Bitcoin confirmed some muscle as we speak, breaching the $93,000 mark, as shopping for noticed quantity of exercise throughout the digital forex market. Even with costs heading north, Bitcoin saved on Binance has been retreating, in response to on-chain information.

That shrinking provide on a significant alternate is one in all a number of forces merchants level to as tightening accessible cash on the market.

Binance Reserves Shrink

Based mostly on an evaluation by CryptoQuant, Binance’s Bitcoin reserves have declined as extra cash transfer off the alternate. A few of that shift comes from holders transferring funds into personal chilly wallets for safekeeping.

Experiences present that giant consumers within the US — together with spot ETF managers — are additionally taking cash off the market and putting them with custodians.

These strikes scale back the float accessible to merchants and might add upward strain on costs when demand rises.

Why Binance’s Bitcoin Reserves Are Declining

“Traditionally, such situations have supported medium- to long-term value appreciation. The present development means that Binance’s reserve decline is a standard re-accumulation part.” – By @xwinfinance pic.twitter.com/g3TCG4o6GD

— CryptoQuant.com (@cryptoquant_com) December 3, 2025

ETF Shopping for And Self-Custody

Based on analysts, US spot ETFs have been shopping for significant quantities of Bitcoin for his or her merchandise. Funds from large issuers are held by trusted custodians reasonably than on buying and selling platforms.

On the similar time, strange holders and whales steadily shift holdings to self-custody throughout rallies, signaling they don’t plan to promote quickly.

Collectively, these tendencies take away provide from exchanges and assist clarify why reserves on Binance are shrinking.

BTCUSD buying and selling at $92,678 on the 24-hour chart: TradingView

Derivatives And Liquidations

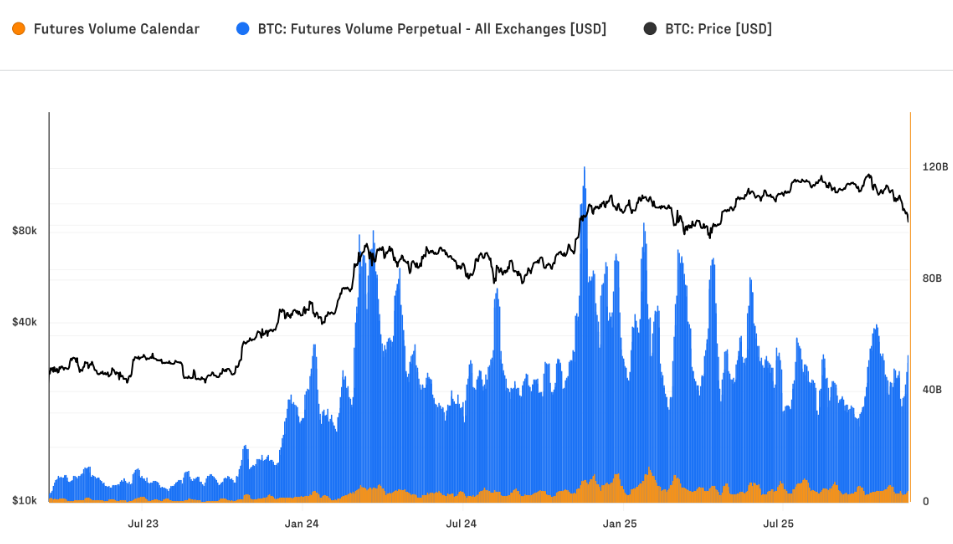

Derivatives exercise additionally performed a job in current alternate balances. Every day futures wipeouts have climbed from averages of about $28 million lengthy and $15 million brief within the prior cycle to close $68 million lengthy and $45 million brief within the present run.

That uptick in compelled exits peaked on Oct. 10, when over $640 million per hour in lengthy positions have been liquidated as Bitcoin slid from $121,000 to $102,000.

Open curiosity dropped roughly 22% in below 12 hours, falling from near $50 billion to $38 billion on the time.

Market Exercise in Bitcoin Futures. Supply: Glassnode

Nonetheless At A Excessive

Whereas these liquidations have been dramatic, the futures market has grown total. Open curiosity is at a report $67 billion and each day futures turnover reached $68 billion.

Greater than 90% of that exercise is in perpetual contracts, which are inclined to amplify short-term strikes. That mixture raises each buying and selling quantity and the potential for sharp strikes when sentiment flips.

Worth Ranges To Watch

Based mostly on dealer calls, the market is watching the $92,000–$94,000 zone as a key resistance space. A clear each day shut above that band may pace momentum towards $100K.

Nearer-term assist sits round $88,000–$89,000, the place consumers are anticipated to step in if costs pull again. Buying and selling quantity on a busy day climbed near $86 billion, displaying renewed curiosity from each retail and institutional members.

Featured picture from Safelincs, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.