The Ethereum Basis has confirmed that the upcoming Fusaka onerous fork will introduce a protocol-level ceiling on how a lot fuel a single transaction might eat, formally codified as EIP-7825. The cap is ready at 2²⁴ fuel—16,777,216 items—marking the primary time Ethereum enforces a per-transaction restrict distinct from the block fuel restrict. The change is already lively on Holesky and Sepolia and can go reside on mainnet when Fusaka prompts.

In a submit revealed October 21, Toni Wahrstätter framed the rationale in direct phrases: “Beginning with the upcoming Fusaka onerous fork, EIP-7825 introduces a per-transaction fuel restrict cap of 2²⁴ (≈ 16.78 million fuel).” The Basis’s word emphasizes that whereas the cap bounds particular person transactions, it doesn’t alter the block fuel restrict; as an alternative, it’s designed to mitigate denial-of-service vectors the place a single outsized name monopolizes a whole block and to enhance block packing predictability because the community prepares for parallel execution.

EIP-7825 attracts a clear line between transaction-level complexity and system-level throughput. Beforehand, exceptionally massive calls might strategy the total block fuel goal (round 45 million at occasions), creating timing and scheduling pathologies for builders and validators.

The brand new ceiling obliges workloads that may exceed 16.78 million fuel to be damaged into smaller, sequenced calls. The Basis’s steerage is cautious to notice that “for many customers, nothing adjustments,” for the reason that statistical distribution of real-world transactions already sits effectively under the edge; the chance floor primarily issues batch-heavy contracts, deployment scripts, and specialised routers.

What This Means For Ethereum And Customers

From a roadmap perspective, the cap is explicitly positioned as groundwork for parallel execution. The weblog submit connects the change to anticipated efforts resembling EIP-7928 within the “Glamsterdam” period, the place predictable, bounded transactions are a prerequisite for significant concurrency within the execution layer. By making certain that at the very least a number of impartial transactions might be packed per block—even underneath pathological mempool situations—the cap reduces worst-case rivalry and simplifies scheduler design for builders experimenting with parallelizable execution paths.

The specification itself is spare and mechanical. EIP-7825’s summary states the intent “to 16,777,216 (2^24) fuel” per transaction, enhancing resilience towards sure DoS vectors and making transaction processing extra predictable as block limits rise. That simplicity has been a part of its enchantment in core-dev channels: a small, well-scoped constraint that preserves ahead compatibility with extra bold scaling work.

Debate on learn how to encode and talk the ceiling has been lively for months, together with discussions over naming and parameterization on Ethereum Magicians and through AllCoreDevs calls. One thread summarized the core assure being focused by a number of contributors: aligning block targets to multiples of 2²⁴ so builders can at all times embrace at the very least n transactions if the mempool has n eligible ones—an argument for predictability fairly than uncooked throughput.

Operationally, the Basis says all main purchasers—Geth, Erigon, Reth, Nethermind, and Besu—have carried out the change in Fusaka-ready releases, decreasing cross-client divergence threat at activation. The submit additionally stresses that eth_call semantics are unaffected and that pre-signed transactions whose fuel limits exceed 2²⁴ will should be re-signed under the cap. The improve path for builders is simple: take a look at towards Holesky or Sepolia, re-tool batch operations that flirt with the restrict, and modify gas-estimation logic and alerts so that they fail quick when constructions exceed the brand new ceiling.

The coverage context is price parsing. Ethereum’s historical past has favored minimal, general-purpose constraints, deferring complexity to increased layers. EIP-7825 matches that sample: it doesn’t opine on what contracts ought to do, solely that they respect an higher sure that protects liveness and prepares the execution layer for a multi-threaded future.

It additionally sidesteps fee-market alterations and leaves blob-space economics and block targets to different EIPs and forks. Because the Basis put it, the cap “establishes a safer and extra predictable basis for increased throughput in future forks,” a line that sums up the trade-off succinctly.

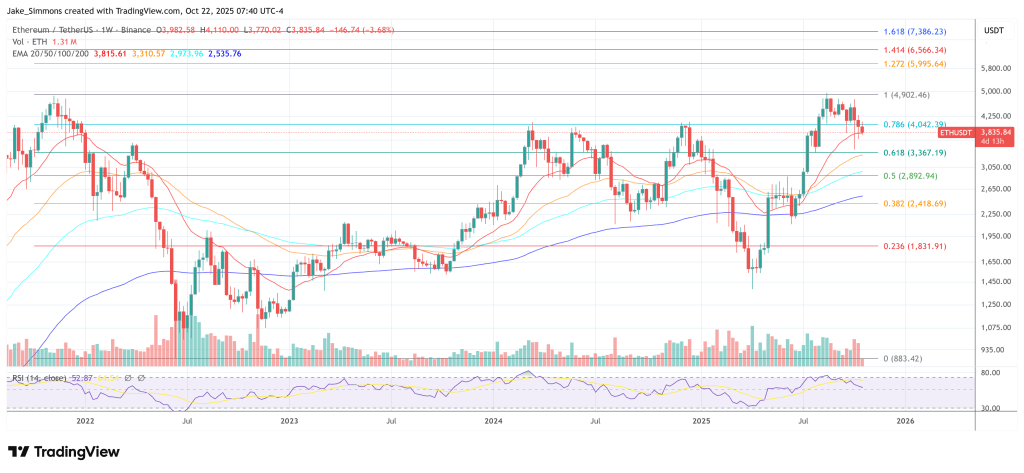

At press time, ETH traded at $3,835.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.