) and -DI (unfavorable directional indicator). +DI is at 19.3, down from 25.2 two days in the past, whereas -DI is at 17.2, down from 18.8.

This means each bullish and bearish pressures are weakening. For ETH to regain $3,000, ADX would wish to rise above 20, signaling stronger development momentum, whereas +DI must climb above -DI with a wider hole, indicating renewed bullish energy.

ETH Value Prediction: Will Ethereum Return To $3,000 In February?

Ethereum value has been buying and selling between $2,800 and $2,550 since February 7. Its EMA traces nonetheless present a bearish outlook, as short-term traces stay under long-term ones.

Nevertheless, the hole between them is narrowing, suggesting a possible shift in momentum. For ETH to succeed in $3,000 in February, it should first break the $2,800 resistance after which maintain a transfer above $3,020. If momentum strengthens, ETH may even take a look at $3,442, a degree final seen in late January.

ETH Value Evaluation. Supply: TradingView.

On the draw back, if Ethereum retests the $2,551 help and fails to carry, additional declines may observe.

Dropping this key degree might open the door for a drop towards $2,160, a considerably decrease help.