August didn’t include a flood of shiny new chains, however it did floor a handful of tasks that felt price a more in-depth look. Some had been long-promised concepts lastly hitting mainnet, others had been recent makes an attempt to rethink acquainted fashions, and at the very least one or two merely managed to seize extra consideration than the standard noise. Listed here are those that stood out to us this month, and why they earned a spot within the dialog.

Succinct – A Decentralized Market for Zero-Data Proofs

Kicking issues off with infrastructure, one of many extra tangible launches this month got here from the ZK world. Succinct is constructing what quantities to a clearinghouse for zero-knowledge computation: a decentralized community of provers that any rollup or dApp can faucet into once they want proofs generated or verified. In early August, it stopped being concept and went stay on Ethereum mainnet.

We’ve been listening to “zero-knowledge is the longer term” lengthy sufficient that it’s straightforward to glaze over one other pitch about cryptographic speedups. However this one felt a bit laborious to dismiss: purposes can now ship proof requests into the wild, and unbiased provers compete to meet them. The result’s mainly “ZK proofs as a service,” paid and secured via the community’s PROVE token.

What makes it land is the traction. Succinct isn’t ranging from a chilly boot — it’s already dealt with tens of millions of proofs throughout testing, secured billions in worth, and plugged into protocols like Polygon, Celestia, Mantle, and Lido. That’s a far cry from a analysis demo.

Does it resolve scaling as soon as and for all? Most likely not — bottlenecks all the time discover their manner again into crypto programs. However in comparison with the standard “belief us, it’ll work ultimately” chorus, Succinct’s launch carries the load of one thing actual: infrastructure rollups can lean on in the present day, not in some hypothetical ZK-powered tomorrow.

QF Community – A New Excessive-Efficiency Layer-1 on the Horizon

From one thing already stay to one thing nonetheless within the blueprint stage: QF Community solely supplied an announcement this August, however it was sufficient to plant a flag. The challenge is the newest Layer-1 chain vying for consideration, pitched as a efficiency monster with a RISC-V execution core, a customized SPIN consensus, and zkTLS for bridging Web2 and Web3. In mid-August the group confirmed what had solely been whispers earlier than: mainnet is formally slated for This autumn this yr.

That’s about so far as the story goes for now — guarantees and structure diagrams. It’s daring on paper: sub-second block occasions, throughput numbers meant to place Solana to disgrace, and a developer toolkit that supposedly makes Web2 integration painless. However we’ve all learn sufficient whitepapers to understand how large the hole will be between a crisp pitch deck and a buzzing mainnet.

The attention-grabbing half isn’t whether or not QF will ship all the things it claims — few tasks ever do — however that it’s planting a flag in an more and more crowded discipline with a really particular ambition: pace because the defining function. In an ecosystem the place Ethereum is doubling down on modular rollups and Solana is glad to flex transaction charts, QF desires to reach with “quicker than each, belief us” type of power.

Will it really matter when the chain flips on later this yr? Exhausting to say. In all honesty, QF feels extra like a concept proper now than a dwelling community. However at the very least they’ve put a date on it, which suggests the clock is ticking — and on this area, delivering something in any respect on time is already a minor victory.

R0AR – A DeFi Tremendous-App Constructing Its Personal Layer-2

In comparison with QF’s experimental twist, R0AR goes for a unique type of experiment — group possession. August was when the challenge lastly opened up its validator license sale and launched one other DeFi protocol. Particularly, an Optimism-based Layer-2 chain designed to be a one-stop store: wallets, staking, NFTs, AI buying and selling instruments, all orbiting round its 1R0R token. The hook is that it desires to be community-owned from day one — no shadowy sequencer cabal, however a validator set anybody can be a part of by shopping for a Node NFT license.

That pitch obtained actual in August, when the challenge opened up its node license sale. Early companions obtained first dibs mid-month, the broader public adopted proper after, and immediately you had retail and small establishments lining as much as stake a declare on the community’s infrastructure. Every license provides you the best to run a validator, deal with transaction execution, and earn rewards as soon as the mainnet goes stay in This autumn.

It’s not laborious to see the attraction. Most Layer-2s in the present day are technically spectacular however structurally centralized — one sequencer, one swap. R0AR is making decentralization its promoting level, betting that individuals will need to really personal a bit of the rails they’re utilizing. If it really works, validators received’t simply be a safety layer; they’ll be a group invested within the chain’s success.

After all, the query is whether or not packing all of DeFi into one branded super-app can keep away from the destiny of a dozen “all-in-one” platforms earlier than it. However R0AR’s timing is sharp: it’s plugging into the Optimism Superchain narrative and dangling tangible upside (node rewards, governance) to early believers. If nothing else, it’s one of many first makes an attempt to make an L2 really feel much less like a company product and extra like a co-op.

