- The Ethereum value is close to the vital trendline and will bounce or slice via the $1,800 excessive.

- Whales have purchased 449,000 ETH, and change balances are being diminished.

- The degrees of $1,670 and 2000$ appear to be essential for ascertaining whether or not the value will flip bullish or fall additional.

Ethereum (ETH) has proven notable indicators of power regardless of ongoing bearish market strain. Just lately, the on-chain information present that long-term traders maintain 449,000 ETH whereas nonetheless in losses, demonstrating their confidence within the additional progress of ETH. Alternate reserves have additional decreased to 19.1 million ETH, conserving with the development of customers shifting their property off exchanges and holding them in private wallets.

Supply: CryptoQuant

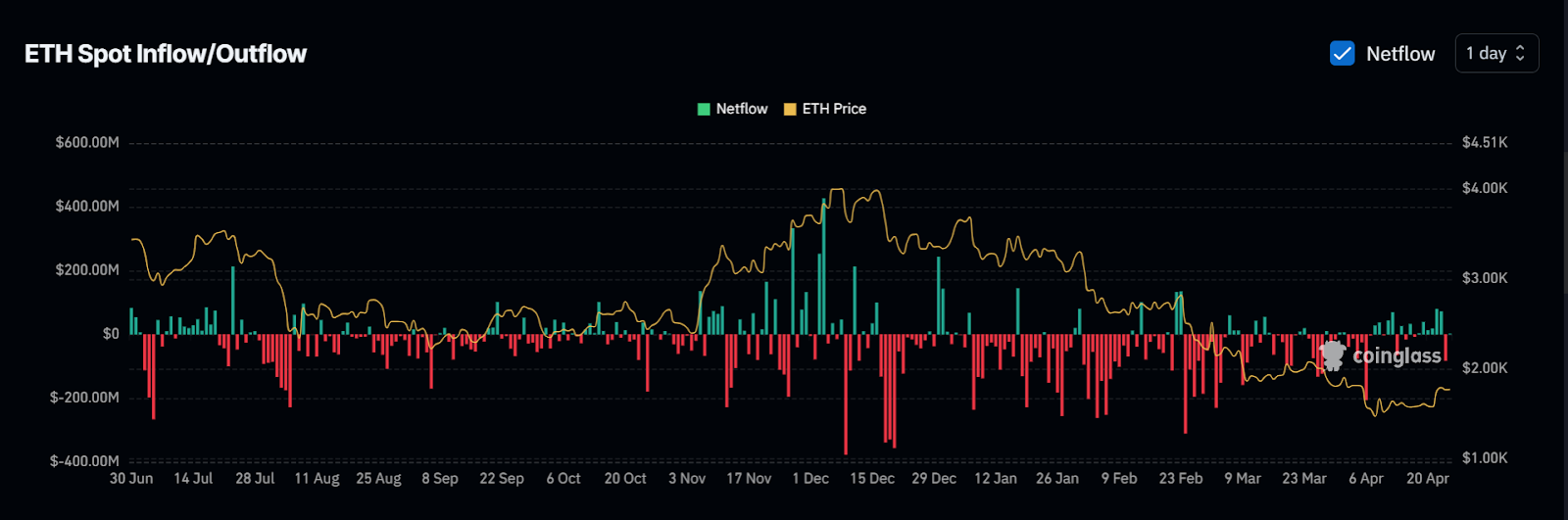

In the meantime, netflows stay largely unfavorable. The info obtained from Coinglass reveals that ETH has recorded extra outflows than inflows since February. Sustained outflow might imply a build-up on the buy-side and the relief of promoting strain, which might increase a rebound within the value.

Supply: Coinglass

Nonetheless, buying and selling quantity declined by 19.18% during the last 24 hours, which exhibits indicators that short-term demand is waning. On the time of writing, ETH trades at $1,775.60, up 1.12% previously day. It has gained 12.12% within the final week, lifting its market cap to $214.3 billion.

Key Ranges to Watch: $1,895 Resistance and $1,540 Help

Completely different technical analyses reveal a major zone of resistance close to $1,895, with a stage of $2,142 as pivotal for additional developments that will influence mass Ethereum bullishness. Bollinger Bands exhibits Ethereum is within the technique of crossing above the midline, however it has not been decided but. The RSI is nearer to 53.7,9, which requires impartial momentum whereas focusing on a hostile breakout previous 60, which can sign short-term continuation.

Supply: TradingView

In response to the dealer DonAlt, ETH must regain $2,000 as help to validate an even bigger turnaround. He identifies $1,670 as his present short-term pivot, hinting that any failure to carry above this stage will likely be bearish. If the value breaks beneath the impulse low at $1,540, a bearish sample would emerge to disprove the present construction.

