Regardless of the red-hot begin to the month, the traditionally bullish “Uptober” interval has not significantly gone in accordance with the expectations for the Bitcoin value. Following the market-wide downturn on October 10, the premier cryptocurrency has not been capable of mount a transparent restoration again to its former highs.

In truth, the Bitcoin value motion continues to wrestle below lasting bearish strain, falling to a brand new low round $103,000 on Friday, October 18. With uncertainty taking up the market, traders are left questioning whether or not the bull run is over or the sluggish motion is a minor blip.

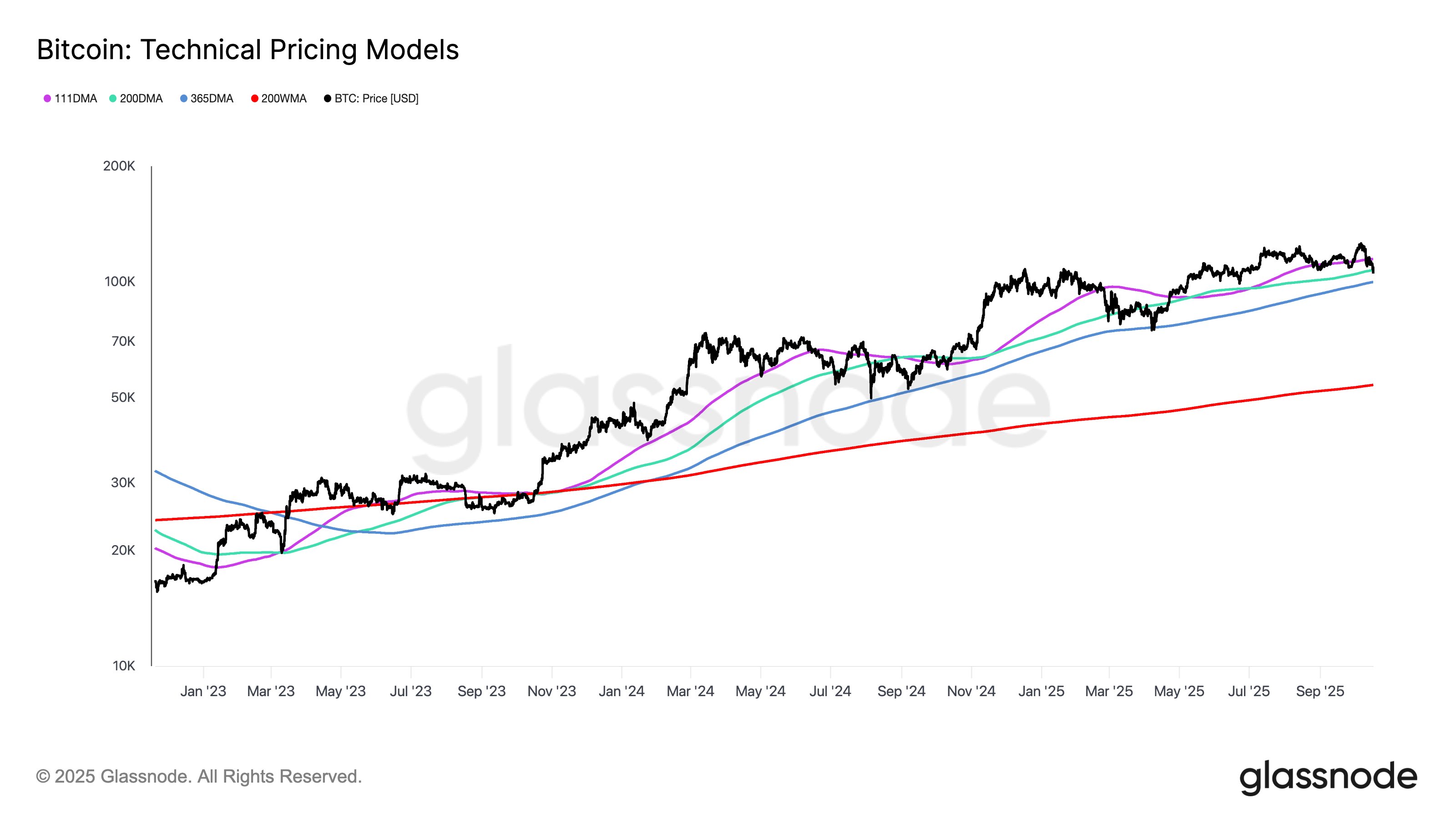

In keeping with a latest outlook, the present technical place of the BTC value may provide perception into its subsequent step.

BTC At Threat Of Deeper Correction If It Loses $99,900 Assist

In an October 17 put up on the social media platform X, Glassnode put ahead an attention-grabbing analysis of the present Bitcoin value setup. The outstanding crypto analytics agency revealed that the flagship cryptocurrency is presently sitting between two main help zones.

This evaluation is predicated on the Glassnode Technical Pricing Mannequin, a chart containing numerous technical indicators, together with the Pi Cycle indicator, the Mayer A number of, the Yearly Transferring Common (MA), and the 200-Week Transferring Common.

In keeping with Glassnode, the Bitcoin value is presently wedged between the Mayer A number of ($107,400) and the Yearly MA ($99,900).

Supply: @glassnode on X

The Mayer A number of (200-Day Easy Transferring Common) is a well-liked technical indicator typically linked with the transition level between a bull and bear market. In the meantime, the 365 Day SMA provides a long-standing baseline for high-timeframe market momentum.

Following the most recent dip, the Bitcoin value slipped beneath the 200-day Transferring Common, signaling a potential shift from a bullish market situation to a bearish one. Whereas BTC nonetheless holds above the 365-day MA, the premier cryptocurrency wants to remain above this stage to regular the present pattern.

In the end, traders may wish to keep watch over the BTC value, as a break beneath the $99,900 stage may spell a lot greater hassle for the world’s largest cryptocurrency. It’s price noting {that a} return to above the Mayer A number of may very well be important for Bitcoin’s development, albeit with value resistance across the 111-day transferring common (presently at $114,700).

Bitcoin Worth At A Look

As of this writing, Bitcoin is valued at round $106,427, reflecting an virtually 2% value drop up to now 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.