Mawari – Decentralized Streaming for the AR/VR Crowd

In comparison with most up-to-date base layer fintech tasks, Mawari goes after one thing stranger: learn how to stream 3D and XR content material with out melting your telephone or choking a knowledge middle. Consider it as a decentralized content material supply community, however as an alternative of static recordsdata it’s pushing real-time AR/VR visuals, rendered throughout a swarm of GPU nodes.

In mid-August, Mawari got here out of the shadows with a full community launch and a partnership with Caldera to anchor high quality metrics on-chain. The best way it really works is that this: GPU nodes deal with the heavy lifting of rendering, “Guardian Nodes” log efficiency knowledge (latency, body accuracy, and so on.), and that status will get baked right into a rollup for transparency. Furthermore, Mawari’s patented streaming tech claims an 80% lower in bandwidth in comparison with the standard XR pipelines. So, on paper we’ve obtained a system that would make metaverse experiences viable on regular units.

And so they’re not simply pitching to crypto natives. Mawari has already been piloted with Japanese VTuber businesses, exhibiting it will probably ship stay, animated characters at scale. That element issues — VTubing is huge enterprise in Japan, and it’s an ideal stress check for whether or not this community can deal with actual demand with out collapsing underneath latency.

Does that imply the “metaverse” is saved? Hardly. The complete area nonetheless wants individuals who need to present up in headsets for hours at a time. However Mawari is attention-grabbing exactly as a result of it isn’t a client app — it’s plumbing. If AR/VR content material does take off, someone has to construct the pipes, and proper now Mawari appears to be like like one of many few really laying them.

Irys – Everlasting Storage Constructed on Arweave

There have additionally been recent growth from the crypto storage discipline. Irys is a storage layer aiming to make “eternally” knowledge a bit extra usable. It builds on Arweave’s permaweb, including instruments for provenance and simple archiving so builders and enterprises don’t need to wrestle with uncooked storage contracts. In late August, it stepped out with a $10 million Sequence A led by CoinFund — a strong endorsement in a yr when most crypto startups are struggling to get checks signed.

That spherical places Irys on the hook to ship its mainnet quickly. The pitch is simple: companies, NFT platforms, even historians want a solution to anchor knowledge completely and show the place it got here from. Arweave already gives the spine, however Irys desires to clean the perimeters — indexing, integration, and a mannequin that makes it simpler for tasks to belief their knowledge will nonetheless be there in ten years.

It’s not flashy, and it received’t drive speculative mania the best way a token presale does, however infrastructure like this tends to stay round as soon as it really works. With provenance and permanence turning into sizzling subjects throughout AI, NFTs, and Web3 typically, Irys’s timing feels sensible.

The danger, in fact, is that decentralized storage has been “about to take off” for a lot of the previous 5 years, and adoption curves are sluggish. However for those who imagine permanence goes to be an even bigger a part of the Web3 stack — and with AI fashions scraping all the things, that case is simply getting louder — then Irys simply earned itself a good runway to strive.

