Swan Bitcoin CEO Cory Klippsten stated Bitcoin’s value volatility is probably not over after the cryptocurrency briefly fell to $102,000 on Friday, following US President Donald Trump’s announcement of a 100% tariff on Chinese language imports.

“If the broader risk-off temper holds, Bitcoin can get dragged round a bit earlier than it finds assist and begins to decouple once more,” Klippsten informed Cointelegraph on Friday.

Klippsten stated that Bitcoiners ought to count on some turbulence over the approaching days. “Macro-driven dips like this normally wash out leveraged merchants and weak arms, then reset positioning for the subsequent leg up,” Klippsten stated.

$8 billion worn out in crypto market

Over the previous 24 hours, round $2.19 billion in Bitcoin (BTC) lengthy positions have been liquidated, contributing to a complete of $8.02 billion in lengthy liquidations throughout the broader crypto market, in response to CoinGlass.

“We’ve obtained just a little panic within the markets proper now, traditional macro whiplash. Trump and China are buying and selling tariff threats, equities are off, and merchants are scrambling to derisk,” Klippsten added.

Cointelegraph head of markets Ray Salmond stated that leveraged merchants “had been completely caught off guard” as Trump’s tariff announcement “despatched shockwaves throughout the crypto market.”

Bitcoin has barely recovered buying and selling at $113,270 on the time of publication. Supply: CoinMarketCap

Salmond defined that Bitcoin’s value dislocation between crypto change Coinbase, the place the BTC/USD pair fell to $107,000 and and crypto change Binance perpetual futures, the place the BTC/USDT pair crashed to $102,000, “actually illustrates the severity of the cascading liquidations and the way stops had been fully obliterated.”

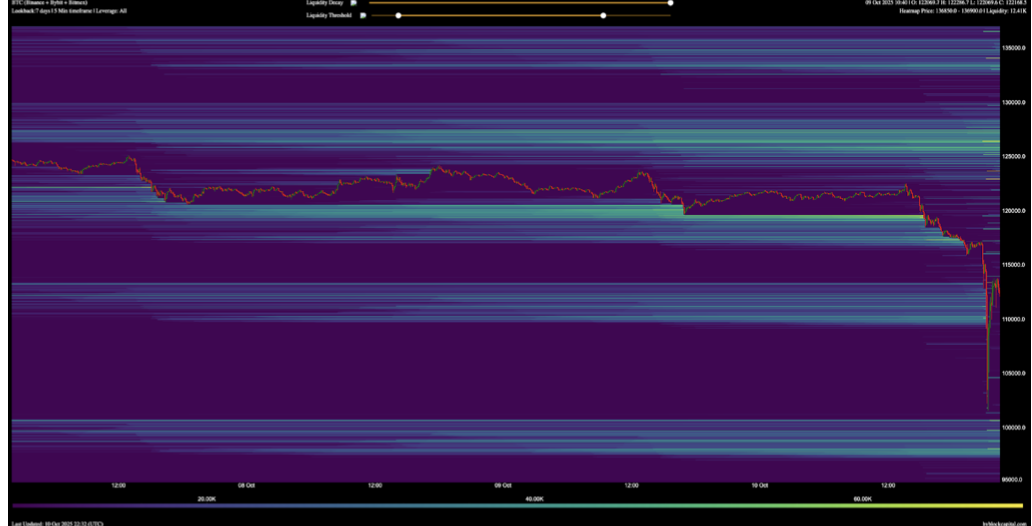

Salmond pointed to liquidation heatmap knowledge from Hyblock, which exhibits “actually all draw back lengthy liquidity absorbed, with a liquidation cluster $102,000 to $97,000 remaining.”

Bitcoin liquidation heatmap, 7-day look again. Supply Hyblock

It’s not the primary time Bitcoin has dropped sharply after a Trump tariff announcement. In April, Trump’s first tariff bulletins despatched shockwaves by crypto markets and sparked fears of a recession.

On Feb. 1, when Trump signed an govt order to impose import tariffs on items from China, Canada, and Mexico, Bitcoin fell beneath $100,000.

Bitcoin analysts are staying optimistic

A number of Bitcoin analysts say the newest value drop may current a shopping for alternative.

Bitwise Make investments senior funding strategist Juan Leon stated in an X publish that “the very best time to purchase BTC has tended to be when it’s being dragged down by broader markets.”

In the meantime, Bitwise Make investments chief funding officer Matt Hougan reminded his 85,900 X followers of a typical sample amongst market contributors, noting that whereas many say they’ll purchase Bitcoin throughout a value pullback, they usually hesitate when it occurs as a result of “the market doesn’t ‘really feel’ good at that time.”

“It by no means feels good while you purchase the dip. The dip comes when sentiment drops. Writing the quantity down generally is a good type of self-discipline,” Hougan stated.