Ethereum has been displaying indicators of weak spot after failing to reclaim the important thing $4,200 resistance. Regardless of sturdy bullish momentum earlier this month, worth motion stays capped inside a descending channel, and the current bounce has been comparatively weak. Merchants are actually watching to see whether or not ETH can set up a better low or if additional draw back is to return.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum continues to respect the boundaries of the descending parallel channel, with a number of rejections from the higher trendline. The newest try to interrupt out close to $4,200 failed, sending the worth again towards the mid-range and testing help round $3,700.

The asset remains to be holding above the 200-day shifting common for now, which is a crucial dynamic help stage, however we’re now seeing decrease highs type, which is an indication of weakening bullish momentum.

The RSI on the day by day has additionally dropped to round 42. This displays a cooling off in shopping for strain with out but coming into full oversold circumstances. If ETH loses the $3,700 help, the subsequent main demand zone lies round $3,400, the place the decrease channel help and a horizontal stage intersect. Nonetheless, if consumers can reclaim the $4,000 area, one other take a look at of the $4,200 stage could be very possible.

The 4-Hour Chart

On the 4-hour chart, the image turns into extra granular. After the current rejection from $4,200, ETH noticed a pointy drop into the lows of the vary, which was swept earlier than a small bounce emerged. The value is at present hovering round $3,800 and making an attempt to reclaim momentum. The RSI additionally hit oversold territory and has now began turning up, indicating a possible short-term reduction rally or range-bound consolidation.

Regardless of the small bounce, ETH stays beneath the important thing resistance zone at $4,000. This space might be essential, as a clear break and shut above it will sign renewed purchaser curiosity. Till then, short-term rallies could face promoting strain. If the present bounce loses steam, ETH may revisit the $3,650 low and even take a look at the $3,400 demand zone, aligning with the underside of the bigger descending channel.

Sentiment Evaluation

Open Curiosity

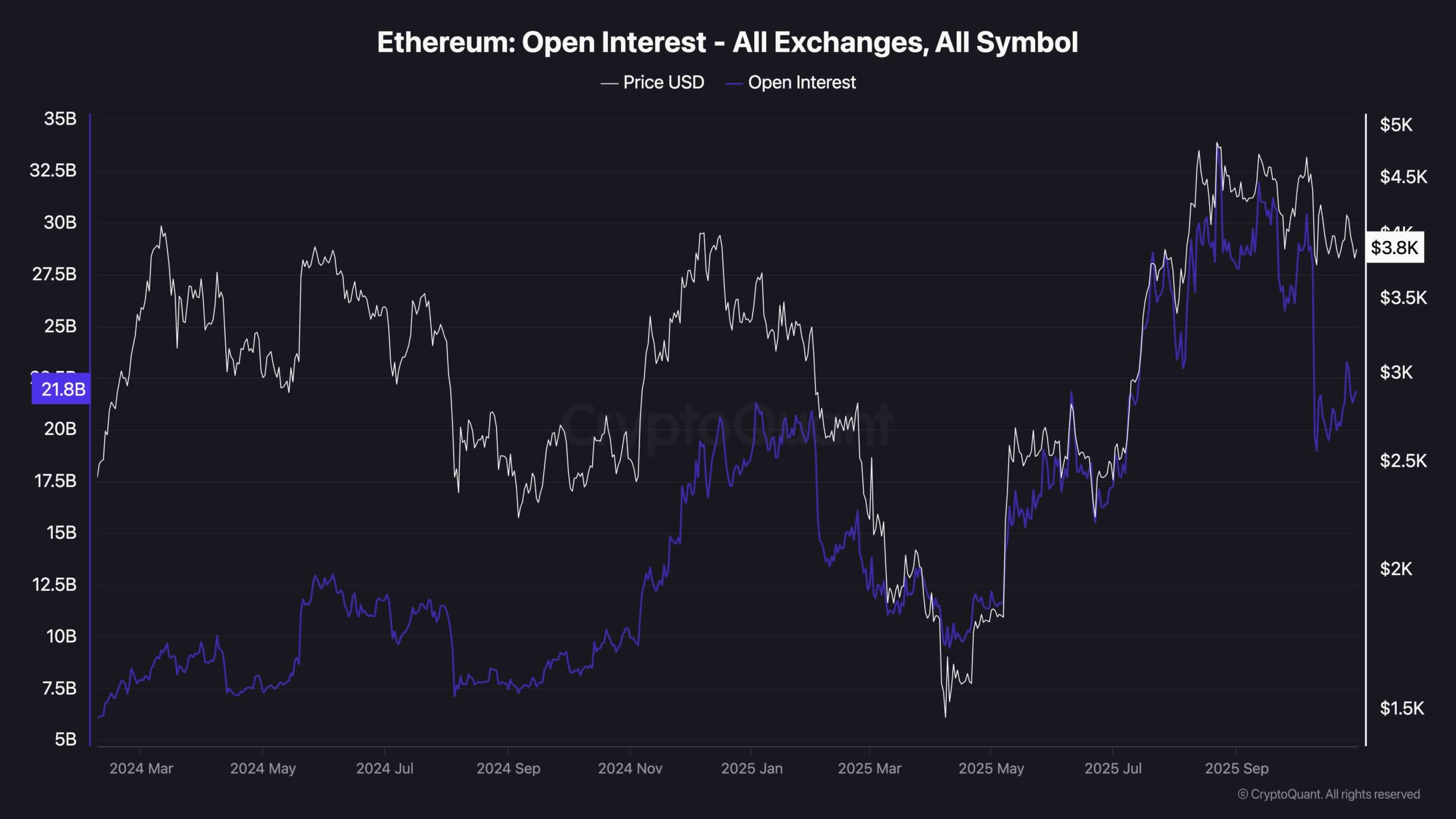

Open Curiosity on Ethereum has seen a big reset, falling sharply from over $32 billion all the way down to round $22.8 billion. This drop displays a broad deleveraging throughout the market, possible triggered by a mix of cease hunts, liquidations, and risk-off conduct from merchants. The fast flush of open positions means that many overexposed longs had been pressured out, particularly after ETH’s rejection from the $4,200 resistance space.

Such a pointy OI decline is usually a crucial clean-up to reset overheated circumstances. When leverage builds up too aggressively, markets are likely to shake out weak fingers earlier than establishing a extra secure pattern. That’s what seems to have occurred right here. Nonetheless, what’s notable is the present stagnation, as open curiosity has not rebounded with worth, which indicators that merchants are nonetheless hesitant to re-enter in measurement.