Bitcoin maintains its bullish type from April because it good points by over 4% within the first two days of Could to surge above $97,000. Following this latest achieve, the premier cryptocurrency is experiencing a minor retracement as buyers try and decipher the present market section.

In the meantime, a outstanding crypto analyst with the X deal with IT Tech has shared some worthwhile insights on Bitcoin’s market construction, highlighting the important thing value ranges that might resolve the asset’s motion within the brief time period.

Bitcoin Cools Off After Worth Rally: Breather Or Bull Lure?

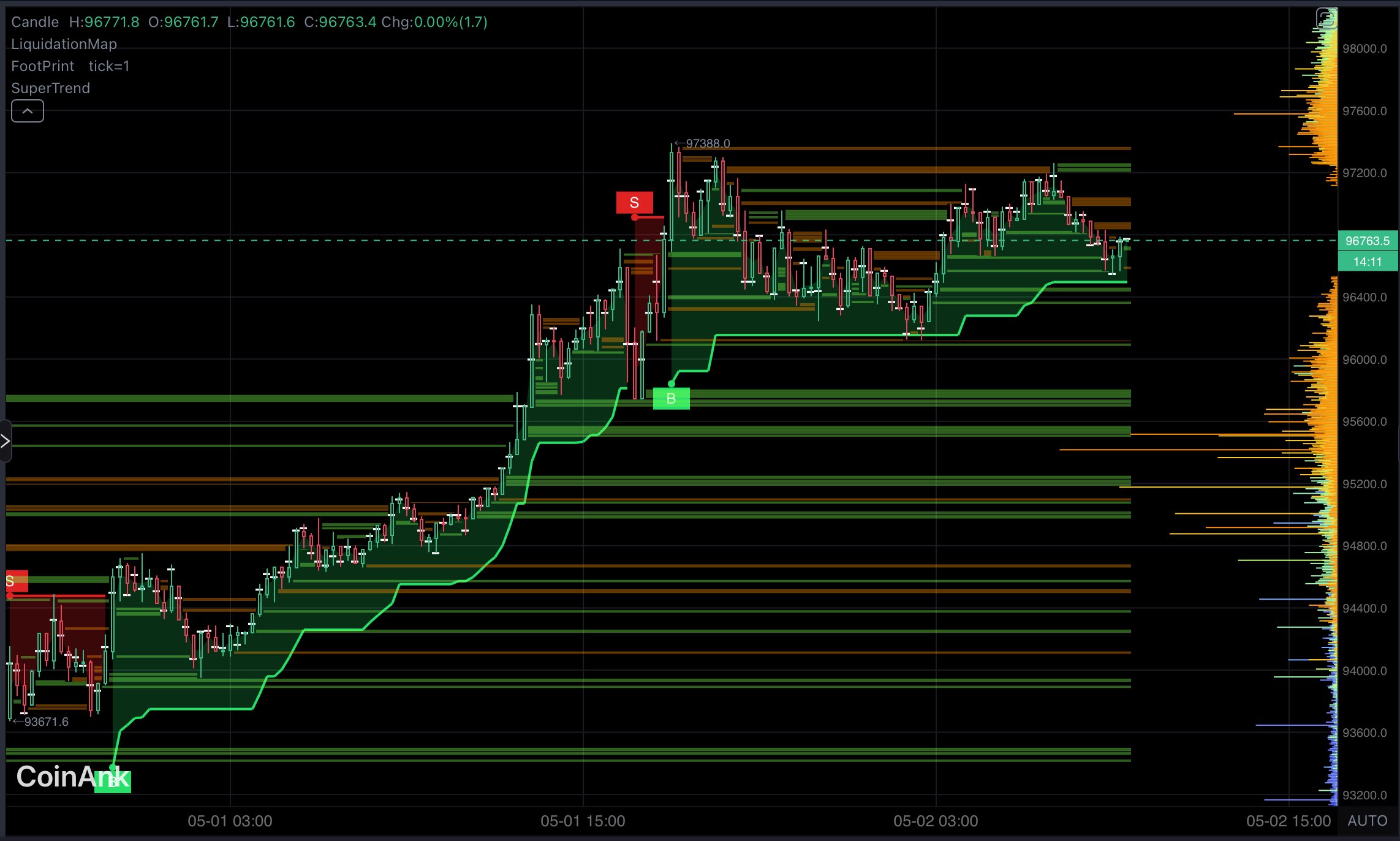

In keeping with IT Tech in an X put up on Could 2, Bitcoin seems to be catching its breath following a value rally from $93,600 to above $97,000. As market merchants await to see if this will probably be a mere cooling interval earlier than one other upswing or the beginning of a deeper value correction, IT Tech has shared some useful technical and on-chain insights on potential value targets.

The analyst states that the Bitcoin SuperTrend Indicator had printed a purchase sign when costs hit $94,000, adopted by a promote sign at $97,300. Nevertheless, with market costs nonetheless above $94,000, the Bitcoin market construction and SuperTrend Indicator stay bullish.

In the meantime, liquidation information has additionally hinted at potential factors for value volatility. Most notably, IT Tech states there are lengthy liquidation zones between the $95,200 – $96,000 value area and one other dense cluster of orders on the $93,600 – $94,000 value area. Each areas are anticipated to behave as sturdy value helps within the case of an sudden decline.

In figuring out Bitcoin’s subsequent transfer, IT Tech says that market sentiment stays cautiously bullish so long as the $96,000 help stage stays legitimate. It’s because a decisive value fall under this stage would set off a liquidation cascade pushing costs again to $94,000. In the meantime, one other value breakout above $97,400 to permit Bitcoin to commerce as excessive as $98,500.

What’s Subsequent For Bitcoin?

At press time, Bitcoin trades at $96,463, reflecting a 1.64% achieve up to now seven days. In the meantime, the asset’s buying and selling quantity is down by 21.82% and valued at $26 billion.

As earlier acknowledged, bullish sentiment continues to ravage the market as indicated by latest developments, together with the surge in Bitcoin Spot ETF inflows. In the meantime, the US’s willingness to barter a brand new commerce take care of China might signify no additional detrimental developments on worldwide commerce tariffs.

Amidst Bitcoin’s latest bullish stint, analysts proceed to roll out bullish predictions with lofty value targets as excessive as $150,000.

Featured picture from Pexels, chart from Tradingview