Hyperliquid now controls roughly 80% of the decentralized perpetual futures market, highlighting its fast dominance over rivals. Nonetheless, this focus raises considerations about sustainability and potential dangers if buying and selling volumes decline.

Abstract

- Hyperliquid has shortly develop into the main decentralized perpetual futures platform, dealing with as much as $30 billion in each day trades.

- Its lean, self-funded group constructed a quick, execution-focused blockchain with fee-sharing incentives that appeal to merchants and builders.

- Regardless of fast progress, dangers like validator focus, transparency gaps, and reliance on excessive buying and selling volumes go away its future unsure.

In simply over a 12 months, Hyperliquid has grown into the dominant participant in decentralized perpetual futures, with Redstone estimating it controls about 80% of the market, buying and selling volumes on par with huge centralized exchanges, and contemporary considerations over how lengthy such concentrated exercise can final.

At its peak, the platform processed as a lot as $30 billion in each day trades. That milestone, just a few decentralized exchanges have ever reached, regardless of being run by a lean group of simply 11 folks.

The platform, co-founded by Jeff Yan, a former Hudson River Buying and selling quant and Harvard graduate, selected from the begin to keep away from enterprise capital, a call that, mixed with timing, gave Hyperliquid a gap it exploited quicker than rivals.

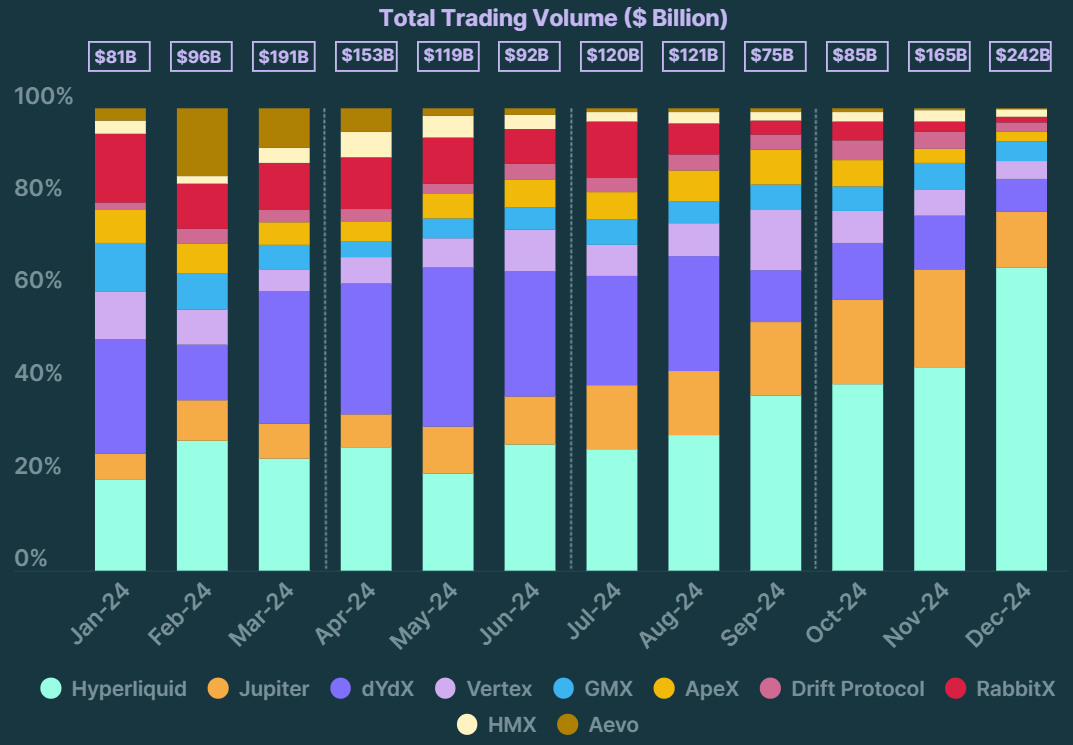

Buying and selling quantity throughout decentralized exchanges | Supply: CoinGecko

At the beginning of 2024, decentralized change dYdX had roughly 30% of buying and selling quantity throughout decentralized exchanges. By the top of that 12 months, its share had fallen to round 7%, whereas Hyperliquid’s share stabilized above 65%, per CoinGecko’s knowledge.

A lot of Hyperliquid’s progress appears tied to execution. One-click buying and selling, zero gasoline charges, and sub-second order finalization make it really feel nearer to a centralized change than most DEXs, which has helped appeal to each retail {and professional} merchants.

