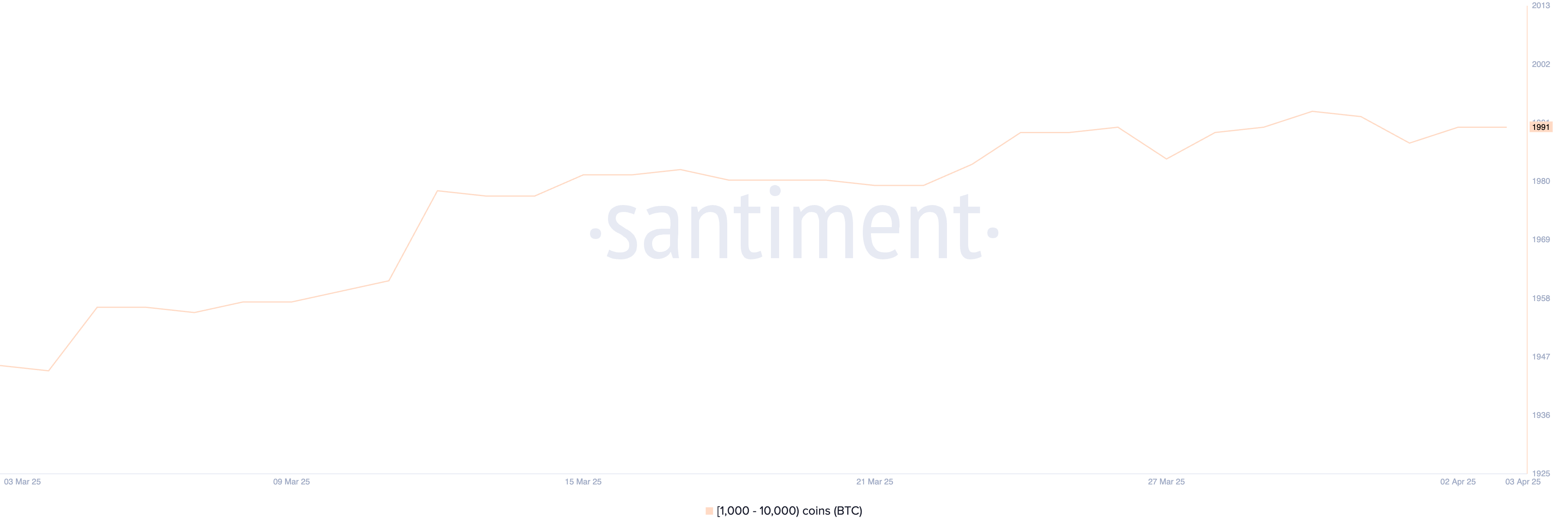

Bitcoin (BTC) continues to hover in a state of uncertainty as each whale exercise and technical indicators level to a market missing sturdy conviction. Massive holders have remained inactive for over per week, with the variety of whale wallets holding between 1,000 and 10,000 BTC regular at 1,991 since March 24.

In the meantime, technical charts just like the Ichimoku Cloud and EMA strains supply a combined outlook, reflecting hesitation in each bullish and bearish instructions. As BTC trades close to key assist and resistance ranges, the approaching days might decide whether or not April brings a breakout or deeper correction.

Bitcoin Whales Aren’t Accumulating

The variety of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—presently stands at 1,991, a determine that has remained remarkably regular since March 24.

This degree of consistency in giant holder exercise means that main gamers are neither aggressively accumulating nor offloading their positions.

Given the dimensions of those holdings, even minor shifts in whale habits can considerably impression the market. This stability is especially noteworthy given current volatility throughout the broader crypto market.

Bitcoin Whales. Supply: Santiment

Monitoring Bitcoin whales is essential as a result of these giant holders typically have the facility to affect value motion via their shopping for or promoting selections.

When whales accumulate BTC, it might sign confidence in future value appreciation, whereas large-scale promoting can point out upcoming downward stress. The truth that the variety of whales has remained steady for the final 11 days might counsel a interval of consolidation, the place massive buyers are ready for a clearer macro or market sign earlier than making their subsequent transfer.

This might suggest that main gamers see the present BTC value as truthful worth, doubtlessly resulting in a tightening of value motion within the quick time period earlier than a breakout in both route.

