Bitcoin remained resilient in the course of the newest market sell-off, whereas altcoins confronted estimated liquidations of $8 billion to $10 billion, with funding charges turning deeply unfavourable, a survey claims.

A pointy spike in volatility shook the crypto market, erasing billions in open curiosity, with Bybit and Block Scholes reporting that Bitcoin (BTC) stayed regular whereas altcoins took the most important hit.

In a analysis report shared with crypto.information, Bybit acknowledged that Bitcoin “outperformed relative to the broader crypto market,” including that its perpetual swaps fared higher as effectively. In distinction, the Ethereum (ETH) choices market skilled a pointy spike in short-term volatility, surging above 140%, its highest stage in over three months.

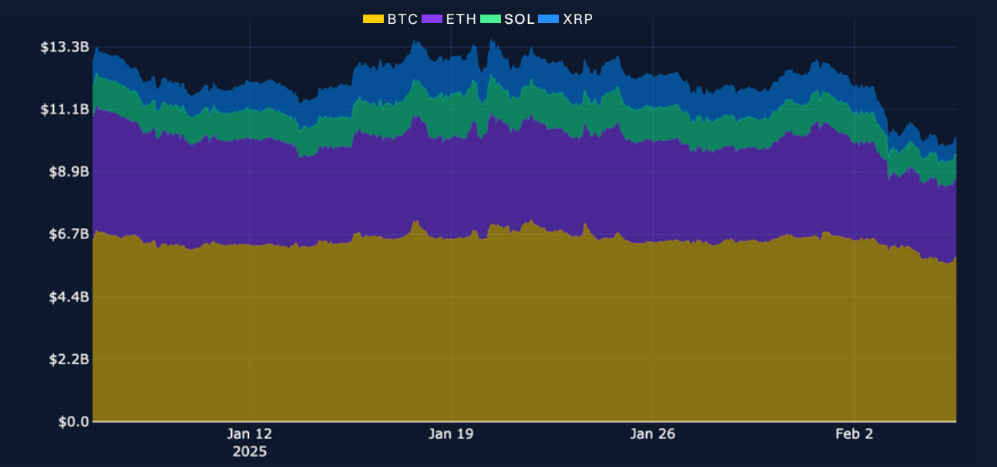

Bybit perp open curiosity | Supply: Bybit

Liquidations have been brutal. As crypto.information earlier reported, Bybit CEO Ben Zhou estimates that the true notional worth of liquidated positions might have been “no less than $8 billion to $10 billion.” Throughout BTC, ETH, XRP (XRP), and Solana (SOL)’s perpetual swaps, greater than $3.1 billion in open curiosity vanished after a late-Friday excessive.

You may additionally like: Ethereum nosedives 23%, is a deeper correction coming?

Funding charges drop for altcoins

Funding charges mirrored the bearish shift. Altcoins noticed deeper unfavourable funding charges within the days following the crash, whereas BTC remained comparatively secure, the report states. Open curiosity ranges plummeted throughout main tokens, with one key exception—Bitcoin’s choices market. Not like perpetuals, Bitcoin choices didn’t expertise a significant liquidation occasion, and its time period construction inversion shortly resolved, Bybit famous.

Regardless of the market turmoil, buying and selling quantity surged, with over $31.1 billion in perpetual swaps traded on Feb. 2, marking the very best every day quantity in over a month. For Bitcoin, short-term choices volatility eased after an early-week spike, suggesting a return to stability, no less than for now.

Learn extra: Crypto crash wipes out $2.2B—Worse than FTX and LUNA