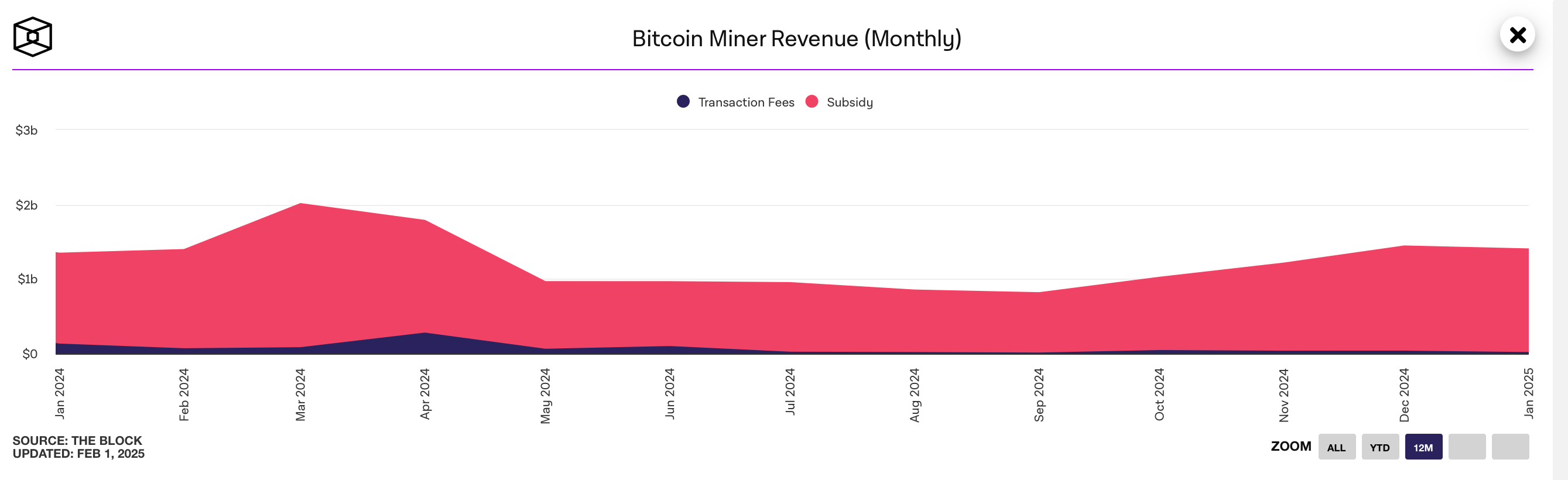

Knowledge gathered from the primary month of 2025 reveals that bitcoin mining income reached $1.4 billion for January, trailing final month’s figures by about $40 million.

First Month of 2025—Bitcoin Mining Income Mirrors December’s Figures

Statistics reveal that bitcoin miners secured about $40 million lower than in December, marking the second most worthwhile month previously 9 months. Metrics sourced from theblock.co point out that December generated $1.44 billion in income from the mixed subsidy and charges.

Roughly $39.38 million of the combination was amassed from onchain charges. Of the $1.4 billion recorded in January 2025, charges accounted for $20.37 million. These outcomes sign a nuanced surroundings for bitcoin miners.

Whereas onchain charge income and bitcoin costs fluctuate, sustained earnings spotlight operational viability amid evolving situations. Miners should negotiate price dynamics and market competitors as earnings mirror adaptability.