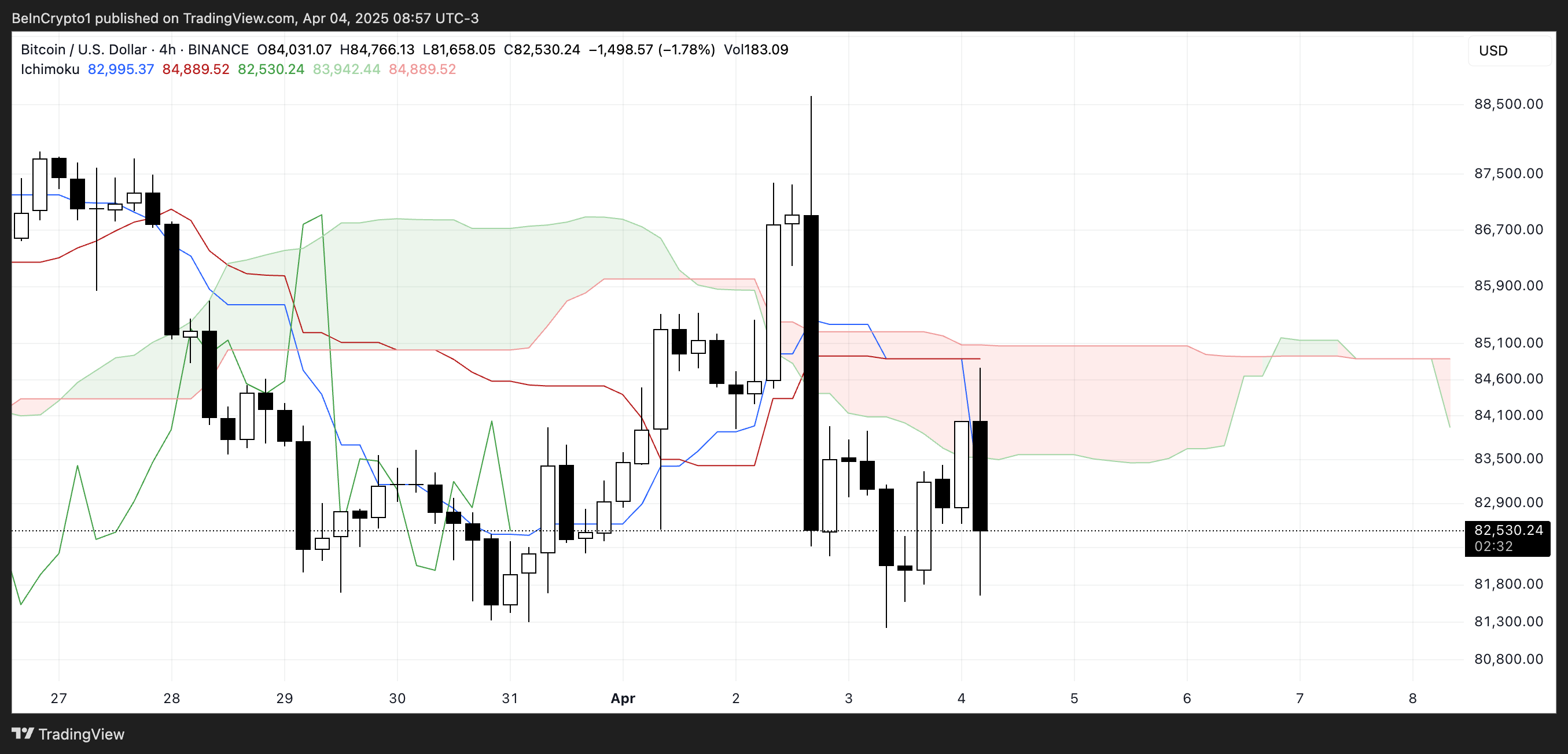

BTC Ichimoku Cloud Exhibits A Combined Image

The present Ichimoku Cloud setup for Bitcoin reveals a combined however barely cautious sentiment.

The value not too long ago dipped beneath the crimson baseline (Kijun-sen), and regardless of a short push into the cloud, it was rejected and fell again beneath it—indicating that bullish momentum lacked follow-through.

The blue conversion line (Tenkan-sen) is now trending downward and has crossed beneath the baseline, which frequently displays short-term bearish momentum. In the meantime, the Main Span A (inexperienced cloud boundary) is beginning to flatten, whereas Main Span B (crimson boundary) stays comparatively horizontal, forming a skinny and impartial cloud forward.

BTC Ichimoku Cloud. Supply: TradingView

Such a skinny, flat cloud suggests indecision available in the market and an absence of sturdy trending momentum. The value hovering slightly below the cloud additional reinforces the concept BTC is in a consolidation section relatively than a transparent pattern.

If the worth can break again above the cloud and keep that degree, it might sign renewed bullish power.

Nonetheless, continued rejection on the cloud and stress from the falling Tenkan-sen might preserve BTC in a corrective or sideways construction. For now, the Ichimoku setup displays uncertainty, with no dominant pattern confirmed in both route.

