The Ethereum worth fell sharply prior to now 24 hours, dropping from close to $4,300 to as near $3,400 earlier than partially rebounding to round $3,800. The transfer got here alongside virtually $19 billion in crypto liquidations, one of many largest single-day sell-offs this yr, led by the China-US tariff dispute. The sudden flush worn out lengthy positions throughout main exchanges and despatched merchants speeding to hedge in futures markets.

Whereas Ethereum stays down about 13% at press time, early indicators from derivatives and technical charts counsel the sell-off could have gone too far — and {that a} rebound may very well be forming underneath the floor.

Bearish Positioning Builds, However Derivatives Trace at a Rebound Setup

Crashes of this measurement hardly ever start within the spot market. They begin with derivatives, the place heavy leverage magnifies each features and losses.

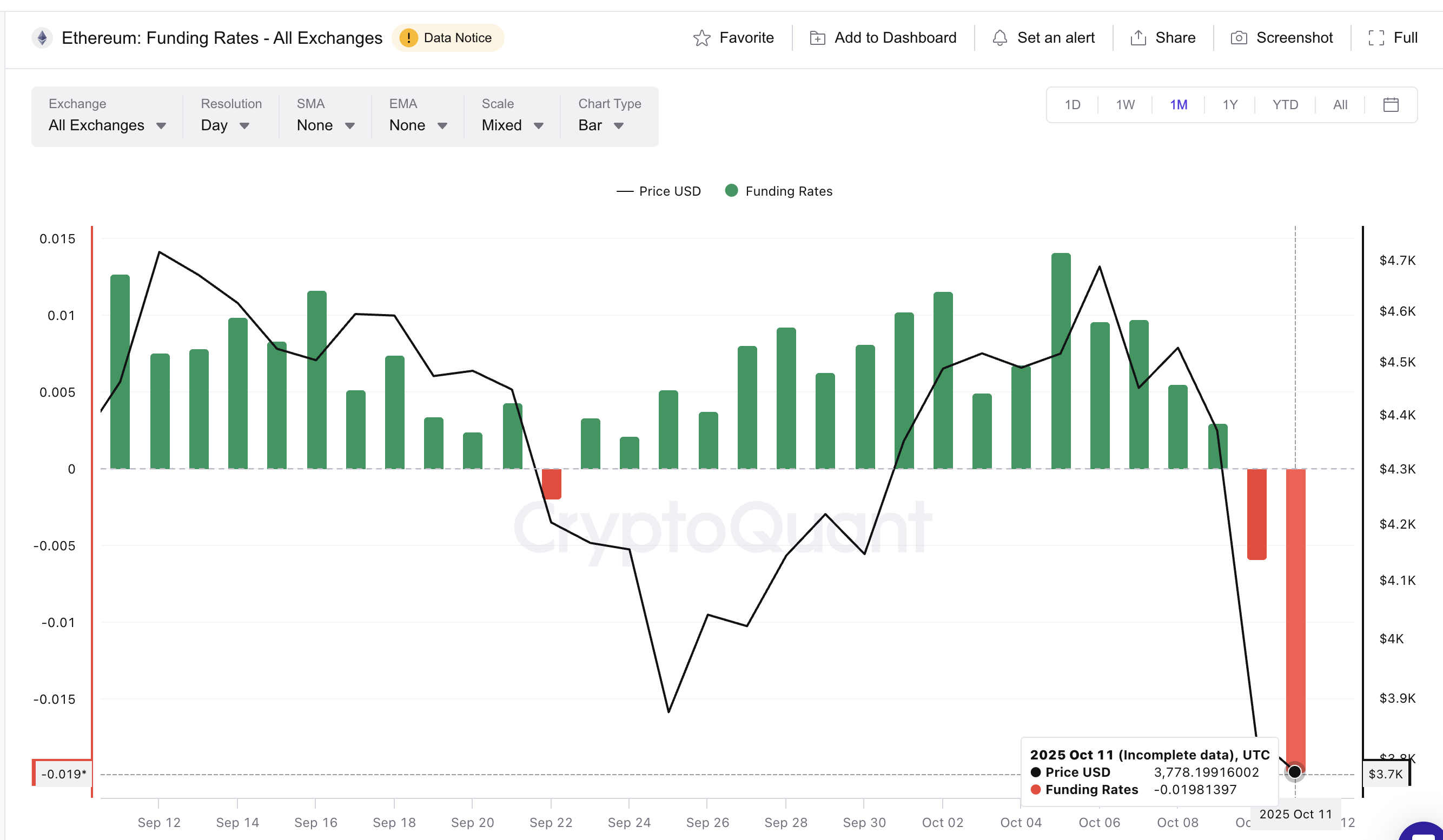

Ethereum’s funding price — the payment merchants pay or obtain to carry perpetual futures — flipped from +0.0029% on October 9 to –0.019% by October 11.

A adverse funding price means brief merchants are paying lengthy merchants, displaying that many of the open curiosity now bets on additional draw back.

ETH Funding Charges Flip Detrimental: CryptoQuant

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

That imbalance, whereas bearish on the floor, may create a rebound setup. When shorts turn out to be overcrowded, even a small worth bounce can set off a brief squeeze, forcing merchants to purchase again their positions and pushing costs increased.

