Ethereum has come underneath heavy promoting stress over the previous few days because the broader crypto market entered a deep corrective part. But, regardless of the volatility and widespread concern, ETH has managed to carry firmly above the important thing $3,000 stage — a zone many analysts take into account important for sustaining the broader bullish construction.

Now, as value stabilizes and patrons start to re-emerge, a number of market observers are beginning to name for a possible restoration, arguing that Ethereum could also be nearing the tip of its downturn.

Including gas to this narrative is the continued accumulation from main gamers, most notably Tom Lee’s Bitmine. Tom Lee — a well known Wall Road strategist, co-founder of Fundstrat World Advisors, and long-time Bitcoin and Ethereum bull — has been one of the crucial influential voices within the digital asset marketplace for almost a decade. His agency Bitmine operates as a big institutional crypto funding entity targeted on long-term accumulation, market-making, and strategic positioning during times of concern.

In line with current on-chain knowledge, Bitmine has continued shopping for ETH whilst costs fell, signaling robust conviction within the asset’s long-term outlook. This habits stands in sharp distinction to the broader market, the place short-term holders have been capitulating.

Bitmine Continues Accumulating ETH Regardless of Market Weak point

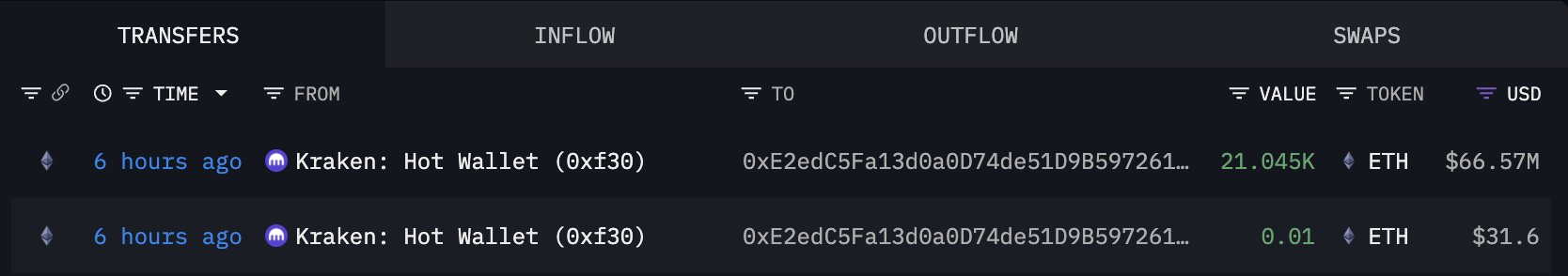

In line with contemporary on-chain knowledge from Lookonchain, accumulation exercise round Ethereum is way from slowing down. A newly flagged pockets, 0xE2ed, believed to be related to Tom Lee’s Bitmine, acquired 21,054 ETH (value $66.57 million) from Kraken just some hours in the past. This transfer reinforces the view that giant, refined gamers are treating the current correction as a chance reasonably than a risk.

The timing of this switch is notable. Ethereum has been underneath sustained promoting stress for weeks, with sentiment turning sharply bearish because the market grappled with concern, liquidations, and a broader rotation into stablecoins. But regardless of this surroundings, Bitmine-linked wallets proceed to soak up provide aggressively.

This sample aligns with Bitmine’s broader technique: accumulating high-quality crypto property during times of uncertainty to place for long-term upside. Massive inflows to accumulation wallets throughout drawdowns have traditionally steered robust conviction amongst institutional gamers, usually previous phases of restoration and renewed power.

Suppose this pockets is certainly tied to Bitmine. In that case, it alerts that a few of the market’s most well-capitalized contributors stay assured in Ethereum’s long-term worth, no matter short-term volatility.

ETH Value Evaluation: Testing Lengthy-Time period Help Amid Heavy Volatility

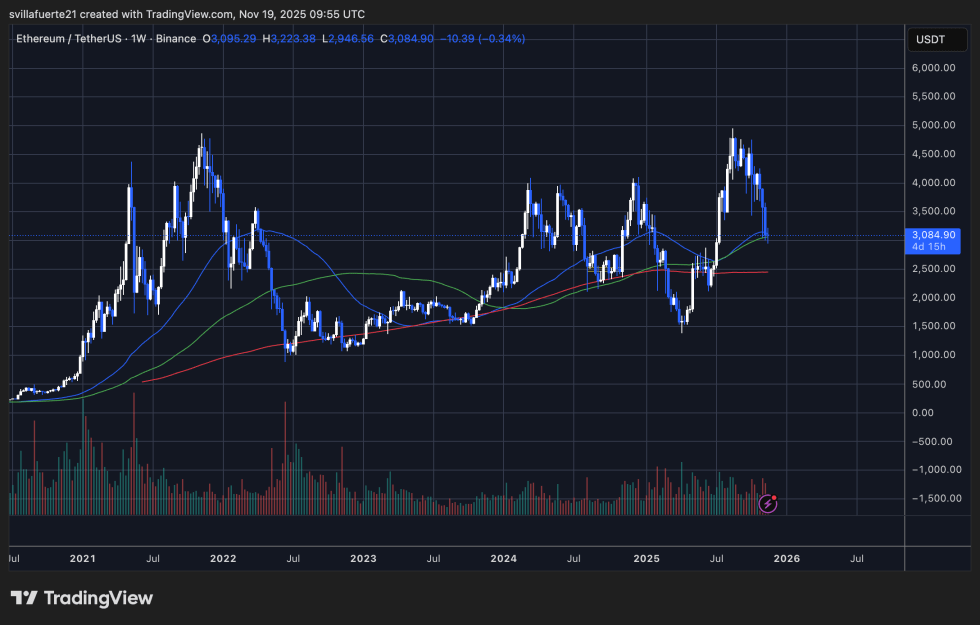

Ethereum’s weekly chart exhibits the asset navigating a vital zone as value hovers simply above $3,000, a stage that has traditionally acted as a serious demand space. After weeks of sustained promoting stress, ETH has pulled again from the $4,500 area and is now retesting its long-term shifting averages. The 200-week MA, specifically, is positioned carefully beneath the present value, performing as a structural anchor that has supported Ethereum in earlier cycle corrections, together with the deep capitulation seen in mid-2022 and the restoration part of 2023.

The current candle construction displays heightened volatility, with lengthy wicks suggesting robust reactions from patrons close to the $3,000 threshold. Quantity has elevated barely throughout this downturn, indicating energetic participation from each sellers locking in earnings and patrons positioning for potential reversal. But ETH stays beneath its 50-week MA, exhibiting that short-term momentum continues to lean bearish.

Nonetheless, the broader sample resembles earlier cycle pullbacks the place Ethereum retraced sharply earlier than forming larger lows and resuming its macro uptrend. If ETH can keep this help band and reclaim the $3,300–$3,500 area, it might sign renewed power. However a weekly shut beneath $3,000 dangers opening the door to deeper correction targets close to $2,700.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.