Previous Ethereum addresses are displaying the quickest tempo of distribution since 2021. The market has to soak up round 45K ETH every day from early buyers.

Previous Ethereum wallets are coming into an accelerating distribution part, with promoting returning to ranges not seen since 2021. Whereas there are additionally indicators of storing and staking ETH in accumulation addresses, vaults, and good contracts, older whales are inflicting peak turnover.

Following the newest wave of promoting, ETH dipped to $3,152.17, on a mixture of worsening sentiment and lengthy liquidations. ETH open curiosity sank to $17B after the newest spherical of liquidations.

Primarily based on Glassnode information, a major a part of the promoting originated from wallets aged 3-10 years. These sellers are realizing earnings to keep away from getting caught in one other bear market.

Ethereum proponents nonetheless see it as a long-term wager, however whales are much less keen to carry via one other bear market. Distribution began in August, however accelerated prior to now month, pushed by worsening sentiment and the document liquidation occasion on October 11.

Ethereum nonetheless carries excessive unrealized beneficial properties

The strategic buying and selling of Ethereum whales means the token at present carries extra alternatives to understand earnings. The ratio of market worth to realized worth (MVRV) factors to an accumulation of wallets with important unrealized beneficial properties. Damaging MVRV is an indication of market capitulation, which ETH has not reached even throughout earlier sell-offs. Traditionally, ETH spends months with adverse MVRV, particularly throughout extended bear markets.

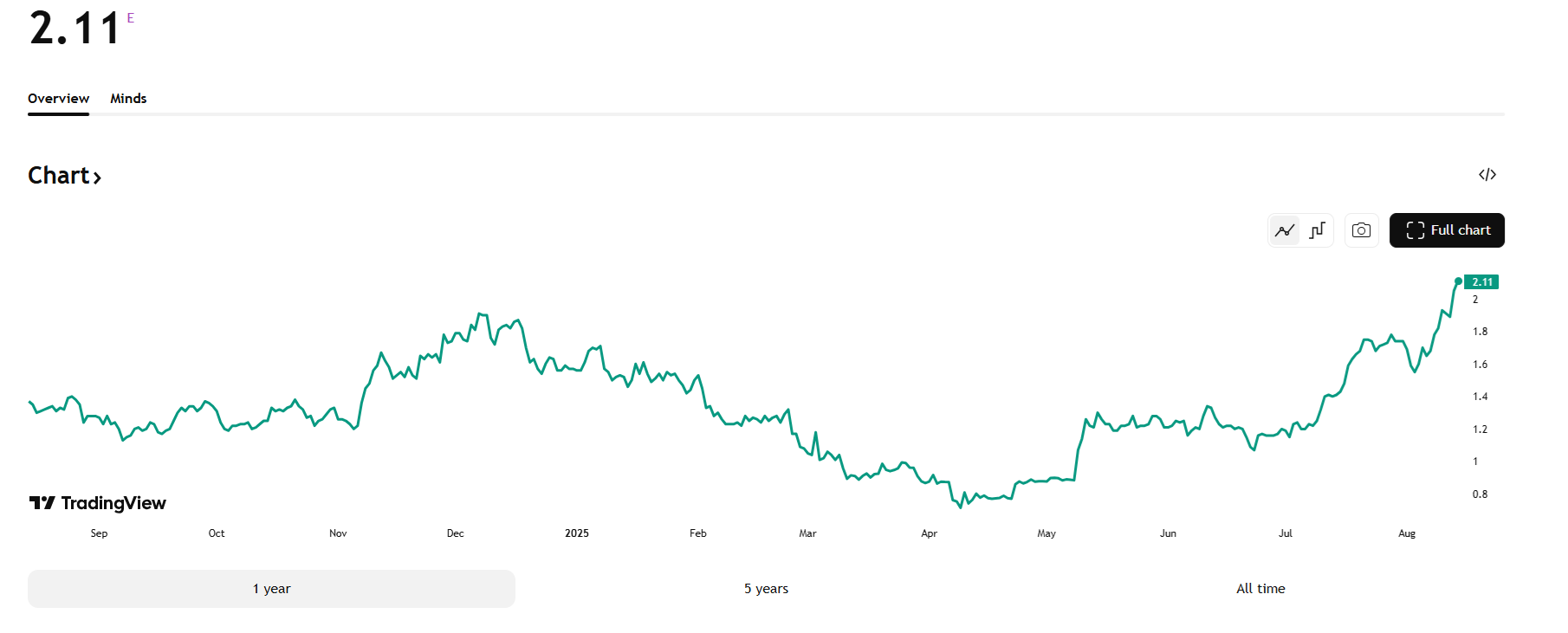

The MVRV ratio is at its highest degree for 2025, at 2.1 factors, doubtlessly inflicting promoting strain if a number of the whales determine to enhance their common worth. ETH stays actively traded, with a number of the provide nonetheless used for short-term swapping.

ETH nonetheless carries important unrealized worth, primarily based on the MVRV ratio. Whales are lively on realizing earnings, but additionally on the shopping for facet throughout market dips. | Supply: TradingView.

Ethereum additionally confirmed weak spot as there are not any expectations for an altcoin season. The token may even see extra lively buying and selling as funds change arms. Presently, Ether sentiment is at yearly lows. The ETH concern and greed index is at 29 factors, indicating a fearful buying and selling sentiment.

Seven Siblings wallets purchase the dip

ETH has seen ongoing whale exercise throughout market dips. Up to now week, important whales expanded their positions, additionally together with borrowed funds from Aave.

One of many Seven Siblings wallets gathered Ether from Uniswap prior to now 24 hours, now holding over $260M in numerous types of wrapped ETH.

The opposite pockets used Cow Protocol for a number of Ethereum purchases, now holding over $322M in numerous wrapped ETH tokens and different belongings. The Seven Siblings wallets absorbed 1.2M Ether throughout the latest crash, changing into one of many largest web patrons. This time, the whales aggressively leveraged their ETH purchases, borrowing $10M on Spark Protocol, signaling confidence in eventual market restoration.

Traditionally, the involvement of the Seven Siblings related wallets indicators a neighborhood backside for the market. Different whales additionally purchased the dip, absorbing 2.53M cash at $3,150 per Ether, establishing a brand new zone of assist.

A pockets linked to BitMine additionally confirmed shopping for exercise, whereas one other high-profile whale added 16,937 ETH, near the weekly manufacturing of latest tokens.