Hut 8 (HUT), a public bitcoin BTC$109,802.43 mining and power infrastructure agency, surged Tuesday after revealing plans to greater than double the corporate’s energy capability.

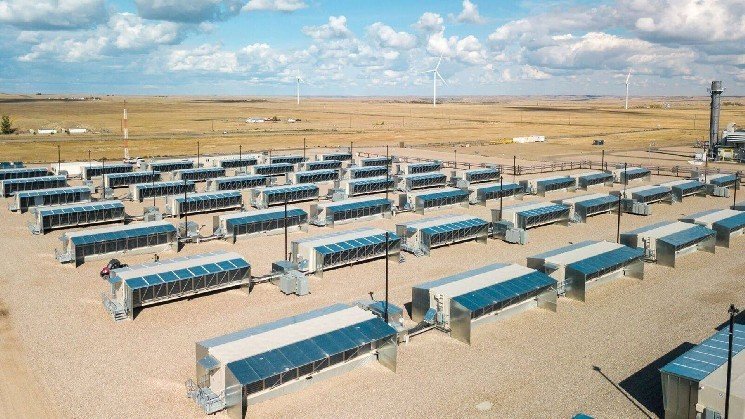

The plans embrace the event of 4 new websites throughout the US with greater than 1.5 gigawatts (GW), increasing whole energy capability to over $2.5 GW throughout 19 places, based on a press launch.

The inventory rose greater than 10%, hitting a seven-month excessive simply shy of $26 per share at the same time as bitcoin costs stay caught within the doldrums under $110,000.

Knowledge heart corporations are having fun with renewed investor curiosity as demand for computing energy soars to gasoline synthetic intelligence innovation. Lately, tech big Google took a minority stake in bitcoin miner TeraWulf as a part of a $3.2 billion AI infrastructure deal.

“This growth marks a defining step in Hut 8’s evolution into one of many largest power and digital infrastructure platforms on the earth,” Hut 8 CEO Asher Genoot mentioned within the press launch.

The corporate mentioned it has reclassified the initiatives from “exclusivity” to “improvement,” that means it has secured land and energy offers and is engaged on design and commercialization.

To finance the initiatives, the agency plans to attract in as much as $$2.4 billion in liquidity from numerous sources. That features borrowing towards its 10,000 BTC stash price roughly $1.1 billion, a $200 million revolving credit score line, an expanded $130 million facility from Coinbase and a lately launched $1 billion at-the-market fairness providing.

Funding financial institution Roth Capital seen the growth plans as a “notable step-up,” with potential to “materially re-rate the inventory” because the websites come on-line and get contracted for AI and high-performance computing.

Learn extra: Bitcoin Mining Faces ‘Extremely Troublesome’ Market as Energy Turns into the Actual Forex