Bitcoin briefly dropped to $93,000 early Monday in Asia earlier than rebounding, sparking $510 million in 24-hour liquidations and wiping out all year-to-date positive aspects for 2025. The sharp transfer drove the Concern and Greed Index to 10, signaling excessive concern amongst merchants.

Market analysts are watching key help zones to evaluate whether or not Bitcoin can get better or faces extra draw back within the coming days.

Sharp Correction Wipes Out 2025 Positive factors

Bitcoin’s current correction erased almost 24% from its early October excessive of $126,000. The dip at $93,000 marked a notable psychological and technical breakdown, formally nullifying all year-to-date returns for 2025.

Weekend worth tendencies shifted markedly. For the primary time in a number of weeks, Bitcoin declined over the weekend as a substitute of rising, creating what market analyst KillaXBT known as a bearish setup heading into Monday. Utilizing 300 days of historic knowledge, this sample suggests a few 36% likelihood that Monday will set up a near-term low.

$BTC

For the primary time in weeks, BTC didn’t pump over the weekend, it really moved decrease. As an alternative of establishing the standard bullish narrative heading into Monday, this created a bearish one.

Primarily based on the final 300 days of worth motion, there’s roughly a 36% probability that Monday… https://t.co/NGkkqLHtYo pic.twitter.com/3lyd1sRxdI

— Killa (@KillaXBT) November 16, 2025

Market sentiment plunged alongside the worth. The Crypto Concern and Greed Index dropped to 10, down two factors from the earlier studying and registering excessive concern. It is a marked reversal from late November 2024, when the index hit a excessive of 93 amid market euphoria.

Large Liquidations Hit Derivatives Market

The worth collapse led to a cascade of liquidations throughout crypto derivatives markets. In 24 hours, exchanges liquidated over 150,000 merchants, leading to closures totaling over $510 million. Lengthy positions suffered essentially the most harm, dropping $40.37 million in a single hour and $77 million over 4 hours.

Bitcoin accounted for $41.61 million in lengthy liquidations, adopted by Ethereum at $13.99 million. Different cryptocurrencies, similar to Solana, XRP, and Dogecoin, additionally noticed multi-million-dollar liquidations as costs adopted Bitcoin decrease.

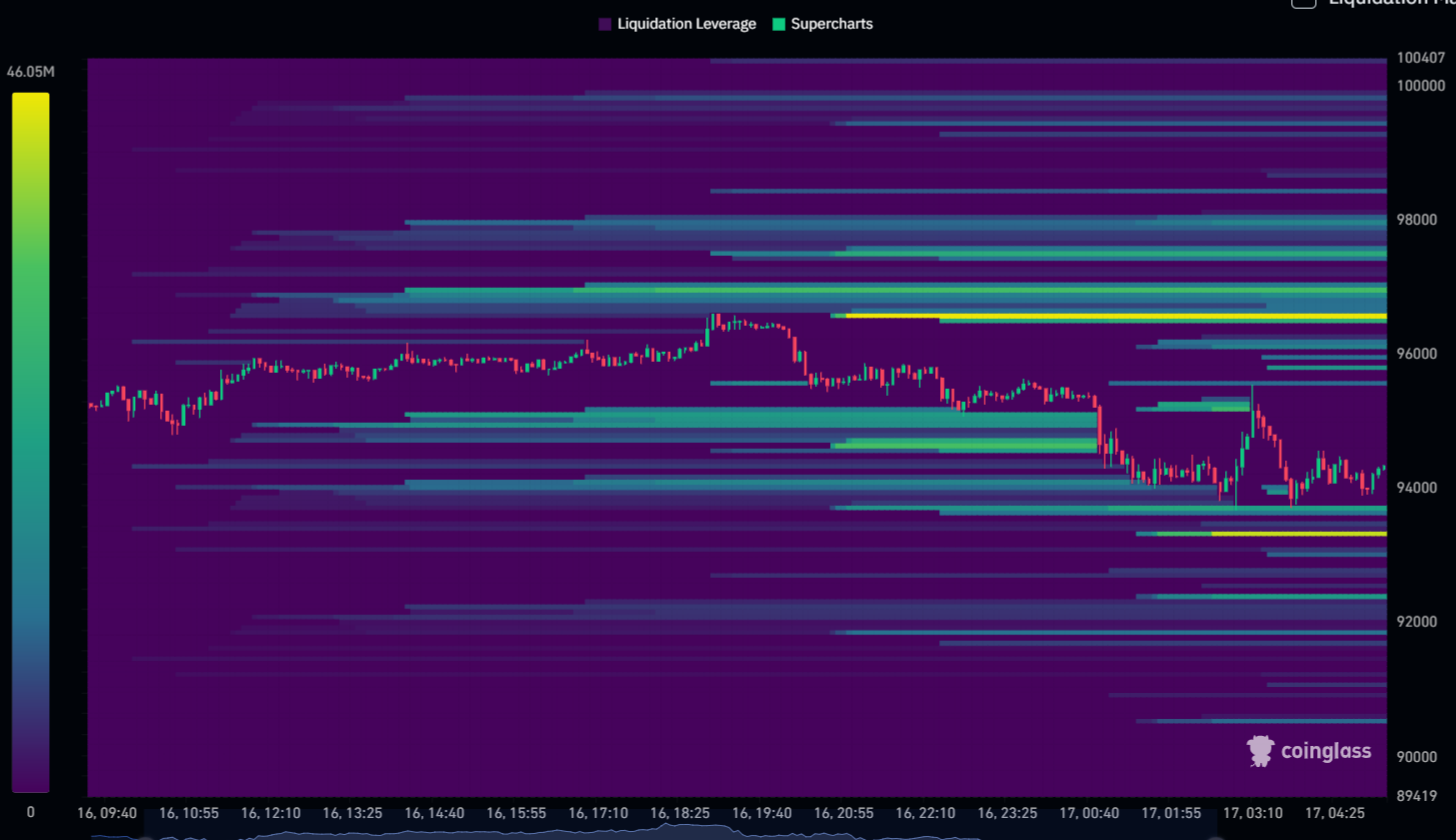

Liquidation Heatmap. Supply: Coinglass

Help Ranges Set the Path for Restoration

Market analyst KillaXBT has identified a number of essential help zones for Bitcoin’s near-term path. Speedy focus is on $94,100, with extra substantial help anticipated at $93,500—the 12 months’s opening worth—and the $89,000-$91,000 vary.

These areas have historically attracted excessive buying and selling exercise and open curiosity, making them key purchase zones based mostly on technical evaluation. Nevertheless, the analyst warned towards utilizing excessive leverage now as a consequence of ongoing volatility and liquidation dangers. With current worth swings of 4-5%, overleveraged positions face elevated danger.

🚨NEW: Bitcoin has formally erased all year-to-date positive aspects for everything of 2025. pic.twitter.com/auOwXIHXMd

— Autism Capital 🧩 (@AutismCapital) November 16, 2025

If Bitcoin falls decisively under $85,000, bullish restoration situations could be invalidated, signaling a pattern reversal. If liquidity is absorbed at decrease helps, a transfer to reclaim the $100,000 mark is feasible, although resistance at $98,300 have to be overcome first.

The present construction factors to heightened uncertainty. With sentiment at excessive concern and main liquidations already occurring, the market sits at a crucial level. Whether or not consumers emerge at help or sellers push the worth decrease will form Bitcoin’s path by November and year-end buying and selling.