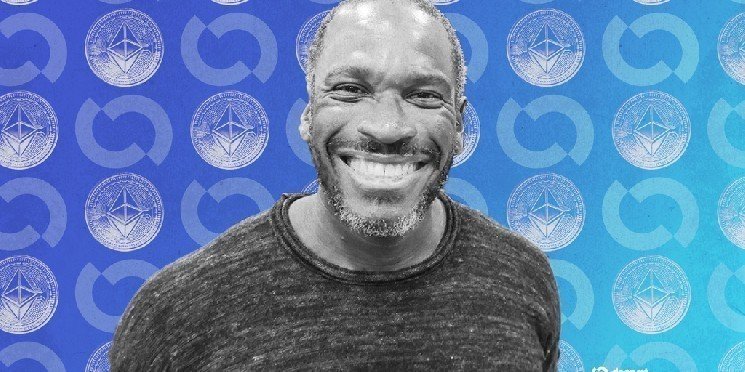

Arthur Hayes, co-founder of crypto funding fund Maelstrom, purchased the Ethena token this week, tying his newest transfer to a mission vying for management of the USDH stablecoin ticker as Hyperliquid validators head right into a decisive vote on Sunday.

Hayes has collected a number of tranches of Ethena’s ENA token over the previous two days, together with 578,956 tokens value about $473,000 on Wednesday and two earlier purchases totaling roughly 672,800 ENA, or $521,000, based on information tracked by Arkham Intelligence.

The full, together with these from Monday, quantities to roughly $995,000 value of Ethena tokens inside a 48-hour window.

Hayes’ purchases come as Ethena stays a contender within the USDH stablecoin race, with Hyperliquid validators set to determine the ticker on Sunday.

Ethena’s proposal, backed by BlackRock, would use its USDtb stablecoin to collateralize USDH by way of BlackRock’s BUIDL fund, with 95% of income pledged to Hyperliquid and prices coated for shifting buying and selling pairs from USDC.

Ethena’s proposal is a “robust bid from one in every of crypto’s fastest-growing and most spectacular ecosystems,” David Lawant, head of analysis at FalconX, wrote in a weblog put up revealed Wednesday.

Lawant pointed to USDe’s market cap of greater than $13 billion and Ethena having processed $23 billion in cumulative mints and redemptions with out safety incidents or downtime.

Nonetheless, Hayes’ purchase “reads as private positioning, somewhat than placing a backing behind Ethena particularly for the USDH votes,” Kirby Ong, founding father of HypurrCollective, a grassroots collective for founders, builders, merchants, and energy customers on the Hyperliquid ecosystem, advised Decrypt.

“With the $USDH proposal, the deciding elements will probably come right down to validator alignments with their present stakers, whether or not prediction market sentiment interprets into precise on-chain votes,” Ong mentioned.

Ong defined that whereas prediction markets “assist set expectations,” validator assist “determines the legitimate candidates,” and that “in the end, anybody may help to determine and set the route for USDH by staking their weight and making their votes identified by delegating to the validator that greatest matches their vote.”

Ong added: “The ultimate consequence on Sunday could rely on which staff features probably the most belief and perceived long-term worth for the ecosystem.”

Different contenders

Paxos, backed by PayPal, can be a prime contender, based on Lawant. It revised its proposal on Wednesday, increasing from an emphasis on regulatory pedigree to pledging a bigger share of reserve yield to Hyperliquid’s Help Fund and deferring any issuer take till the product scales previous $1 billion.

On Wednesday night, Paxos introduced it had obtained a suggestion from Kraken to checklist USDH and HYPE from day one, with free USD on- and off-ramps, pending the trade’s customary assessment.

It’s value noting that Native Markets, regardless of being a newly-formed firm, stays the highest contender with 90% odds in its favor, based on stay information on Myriad Markets.

Disclosure: Myriad is a prediction market developed by Decrypt’s dad or mum firm DASTAN.

Native Markets pitched a GENIUS-compliant USDH managed by way of Bridge, Stripe’s stablecoin issuer, with reserves in money and Treasuries overseen by BlackRock off-chain and Superstate on-chain.

Its plan splits yield evenly between Hyperliquid’s Help Fund and ecosystem progress, and guarantees a HyperEVM launch with seamless interoperability.

Decrypt has reached out to Hayes, Paxos, and Ethena for remark. A separate request was despatched to Native Markets by way of an ecosystem operator (Max Feige).

Different contenders embody Sky, the issuer of USDS (previously MakerDAO’s DAI), Frax Finance with a bank-partnered bid, and Agora, which has warned towards Native Markets’ reliance on Stripe-owned Bridge whereas pledging to channel all internet income again into Hyperliquid.