Bitcoin Lengthy-Time period Accumulation Surge Amid International Tensions

Bitcoin surged to $110,000 simply two days in the past, coming inside placing distance of its $112,000 all-time excessive. Nonetheless, heightened geopolitical tensions—particularly following the Israel-Iran battle—have despatched markets right into a state of risk-off volatility. BTC has since retraced to $104,000, a 7% drop from its native excessive, however the value motion stays notably resilient. Bitcoin continues to commerce above important help ranges, and the broader pattern means that bulls should have momentum on their aspect.

The $112,000 zone stays the important thing stage to flip, as a decisive breakout there would push BTC into value discovery and sign the beginning of a brand new explosive part for the whole crypto market. For now, the market waits for affirmation, as Bitcoin consolidates under resistance in a high-stakes setting.

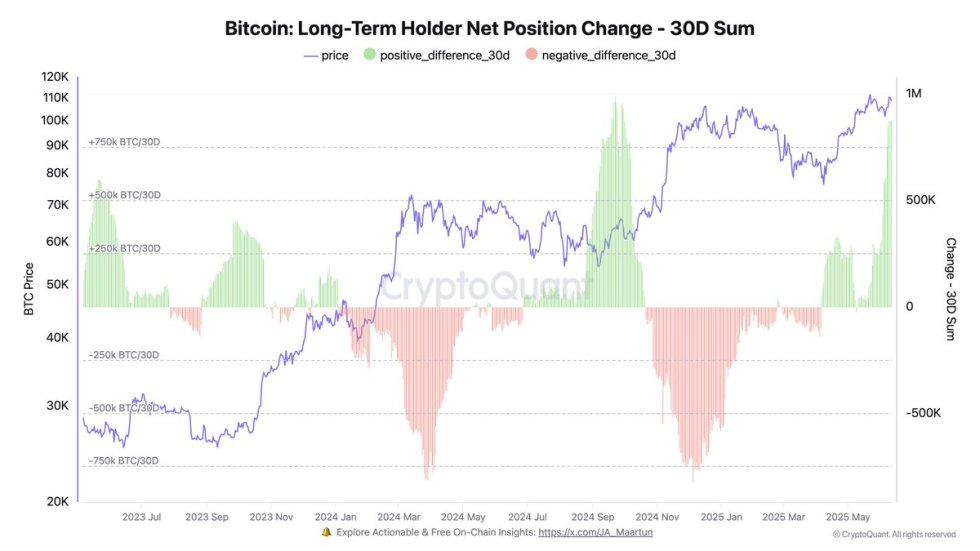

Regardless of the volatility, sturdy on-chain fundamentals are preserving investor sentiment intact. Based on CryptoQuant CEO Ki Younger Ju, long-term holders have added 881,578 BTC to their wallets over the previous 30 days—an enormous wave of accumulation. This cohort is usually composed of extra skilled buyers, signaling confidence in Bitcoin’s medium-to-long-term trajectory.

Whereas international uncertainty continues to dominate headlines, Bitcoin’s potential to carry the $104K stage, mixed with this aggressive long-term accumulation, means that any pullback could also be short-lived. If bulls regain momentum and reclaim $110K, the following cease may very well be uncharted territory past the all-time excessive. The subsequent few days will doubtless outline the tempo for the remainder of the quarter.

BTC Finds Help After Sharp Rejection From $110K Resistance

The 4-hour Bitcoin chart reveals a pointy rejection from the $110K zone earlier this week, adopted by a swift decline to $104K. The value is at present holding simply above a important help stage round $103,600—a zone that beforehand served as a launchpad in early June. The $109,300 resistance stays the important thing stage to interrupt for continuation towards all-time highs, however till then, the pattern stays susceptible to draw back volatility.

Worth motion reveals elevated quantity on the latest sell-off, signaling heightened investor response to the geopolitical tensions triggered by the Israel-Iran battle. Nonetheless, the bounce off the $103,600 stage means that bulls are defending this space, and it continues to function a key structural help.

The 50, 100, and 200-period SMAs are actually converging between $106,000 and $106,500, including confluence as a short-term resistance cluster. A clear break above that area might open the door for a retest of $109,300. If BTC fails to carry the $103,600 stage, nevertheless, the market might revisit the $100K psychological mark.

Featured picture from Dall-E, chart from TradingView