Ethereum has staged a powerful comeback, surging 21% from its $1,380 low to present ranges following per week of intense promoting strain. The rally started final Wednesday, triggered by a serious geopolitical growth: US President Donald Trump introduced a 90-day pause on reciprocal tariffs for all international locations besides China, which now faces a steep 145% tariff. The announcement injected a wave of optimism throughout international markets, with Ethereum among the many high beneficiaries.

Associated Studying: Bitcoin Whales Haven’t Made Their Exit But – Is The Bull Cycle Nonetheless Intact?

Regardless of this bullish restoration, ETH stays beneath essential resistance ranges, and the broader value construction continues to type a consolidation sample. The market now awaits affirmation of whether or not this rebound will evolve right into a full reversal or just a aid rally amid continued macroeconomic uncertainty.

Crypto analyst Ali Martinez shared a technical chart on X, highlighting that Ethereum is at the moment consolidating inside a symmetrical triangle on the hourly chart. In accordance with Martinez, this sample usually alerts an imminent breakout, and if ETH breaks upward, it might set off a 17% transfer to the upside.

As merchants and traders watch carefully, Ethereum’s subsequent directional transfer will doubtless rely upon each technical confirmations and broader sentiment round US-China commerce tensions and their impression on danger property.

Ethereum Faces Crucial Resistance Amid Macroeconomic Uncertainty

Ethereum is buying and selling at a pivotal resistance degree that might decide the subsequent main transfer out there. After rebounding 21% from its $1,380 low, ETH now sits just under key ranges that, if reclaimed, might spark a broader restoration rally. Regardless of this robust bounce, macroeconomic tensions stay in focus, with ongoing uncertainty round US tariffs and overseas coverage—particularly the 145% tariff on China—maintaining traders cautious.

The crypto market, like equities, continues to be formed by international developments. Whereas some analysts consider Ethereum has already priced within the worst of the downturn, others argue that the latest rally is barely a brief aid inside the early phases of a broader bear market. The talk displays the present state of sentiment: blended and pushed extra by short-term reactions than long-term conviction.

Nevertheless, from a technical standpoint, Ethereum could also be establishing for a decisive transfer. In accordance with Martinez, ETH is at the moment consolidating inside a symmetrical triangle on the hourly chart. This sample usually precedes a breakout, and Martinez suggests {that a} 17% transfer might comply with. If Ethereum breaks to the upside, it might push the value again towards the $2,000 degree—a psychological and technical milestone for the asset.

For now, all eyes are on whether or not bulls can preserve momentum and breach the higher trendline of the triangle. A robust breakout might sign a shift within the broader market narrative, remodeling present consolidation into the inspiration for a sustained rally. Nonetheless, given the unstable macro atmosphere, merchants stay cautious, expecting affirmation earlier than totally committing to a bullish thesis.

ETH Bulls Face Key Resistance Forward

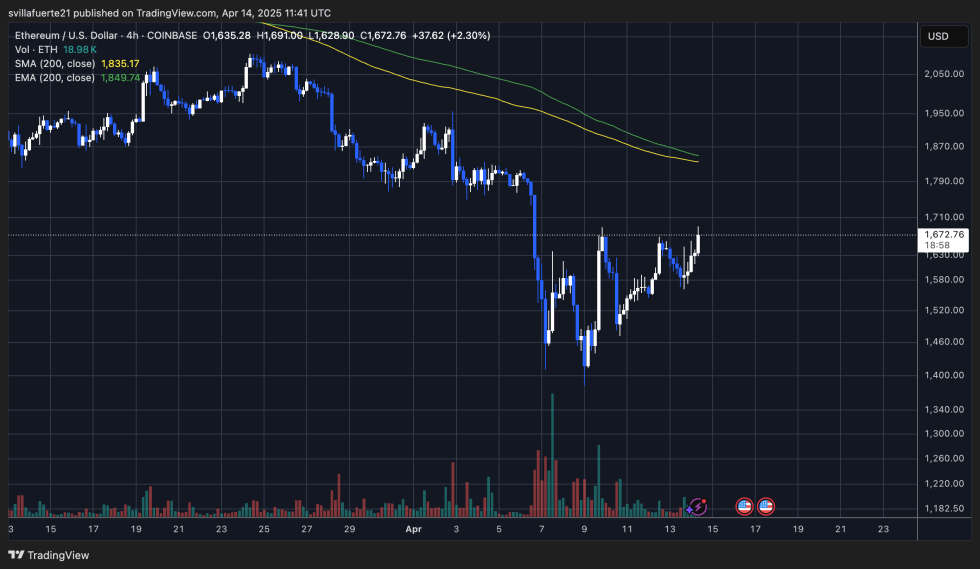

Ethereum is buying and selling at $1,670 after briefly setting a recent 4-hour excessive round $1,691—barely above the earlier peak. This minor breakout alerts that bullish momentum is constructing, but it surely stays fragile. To verify a full reversal and start a real restoration rally, ETH should reclaim the $1,875 degree, which aligns with each the 4-hour 200-day shifting common (MA) and the exponential shifting common (EMA).

These indicators have acted as robust dynamic resistance all through Ethereum’s latest downtrend, and solely a decisive break above them would validate bullish management and probably set off a surge again towards the $2,000 degree. A transfer previous $1,875 would additionally point out a shift in short-term market construction, giving bulls the arrogance wanted to drive larger highs.

Nevertheless, if Ethereum fails to push by means of this essential resistance zone, the asset dangers returning to decrease demand ranges. A rejection at these shifting averages might ship ETH again to $1,500 and even decrease, particularly if broader market sentiment deteriorates. With macroeconomic uncertainty and tariff-related volatility nonetheless looming, bulls have to act quick—or danger dropping the progress made throughout this restoration try. For now, all eyes are on the $1,875 threshold.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.