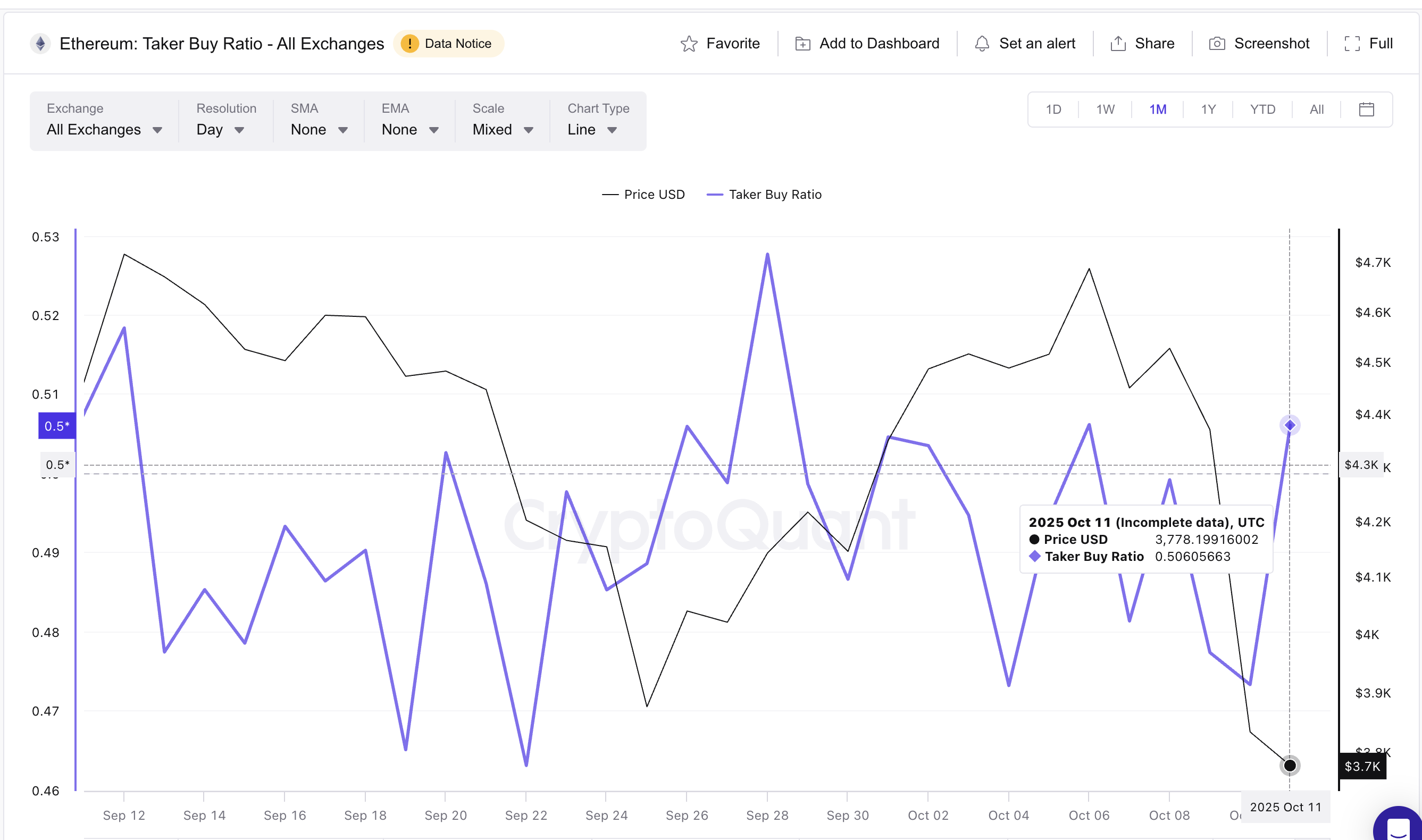

A second spinoff metric helps this view. The taker purchase ratio, which measures whether or not aggressive trades favor shopping for or promoting, has recovered from 0.47 to 0.50 during the last 24 hours.

This shift means consumers at the moment are matching sellers in quantity — an early signal that promoting exhaustion could also be close to.

Ethereum Taker Shopping for Hints At Rising Shopping for Sentiment: CryptoQuant

The final time this ratio hit comparable ranges (a neighborhood peak), on September 28, Ethereum rallied 13%, transferring from $4,140 to $4,680.

Collectively, these readings counsel the market’s bearish positioning would possibly truly be organising the situations for a rebound quite than a deeper crash. The technical charts ought to reveal extra.

Hidden Divergence Strengthens the Ethereum Value Restoration Case

The Ethereum worth chart provides weight to this concept. On the day by day timeframe, Ethereum exhibits a hidden bullish divergence — a sample that kinds when worth makes the next low however the Relative Energy Index (RSI) makes a decrease low.

RSI measures momentum between 0 and 100. When it diverges from worth on this method, it alerts that sellers are dropping energy even when costs haven’t absolutely recovered but.

Ethereum Value Divergence: TradingView

Between August 2 and October 10, this similar setup appeared. The final time Ethereum printed this sign, from August 2 to September 25, it climbed virtually 25% inside days.

If Ethereum holds above $3,430 (key assist), the present rebound setup stays legitimate. Breaking by means of $3,810 (one other key assist) and $4,040 would verify short-term restoration, with a potential goal close to $4,280 — about 13% increased than present ranges.

Ethereum Value Evaluation: TradingView

A drop under $3,350, nonetheless, would invalidate the construction and return momentum to the bears. For now, the Ethereum worth crash could have created its personal rebound zone.

With shorts overcrowded and technical energy quietly returning, a restoration towards $4,280 appears to be like more and more potential if consumers defend key assist. All we want is a day by day candle shut above $3,810 for the energy to return.

The put up Ethereum Crash Might Create a Rebound Zone With Upside Alternative appeared first on BeInCrypto.