Over the previous few years, a wave of digital asset corporations collapsed for a mixture of causes—some dragged down by earlier disasters just like the FTX and Terraform Labs fiascos. Right here’s a more in-depth have a look at a handful of wallets tied to these now-defunct ventures and a glimpse at what’s nonetheless sitting onchain.

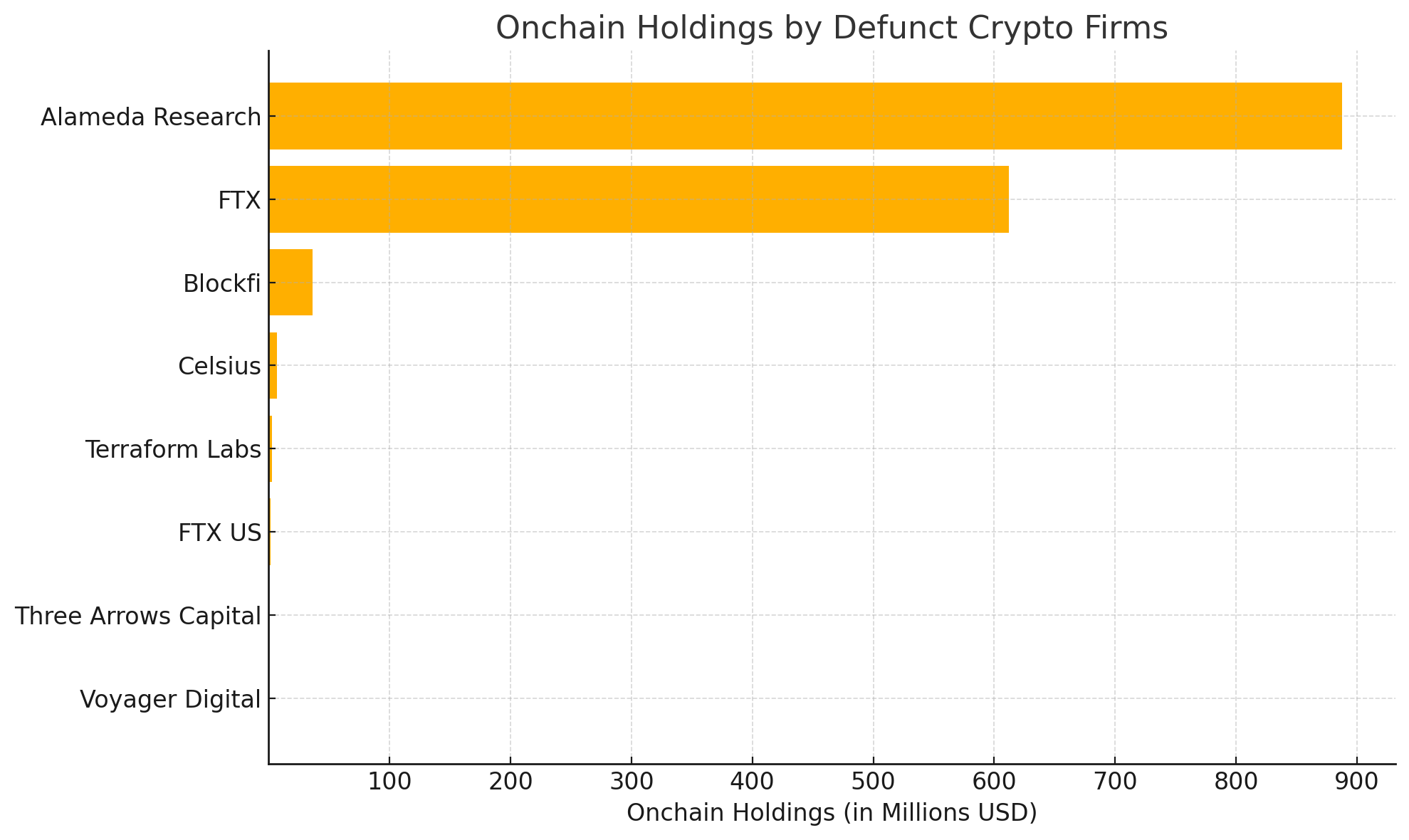

Collapsed Crypto Entities Nonetheless Management $1.5B in Onchain Wealth

Although these firms have vanished attributable to collapses and bankruptcies, their wallets—comparable to these tied to FTX—stay beneath the stewardship of court-appointed chapter estates. These wallets proceed to retain substantial sums onchain, quietly preserving important worth amid the wreckage. Terraform Labs imploded in Could 2022 when its algorithmic stablecoin UST broke from its peg, erasing roughly $45 billion and knocking down corporations like Three Arrows Capital and Celsius in its wake.

FTX adopted in November 2022, unleashing a broader shockwave after disclosures revealed buyer funds had been misappropriated and leveraged to help its personal token. But as of June 14, information from Arkham Intelligence exhibits Terraform Labs nonetheless holds $2.45 million onchain. Most of that worth resides in two tokens: $1.26 million in convex finance token (CVX) and $1.09 million in governance OHM (GOHM).

Then there’s FTX. In response to Arkham, the bankrupt alternate controls wallets holding $611.93 million in digital belongings. Roughly $266 million stems from its 9.777 billion OXY tokens. One other $232 million is tied to FTT, the platform’s native token—which, curiously, nonetheless trades at $0.90 per coin. As of press time, FTX wallets include 257.87 million FTT. The agency additionally retains about $52 million in MAPS and $16.31 million in FIDA.

FTX US, the American arm of the now-defunct alternate, nonetheless controls $1,640,348 in onchain belongings, with the lion’s share coming from 5.938 million tron ( TRX). Blockfi, the crypto lender that filed for chapter in November 2022 following its publicity to FTX, maintains $36.37 million in digital holdings. Most of that sum is concentrated in ethereum ( ETH), with the agency sitting on 12,223 ETH valued at $30.84 million.

Celsius Community, which halted withdrawals and entered chapter in July 2022 amid liquidity woes and dangerous bets, at the moment holds $6.89 million. Its largest asset is $6.1 million in SAVAX, together with a smaller $576,000 in ETH. Wallets tied to Voyager Digital—which additionally filed for chapter in July 2022—retain a comparatively minor $41,600, indicating minimal onchain publicity.

In the meantime, Alameda Analysis, the quantitative buying and selling arm of FTX, nonetheless holds a formidable $887.46 million in digital belongings. Of that, roughly $735 million is in solana ( SOL), with the agency’s wallets securing 5.099 million SOL. Alameda’s reserves additionally embrace $52 million in ETH and 205.006 BTC, value $21.61 million. In distinction, Three Arrows Capital (3AC) holds a mere $46,036—simply over $27,000 of which is in tether ( USDT). On the time of writing, these eight defunct entities collectively maintain an eye-popping $1.546 billion in onchain belongings.