The Arbitrum Basis took to X, previously Twitter, earlier in the present day to announce that the DAO is transferring on to the subsequent part of its Steady Treasury Endowment Program (STEP), after an on-chain vote.

As a part of the brand new part of the DAO’s initiative to diversify its treasury with investments in real-world property (RWAs), it is going to allocate 35 million ARB, price round $11.6 million at present costs, to tokenized U.S. Treasurys by way of main institutional issuers Franklin Templeton, Spiko, and WisdomTree.

It’s an enormous day for RWAs!

The ArbitrumDAO simply accepted 35M ARB by way of STEP 2 to speed up RWA institutional adoption with @FTI_US @Spiko_finance and @WisdomTreeFunds

Solely on Arbitrum, right here’s what this implies 👇 pic.twitter.com/AtnYof4qsH

— Arbitrum (@arbitrum) Could 8, 2025

The funds shall be distributed amongst three issuers

In line with the DAO’s put up, after a proposal course of that evaluated over 50 submissions, the STEP committee really useful an allocation of 35% to Franklin Templeton’s FOBXX (tokenized as BENJI), 35% to Spiko’s USTBL, and 30% to WisdomTree’s WTGXX.

The committee, which is made up of community-elected members, made their choose with a need to strike the best steadiness between charges, current TVL, risk-adjusted setups, and group involvement.

Virtually 89% of the individuals voted in favor of the allocations, with many expressing satisfaction with the choice as they consider it displays the best steadiness of prices, dangers and returns with out compromising on the broader purpose of supporting RWA progress on Arbitrum.

Solely 0.01% voted in opposition to, and round 11% selected to abstain. Voting lasted a number of days, beginning on Could 1 earlier than concluding at 9 a.m. ET on Thursday. Candidates who weren’t chosen will get to reapply within the subsequent spherical, in line with the proposal submitted by Arbitrum DAO strategic consultants Entropy Advisors, on behalf of the committee.

“We’re thrilled to be chosen as a supervisor for the STEP 2 program, deepening our already robust reference to the Arbitrum person base,” Roger Bayston, Head of Digital Property at Franklin Templeton, has stated. “By leveraging Arbitrum’s main Layer 2 expertise, we’re in a position to ship quicker, extra scalable, and cost-efficient options to our shoppers. This collaboration not solely strengthens our dedication to innovation but additionally positions us on the forefront of the subsequent era of monetary companies infrastructure.”

The STEP initiative is essential for the DAO

The STEP initiative is a strategic transfer to foster extra institutional involvement within the Arbitrum ecosystem and develop its affect within the broader blockchain and monetary sectors.

Matthew Fiebach, co-founder of Entropy Advisors, shared his ideas on the event in a latest interview. In line with him, the truth that organizations like Blackrock, Franklin Templeton, Spiko, and Knowledge Tree are publicly interacting with a DAO in a discussion board is “an unbelievable accomplishment for the entire crypto area.”

“Since day one, Arbitrum has been strategically positioned on the coronary heart of crypto’s convergence with TradFi, and STEP is a good instance of the DAO’s steadfast push to proceed bringing establishments onchain,” he added.

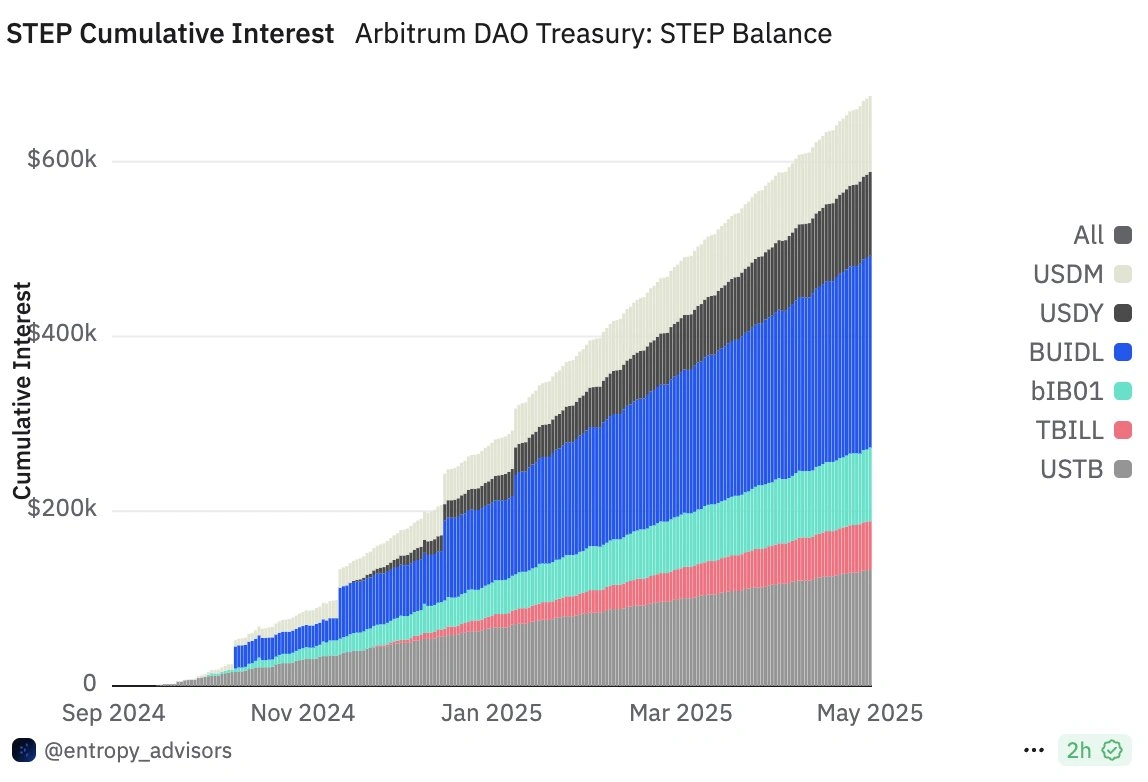

Arbitrum DAO has seen over $650K in curiosity since its launch over 6 months in the past. Supply: Arbitrum

All three organizations concerned within the Arbitrum initiative have a long time of expertise in managing property, and their involvement with STEP 2 can sign to different establishments that the community is a dependable and safe platform for tokenizing and managing RWAs.

Its partnership with these established TradFi companies may also help Arbitrum exhibit that it has a mature ecosystem that’s safe and able to dealing with institutional-grade monetary operations.

In line with the put up from Arbitrum, since its launch over 6 months in the past, over $650K in curiosity has been generated for the DAO.