“Constructed by a lean, self-funded group that refused to just accept VC buyers’ cash, they’ve confirmed that technical excellence and community-first economics can outcompete well-funded rivals.”

RedStone

You may also like: Hyperliquid API outage causes freeze on buying and selling, HYPE down 5%

The platform runs by itself blockchain with HyperBFT, a consensus system designed to course of lots of of hundreds of orders per second with settlement finality beneath a second. By focusing first on velocity and reliability earlier than increasing infrastructure, Hyperliquid seems to have earned credibility amongst merchants quicker than most friends.

Incentives and Income

The platform splits buying and selling charges with its group. Individuals who listing new spot markets can maintain as much as half of the charges these trades generate. Builders who construct person interfaces earn a share that may even exceed the protocol’s personal minimize. And those that launch perpetual markets share their charges with the buyers who stake behind them.

This setup has pushed outdoors builders to construct on the platform without having grants or subsidies. They’ve already created instruments to fill gaps like letting merchants use one stability throughout completely different positions or borrow towards their belongings. The result’s a rising ecosystem that competing decentralized exchanges haven’t been in a position to replicate.

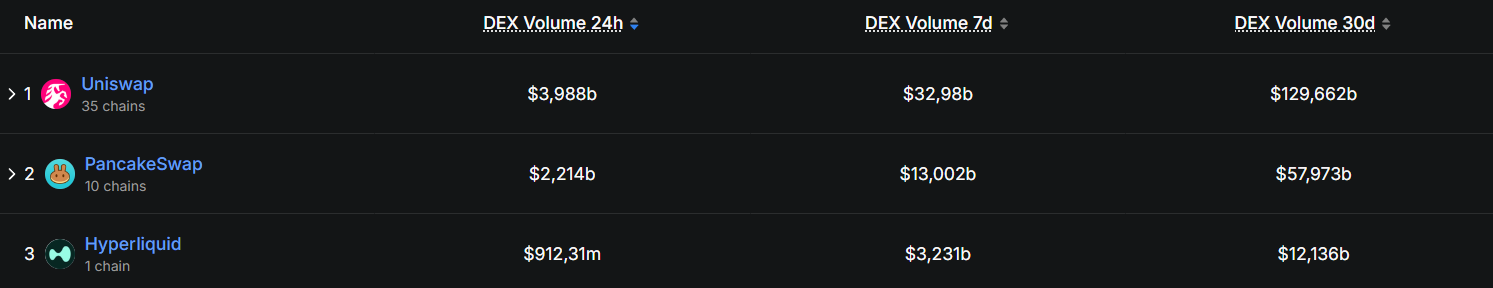

Decentralized exchanges by buying and selling quantity | Supply: DefiLlama

DefiLlama knowledge reveals Hyperliquid ranks third amongst decentralized exchanges by weekly buying and selling quantity, producing over $12 billion, behind solely PancakeSwap and Uniswap. That surge has helped Hyperliquid produce greater than $1 billion in annualized income, translating to an estimated $102.4 million per worker.

As beforehand reported by crypto.information, that determine exceeds Tether at $93 million, OnlyFans at $37.6 million, Nvidia at $3.6 million, and Cursor at $3.3 million.

Dangers forward

A joint report from OAK Analysis and GL Capital notes that regardless of Hyperliquid’s fast progress, “a number of key milestones should nonetheless be met to validate [the valuation] thesis.”

“Centralization stays a priority, with solely 16 validators, and the dearth of transparency within the codebase may deter third-party builders. Whereas full management over the infrastructure is a strong mannequin, it additionally exposes the platform to vulnerabilities, as demonstrated by the HLP incident.”

OAK Analysis and GL Capital

The platform’s reliance on sustained buying and selling quantity additional amplifies danger. A protracted bear market may briefly depress returns and problem the token buyback system that helps a lot of the HYPE ecosystem.

From a valuation perspective, analysts describe the chance as “uneven danger/reward,” with HYPE’s honest worth estimated between $32 and $49 beneath conservative assumptions, which is about 86% of the highest of that vary, on condition that HYPE is buying and selling at $42.

Hyperliquid has demonstrated fast adoption, but it surely nonetheless faces a number of structural and market dangers. Validator focus, transparency gaps, reliance on excessive buying and selling volumes, and execution-dependent progress all imply that outcomes stay delicate to each inside selections and exterior market circumstances.

Learn extra: Circle chooses Hyperliquid as its subsequent USDC stronghold amid $5.5b AUM increase