It’s been a busy week, and ethereum ( ETH) sits close to $4,470 per coin after a 5.3% weekly slip, however leverage and hedging are buzzing.

Ethereum’s Week: Worth Down, Leverage Regular, Sellers Busy

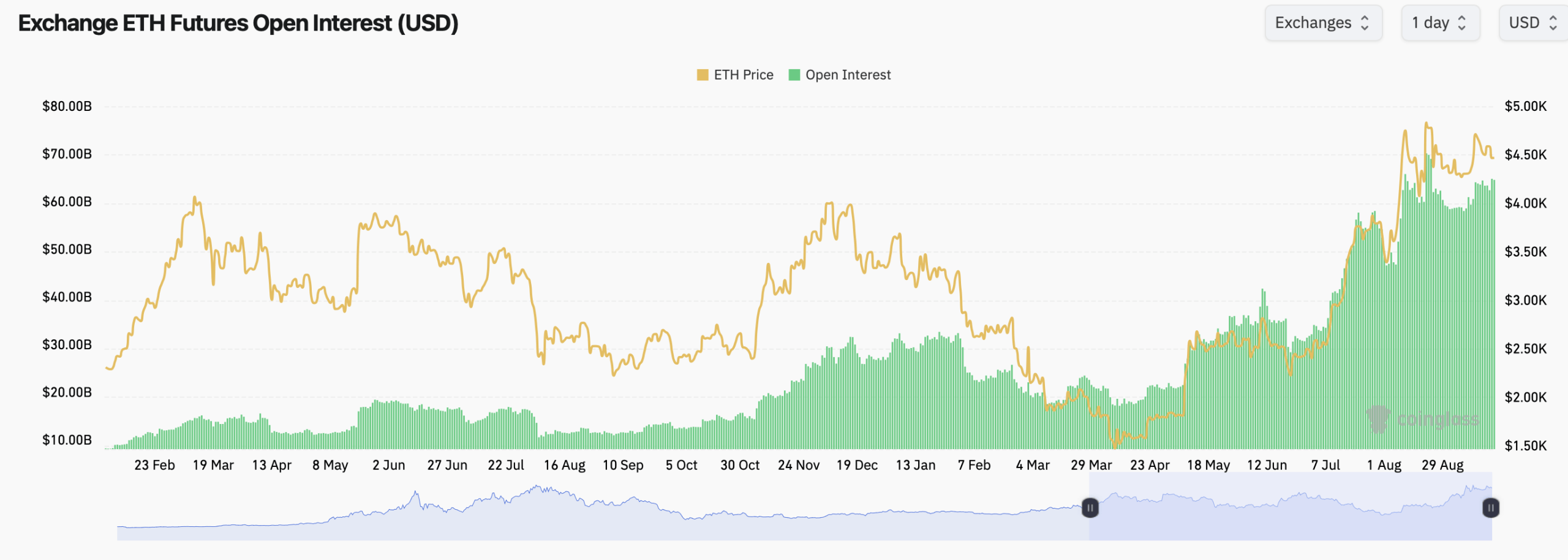

Alternate-tracked ethereum ( ETH) futures open curiosity (OI) stands round $64.57 billion (14.43 million ETH) per Coinglass, climbing by way of September as worth chopped. Binance leads with about $12.26 billion in OI (18.98% share), whereas CME has $9.63 billion (14.91%), a reminder that the TradFi desk remains to be within the area. OKX sits close to $4.12 billion (6.37%), with Bybit and Gate each across the mid-$5 billion vary.

Momentum wasn’t uniform: Bybit’s OI popped 6.28% over 24 hours at the same time as Binance slipped 0.33%, and CME edged greater by 0.23%. Kucoin and Bitget every added roughly 2.7% to 4.6% on the day, whereas BingX confirmed double-digit intraday shrinkage. The weekend’s translation: hedgers shuffled chairs, not exits.

On the choices aspect, the gang leans bullish by positioning however not by a lot. Choices open curiosity is 61.11% calls versus 38.89% places (about 2.25 million ETH calls to 1.43 million ETH places). The final 24 hours had been equally balanced: 54.53% of quantity in calls and 45.47% in places, roughly 118,475 ETH to 98,789 ETH. It’s optimism with a put-spread umbrella.

Open curiosity rank exhibits a chunky flooring across the $4,000 strike. The only largest line is a Deribit 26SEP25 $4,000 put (120,550 ETH), adopted by December calls at $6,000 (92,667 ETH) and $4,000 (74,481 ETH). There’s significant upside curiosity at $7,000 and $5,000 for December, plus September calls clustered between $3,600 and $4,700. Sellers will really feel these magnets.

Max ache tilts towards the mid-$4,000s by way of late September, dipping towards ~$3,600 across the Sept. 26 weekly expiry earlier than rebounding into This autumn; additional out, December curves wobble decrease, maintaining late-year ethereum bears entertained. If worth hovers close to $4,450–$4,550 into the roll, name sellers hold the confetti.

Futures open curiosity has trended greater alongside a uneven worth restoration since early summer season, with the inexperienced bars pushing towards cycle highs simply as spot stalled. That setup often means foundation merchants are busy and perps funding is doing the soiled work whereas directionals anticipate the following catalyst. Close to time period, sellers seemingly fade impulsive strikes.

Backside line: ethereum’s drawdown didn’t scare off leverage; it reshaped it. With OI heavy on Binance and CME, choices skew barely call-heavy, and max-pain gravity within the mid-$4,000s, the trail of most inconvenience is a grindy vary with fast traps each methods. Commerce the degrees, not the drama.