Bitmine Immersion Applied sciences Inc. has reached a four-year worth peak, doubling its worth previously two days. The corporate has unlocked a 3,000% rally after saying its $250M facility to construct an ETH treasury.

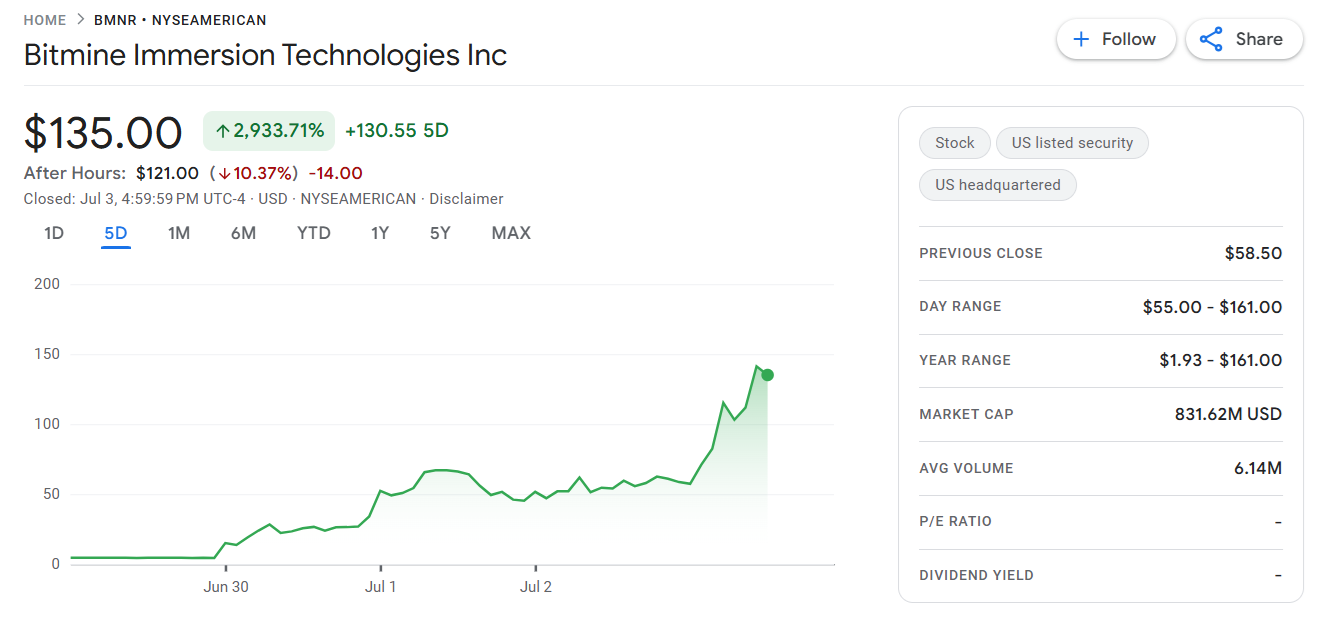

Bitmine was one of many newest treasury corporations to unlock a inventory rally. Prior to now two days alone, Bitmine rallied by greater than 100%, reaching a worth of $135 for the primary time since April 2021.

The most recent inventory rally launched after Bitmine introduced a $250M non-public placement with the objective of buying and holding ETH. The worth jumped moreover after the closing of the non-public placement on July 3.

Bitmine rallied previously day, following the closing of a $250M non-public placement cope with the objective of constructing an ETH treasury. | Supply: Google Finance

Bitmine began out from all-time lows, rising from a $1 mining inventory to over $135 within the span of every week. Bitmine continues to rally because the chief to the pack of Ethereum treasury shares, which joined the Bitcoin pattern previously few weeks.

The expansion pattern additionally boosted the shares of Sharplink Gaming, rising farther from $9.50 to over $12.60. SBET share costs are nonetheless down from their peak, however the current restoration exhibits enthusiasm for ETH treasuries stays excessive. BitDigital, Inc. additionally rose to a one-month excessive of $2.94.

ETH treasuries additionally permit corporations to stake the tokens for added passive earnings. Sharplink Gaming has already staked 95% of its ETH valued at over $450M.

Bitmine plans twin BTC-ETH technique

Bitmine already holds 154.2 BTC, acquired at costs above $106,000 since June 16. The corporate has additionally hidden hashrate that may produce extra BTC inflows within the coming six months.

Bitmine goals to make use of its non-public placement proceeds, together with BTC, to amass extra ETH and construct its treasury. The corporate goals to amass crypto for long-term holding, from a mixture of BTC mining operations or from elevating extra capital.

Bitmine has direct mining operations, contracts in artificial market, and hashrate as a monetary product. Bitmine additionally works as a mining advisor, whereas additionally proudly owning information facilities in low-cost places in Texas.

Can Bitmine reawaken ETH?

Demand for ETH has risen, primarily based on ETF shopping for. The current announcement of company treasuries continues to be not making a dent in the marketplace. ETH stays a speculatively traded asset, with deliberate buying and selling towards lengthy positions, resulting in a depressed market worth buying and selling inside a variety round $2,500.

ETH traded at $2,557.21, removed from the exuberance of treasury firm shares. The token stalled slightly below $2,700, falling on promoting stress.

For bullish merchants, ETH was presupposed to make a hike to $3,000, although for now the rallies are lower brief. Ethereum has seen elevated staking and on-chain exercise, with rising demand for DeFi. The community is slowly regaining its exercise, largely primarily based on stablecoin utilization. USDT and USDC drive visitors on Ethereum, as a part of each centralized and decentralized exercise.

The current treasuries are nonetheless not shopping for on the scale of Technique, which is already affecting the BTC market. Nevertheless, the looks of a brand new wave of altcoin treasury corporations could lengthen the 2025 crypto rally. Firms have already introduced SOL and BNB treasuries, however ETH could also be a major candidate for reserves with assured staking rewards.