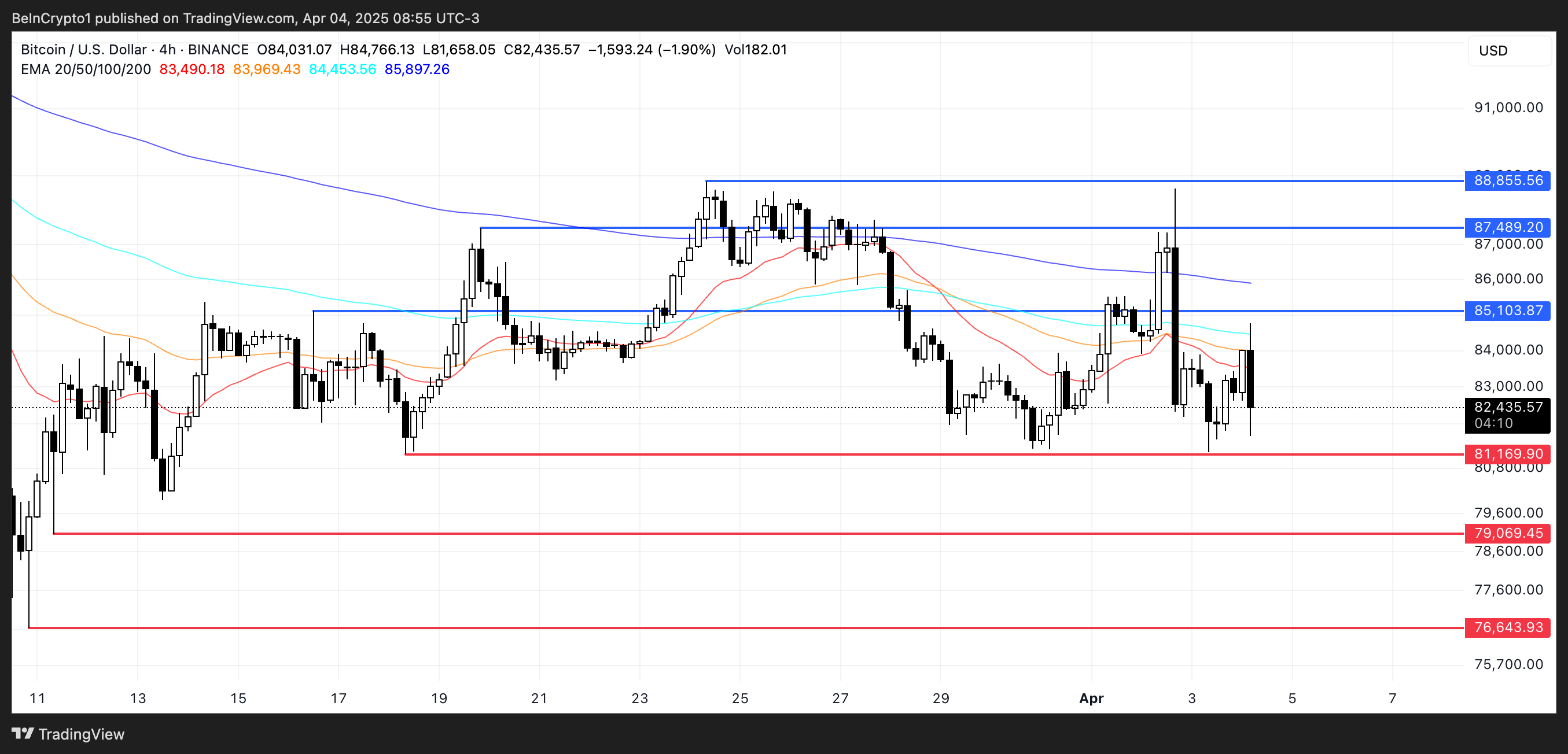

Will Bitcoin Rise Again To $88,000 In April?

Bitcoin’s EMA construction nonetheless leans bearish total, with longer-term EMAs positioned above the shorter-term ones. Nonetheless, the current upward motion within the short-term EMAs suggests {that a} rebound might be forming.

If this short-term power develops right into a sustained transfer, Bitcoin might first check the resistance at $85,103. A profitable break above this degree might sign a shift in momentum, opening the door to increased targets at $87,489. Not too long ago, Normal Chartered predicted that BTC is more likely to break $88,500 this weekend.

BTC Worth Evaluation. Supply: TradingView

If bullish stress stays sturdy past that time, Bitcoin value might push even additional to problem $88,855, a degree that might mark a extra convincing restoration from the current pullback.

“(…) After Wednesday’s volatility, BTC has rebounded greater than 4% and stays firmly above $79,000, with a key assist degree forming at $80,000 and barely increased every day alternate volumes, which is a constructive signal. On prime of this, Bitcoin ETF flows counsel sentiment stays sturdy, with $220 million inflows on “Tariff Day”, April 2.,” Nic Puckrin, crypto analyst, investor, and founding father of The Coin Bureau, instructed BeInCrypto.

Nonetheless, if Bitcoin fails to construct sufficient momentum for this rebound, draw back dangers stay. The primary key degree to look at is the assist at $81,169.

Because the commerce warfare between China and the US escalates, a drop beneath this degree might see BTC falling below the psychological $80,000 mark, with the following goal round $79,069. If this zone can be misplaced, the bearish pattern might intensify, sending BTC additional down towards $76,643.