Market watchers are labeling Andrew Tate as one of many worst merchants in crypto after he was fully liquidated on Hyperliquid, dropping over $800,000.

He joins a rising checklist of high-profile merchants who’ve seen their fortunes evaporate on the platform. Tate’s repeated liquidations underscore the tough actuality of using excessive leverage.

Andrew Tate’s Crypto Buying and selling Ends in Whole Liquidation on Hyperliquid

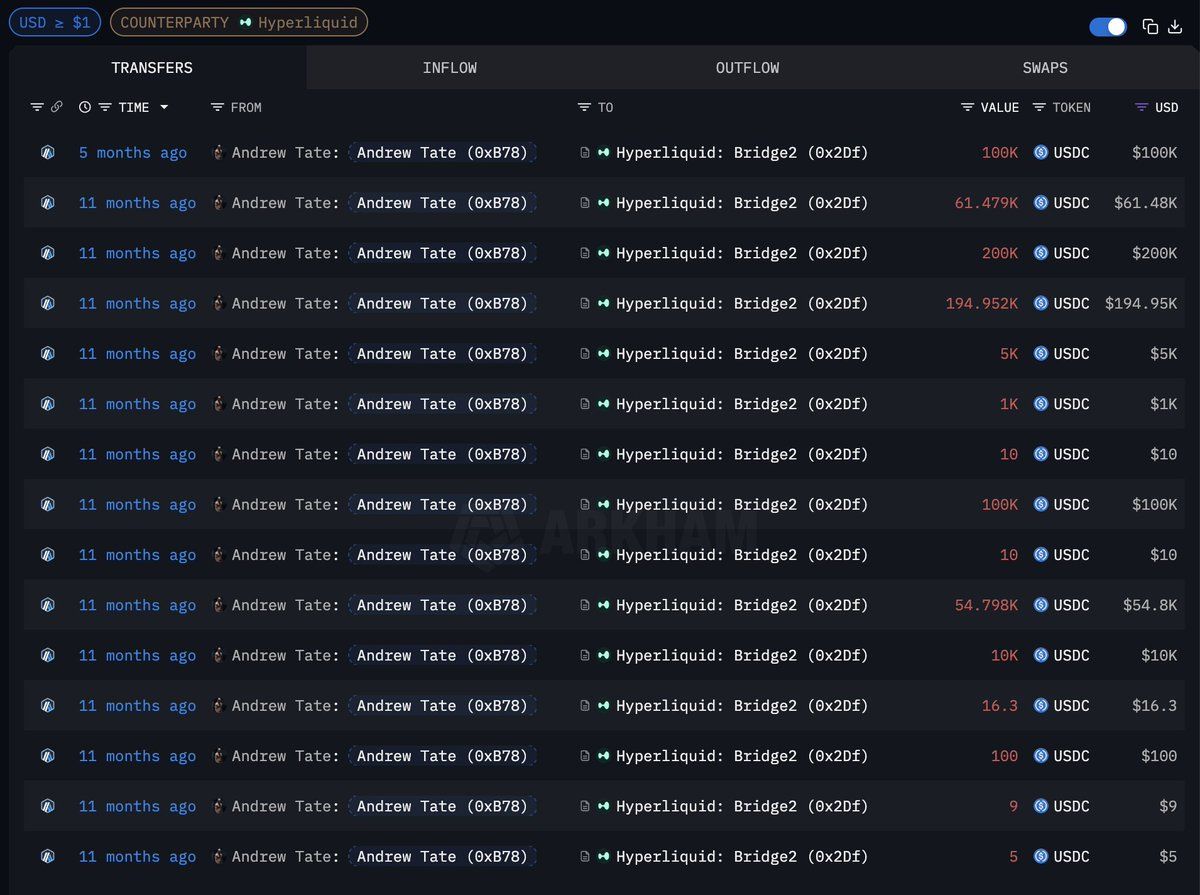

Arkham’s blockchain evaluation uncovered the extent of Tate’s buying and selling losses. The previous kickboxer deposited $727,000 into Hyperliquid, a decentralized perpetual trade.

All his funds remained on the trade, locked into dropping trades till they had been absolutely liquidated.

Andrew Tate’s Hyperliquid Deposits. Supply: Arkham

Tate tried to get better by buying and selling with referral revenue. He acquired $75,000 from customers becoming a member of by means of his referral hyperlink. As an alternative of withdrawing these rewards, he used them in additional trades. All $75,000 disappeared by means of the identical cycle of liquidations.

“Andrew Tate is now absolutely liquidated on Hyperliquid. He has solely $984 left. Some individuals thought he had been liquidated many instances earlier than. However he earned the cash by means of referrals and traded that cash on HL time and again,” analyst Param added.

Sample of Failed Trades

Tate’s buying and selling historical past is sort of risky. In June 2025, he misplaced $597,000 on Hyperliquid. Issues didn’t enhance afterward. Analyst StarPlatinum highlighted that in September, Tate opened an extended place on the World Liberty Monetary (WLFI) token. Nonetheless, this resulted in a lack of $67,500. He opened a brand new place minutes later and was hit with one other loss.

His streak continued into this month. On November 14, he was liquidated once more — this time whereas holding a BTC lengthy at 40× leverage. The wipeout price him $235,000.

August introduced his solely second of success. A small brief on YZY that earned him $16,000. Even that transient victory disappeared, worn out by a contemporary dropping commerce.

General, Tate has executed greater than 80 trades with a win charge of simply 35.5%. His cumulative loss stands at $699,000 in only some months, reflecting a sample of aggressive risk-taking and persistently poor timing.

Crypto analysts have known as him “one of many worst merchants in crypto” as a consequence of his dropping streak.

“Primarily based on this buying and selling document, Andrew Tate is likely to be one of many worst merchants in crypto. And folks nonetheless pay him for recommendation,” a market watcher wrote.

Tate isn’t the one one taking heavy losses from leveraged buying and selling. Different well-known merchants have gone by means of comparable conditions. James Wynn, for instance, misplaced greater than $23 million on Hyperliquid. His account fell from tens of millions to solely $6,010.

In July, Qwatio took a $25.8 million hit after a market rally liquidated his brief positions, wiping out the features he had made earlier. One other whale, often known as 0xa523, had an excellent rougher time. He misplaced $43.4 million on Hyperliquid in a single month.

The experiences of Tate, Wynn, Qwatio, and 0xa523 spotlight the inherent dangers related to buying and selling with excessive leverage on decentralized perpetual exchanges. Whereas some merchants have achieved vital features on these platforms, the fast liquidations seen in these instances show how rapidly positions can transfer towards customers.

Their outcomes function a reminder that leverage can amplify each income and losses, and that even well-known market contributors will not be proof against the volatility of crypto derivatives.

The submit Andrew Tate Known as “One of many Worst Merchants in Crypto” After Dropping Over $800,000 appeared first on BeInCrypto.