Supply: X

Widespread dealer Crypto Caesar additionally famous that the asset is in an space the place it could be set to undergo a bullish breakout via a long-term descending development line. The tweet reads, “$ETH is on the verge of breaking out. We actually simply want that increased excessive…”

Supply: X

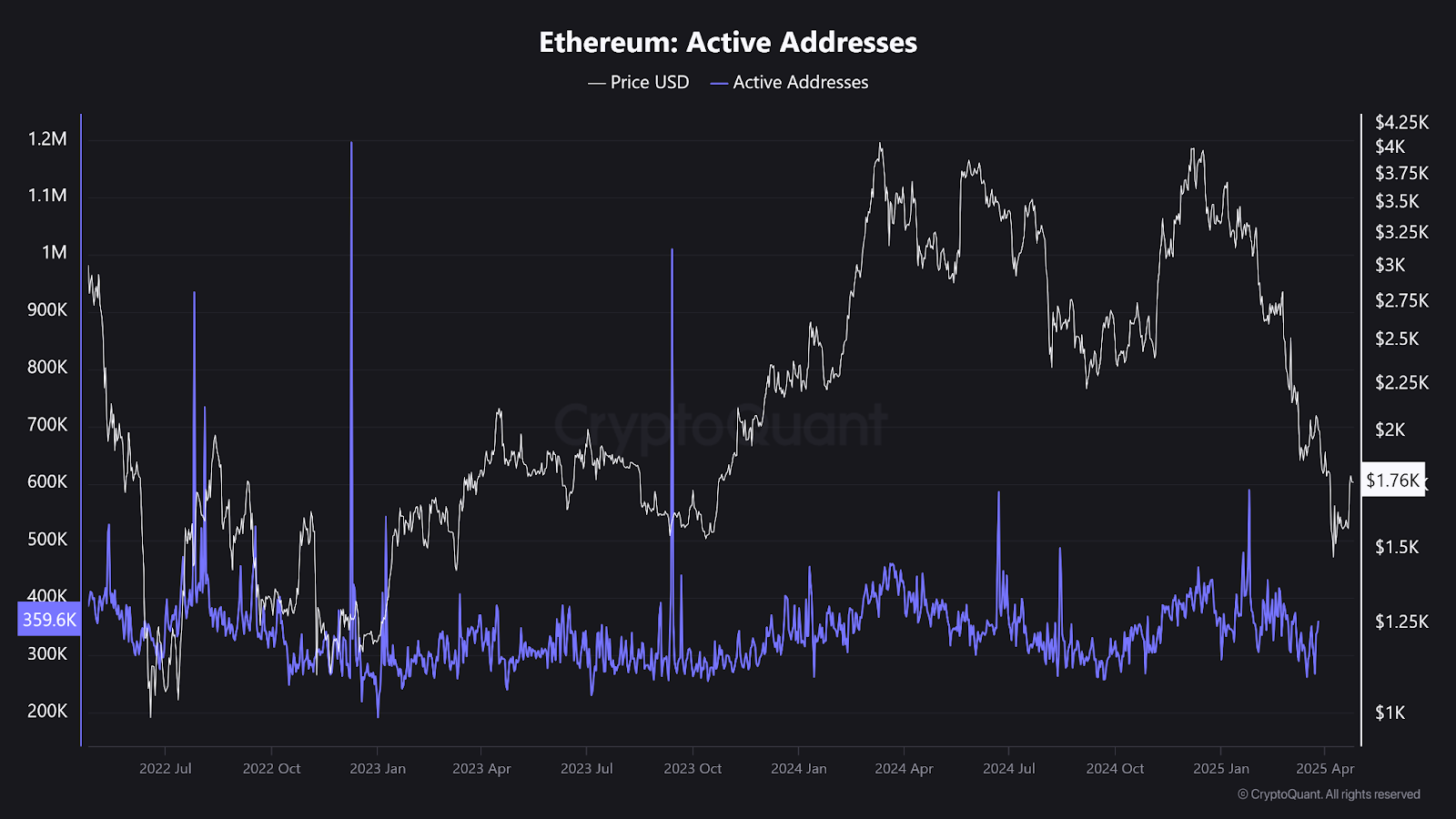

On-Chain Exercise Alerts Combined Sentiment

Ethereum’s lively addresses and transaction rely information inform a nuanced story. The lively addresses have hovered round 359,600, with a denotable sample of enhance but. This is able to imply that the engagement of customers has been kind of stagnant whereas the value has been trending upwards.

Supply: CryptoQuant

The full transaction rely hovers at almost 1.3 million per day, therefore signifying that general Ethereum utilization regularly stays excessive even inside a bearish area. Whereas it isn’t at bull market ranges, it’s sustained properly above the bear market stage low level.

The downtrend of change reserves additional strengthens the sign, suggesting that extra Ether is being withdrawn from change wallets, which extensively signifies accumulation. These reserves have halved from 2022, when it reached 30 million, to just about 19 million, a lower of 37% in two years. These counsel that there’s a basic reluctance amongst traders to promote their securities within the markets.