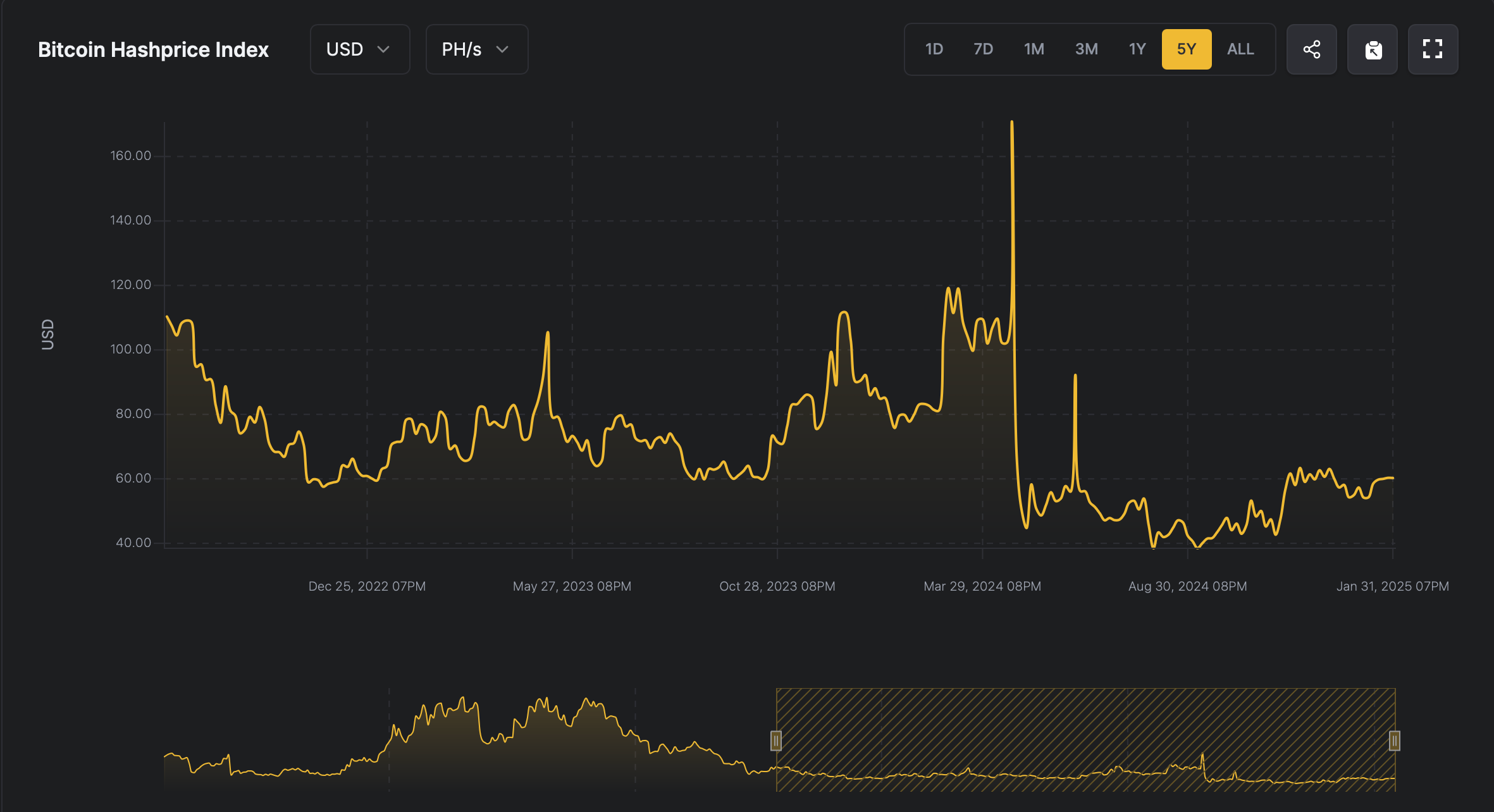

Lately, Bitcoin.com Information reported that miners are encountering a scarcity of switch exercise on the blockchain, an element which may be behind the decrease charge income. Regardless of this pattern, the hashprice—estimated worth of 1 petahash per second (PH/s) of computational energy—is now larger than it was a couple of months again.

Bitcoin’s hashprice between August 2022 till current.

For instance, on Nov. 4, 2024, 1 petahash was simply above $42, and at present it stands at $59.94 per PH/s. The community’s complete hashrate has dropped however stays round 782.98 exahash per second (EH/s), a modest lack of 39 EH/s for the reason that 822 EH/s peak on Jan. 6.

The most recent knowledge implies that bitcoin mining stays at a vital juncture, calling for strategic flexibility amid altering financial forces. Each buyers and operators would possibly uncover that adaptability is crucial to prospering in an surroundings outlined by gradual operational recalibration.

Others are embracing synthetic intelligence (AI) automobiles and bitcoin (BTC) treasury adoption as a way to mitigate losses. As market parameters shift, progressive members will seemingly modify their methodologies to maintain profitability and seize rising alternatives with agency conviction.