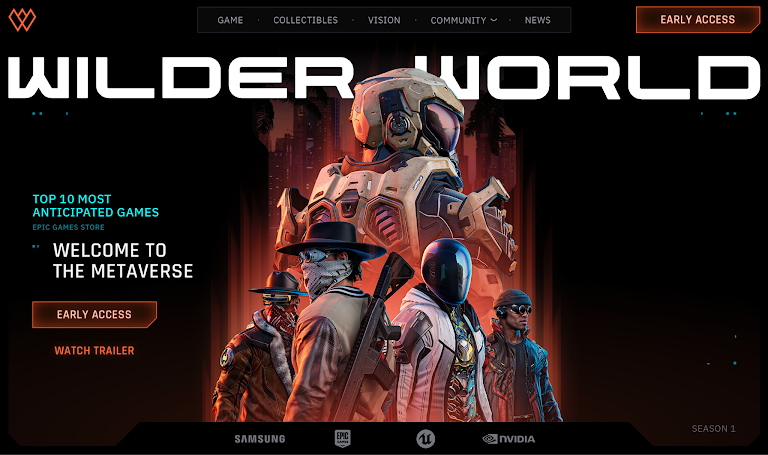

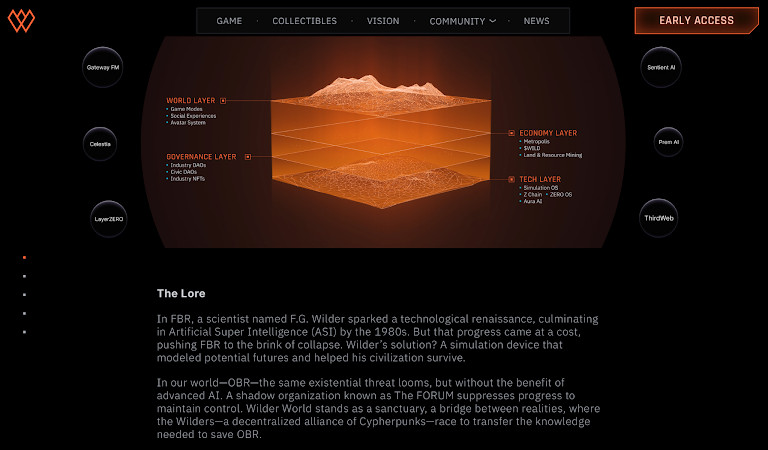

On the gaming entrance, August’s splash got here from Wilder World. The long-teased Unreal Engine metaverse confirmed its arrival on the Epic Video games Retailer. Most “metaverse” pitches sound like they had been dreamed up on a whiteboard and left there. Wilder World, at the very least, is placing one thing tangible in gamers’ fingers: a 5D open-world recreation constructed on Unreal Engine 5, styled as a solarpunk duplicate of Miami. In August the group confirmed it’s touchdown on the Epic Video games Retailer with a phased early entry rollout, beginning with arena-style fight earlier than increasing into racing and, ultimately, a full open world.

The setup is basic Web3: land, condos, autos, wearables — all NFTs, all tradable. However the vibe isn’t low cost shovelware. The visuals look AAA-grade, the atmosphere has been in manufacturing for years, and the Epic Retailer itemizing means curious avid gamers can simply click on “obtain” while not having to the touch a pockets.

Whether or not individuals really stick round is the open query. Web3 video games have a behavior of front-loading pleasure after which ghosting their very own Discords by week three. However Wilder World at the very least appears to grasp the necessity for pacing: early entry is staggered, content material drops come weekly, and the group is promising racing modes by yr’s finish. The wager is clearly not on dropping all the things directly however protecting gamers coming again long-term.

Does this make it the metaverse recreation to lastly crack mainstream? Too early to name. However in comparison with a lot of the style’s half-baked rollouts, Wilder World already feels extra alive — and that’s price noting.

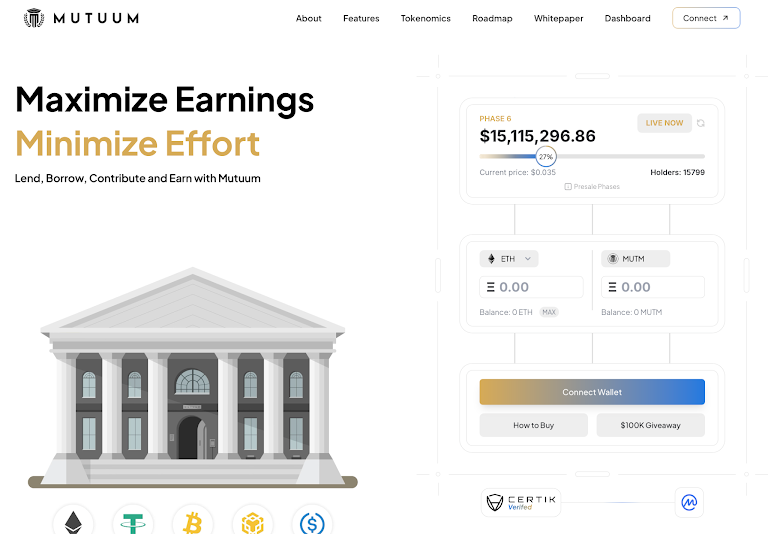

Mutuum Finance – But One other Massive DeFi Pitch, With a Twist

And since no month in crypto is full with no buzzy DeFi presale, Mutuum Finance crammed that slot in August. Mutuum desires to be your subsequent all-in-one lending hub, pairing peer-to-pool contracts with peer-to-peer offers and wrapping it throughout an overcollateralized USD stablecoin. It’s the type of “rebuild banking on-chain” imaginative and prescient we’ve heard dozens of occasions, however August gave it a little bit of traction: the presale hauled in practically $15 million from greater than 15,000 buyers, and CertiK stamped it with a tidy 95/100 audit rating.

That type of fundraising in 2025 is definitely no small feat. Every presale spherical ratcheted the token worth up towards an eventual $0.06 itemizing, and the pitch decks had been filled with fats ROI projections. It additionally flaunts a splashy $100k airdrop marketing campaign and a bug bounty, so we get the sense the group is aware of learn how to maintain a crowd entertained.

Nonetheless, it’s actually laborious to not smirk. We’ve seen a parade of “main new DeFi” launches over time, and most find yourself as footnotes as soon as the incentives dry up. Mutuum’s edge, if it has one, is the hybrid lending mannequin — letting some customers persist with easy pooled lending whereas others lower customized P2P phrases — plus the promise of a homegrown stablecoin to connect the ecosystem collectively.

Will it final? Possibly. Or possibly it’s one other spherical of déjà vu within the endless DeFi expertise present. However for August, Mutuum managed to make sufficient noise, elevate sufficient capital, and rating sufficient early-stage validation that it compelled its manner into the dialog. And typically that’s all a challenge actually wants.