The Bitcoin community is increasing on an industrial scale, with power-hungry mining rigs driving vitality consumption to unprecedented highs even because the stream of transactions slows to a trickle. But, the community appears to be below pressure as rising hashrate and infrastructure collide with weak price income and uncommon mempool clearings that go away miners incomes little past the block subsidy.

Abstract

- Bitcoin’s mining community is rising into an energy-intensive big, drawing greater than 33 gigawatts to maintain new blocks flowing at the same time as on-chain transactions sluggish to their weakest ranges in practically two years.

- The GoMining Institutional report portrays an ecosystem the place hashrate and {hardware} deployments proceed to climb, however price income and general exercise stay subdued, making a mismatch between community scale and miner earnings.

- Observers say this imbalance could linger for years, with operators depending on a diminishing block subsidy that halves each 4 years till the ultimate bitcoin is mined someday round 2140.

The Bitcoin (BTC) community is getting into a part of placing contrasts: its urge for food for electrical energy is hovering, whereas the financial rewards for miners are below strain from low transaction exercise. A brand new report by GoMining Institutional, seen by crypto.information, sketches a panorama of accelerating vitality use, muted mining issue, and an unusually quiet on-chain atmosphere, elevating questions on how sustainable the present trajectory could be.

In response to the report, the community’s estimated vitality consumption has grown at what researchers described as “an unprecedented tempo.” Drawing on knowledge from CoinMetrics Labs, GoMining notes that Bitcoin mining energy use rose from 15.6 gigawatts (GW) in January 2024 to 24.5 GW in January 2025. By the tip of Might 2025, it had climbed once more to 33.1 GW, a greater than 100% improve in simply 17 months.

A lot of that surge has been concentrated within the early a part of 2025. “The January-to-Might bounce alone — a 35% rise in vitality demand — displays each heightened deployment of extra energy-dense mining infrastructure following the April halving,” the report reads.

Business analysts cited within the report recommend that though particular person mining rigs are extra environment friendly than ever, their proliferation is overwhelming these positive factors. “Effectivity positive factors on the machine stage are more and more offset by the sheer quantity of deployed {hardware},” the report mentioned, including that the significance of innovation now extends past ASIC design to how and the place miners supply their energy.

Steepest decline since 2021

The accelerating vitality use comes because the community’s mining issue — an indicator of how onerous it’s to confirm new blocks — has been comparatively subdued. The primary half of 2025 noticed 13 issue changes, with the metric rising from 109.78 trillion initially of the yr to 116.96 trillion by the tip of June. That represents a year-to-date improve of simply 6.54%, with a median month-to-month climb of 1.09%.

The report frames this slowdown in opposition to 2024’s fast enlargement, when issue rose 4.48% monthly on common. The relative calm in 2025 was punctuated by moments of volatility: a 6.81% upward adjustment on April 5 and a 4.38% improve on Might 30 pushed issue to an all-time excessive of 126.98 trillion. However that peak rapidly gave strategy to a pointy reversal.

By late June, warmth waves throughout North America pressured some operators to restrict exercise, sending hashrate down by 147 EH/s. “Bitcoin’s issue adjusted downward by -7.48%, the steepest decline since July 2021,” the report famous, drawing a comparability to the post-China mining ban period.

You may also like: Cango finalizes pivot to a Bitcoin mining firm

If the community’s energy draw is climbing, its transaction layer tells the other story. On-chain exercise within the first half of 2025 has slumped to ranges not seen since October 2023. The seven-day transferring common of day by day transactions additionally fell to about 313,510 by June 25, with a low of 256,000 confirmed transactions on June 1.

That weak point has translated into traditionally low charges. All year long, customers have been in a position to broadcast transactions on the naked minimal price of 1 satoshi per digital byte, no matter precedence. “All through H1, there have been a number of events when transactions — no matter precedence stage — may very well be broadcast for the naked minimal price of simply 1 sat/vB, highlighting the persistently low demand for blockspace throughout the community,” the report mentioned.

Ghosted mempool

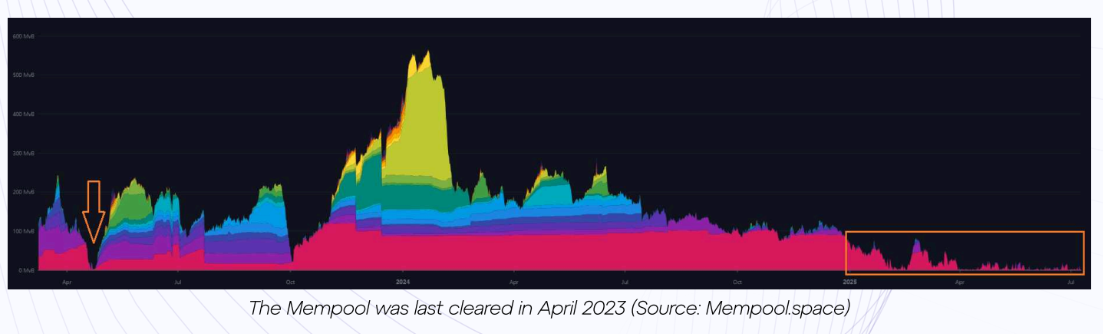

The atmosphere has produced a uncommon phenomenon: a completely cleared mempool. The mempool — a ready space for unconfirmed transactions — emptied twice in 2025 for the primary time in practically two years. The final comparable occasion was in April 2023, when Ordinals and BRC-20 token exercise had not but crowded block house to present norms.

When the mempool clears, the report notes, miners briefly function with “virtually no transaction price income,” relying virtually totally on the block subsidy. That dynamic underlines one in all Bitcoin’s long-term financial questions. Because the fastened subsidy halves roughly each 4 years — finally disappearing totally — the community will depend on transaction charges to maintain miners. Low-fee environments, whereas welcome for customers, can pinch operators already grappling with excessive vitality prices.

Bitcoin’s mempool | Supply: GoMining

For Bitcoin miners, the strain between rising energy demand and thinning income is changing into tougher to disregard. Excessive warmth in key U.S. mining areas has already demonstrated the fragility of hashrate below environmental strain. In the meantime, the doubling of community vitality consumption since early 2024 hints at infrastructure scaling quicker than transaction exercise or price earnings.

Business observers recommend that this paradox could persist. Mining corporations proceed to deploy energy-dense fleets to safe the community and seize block rewards, however their long-term economics are tethered to elements outdoors their management, community exercise, consumer demand for block house, and the tempo of Bitcoin’s programmed halvings, that are anticipated to proceed roughly each 4 years till round 2140, when the ultimate BTC is projected to be mined and the block subsidy drops to zero.

Learn extra: Bitmain to launch first U.S. Bitcoin mining chip manufacturing facility by 2026: Bloomberg