Ethereum (ETH) is dealing with growing stress from whale exercise as giant holders proceed to dump important parts of their holdings.

This ongoing sell-off comes throughout a difficult season for the cryptocurrency, with Ethereum grappling with poor value efficiency.

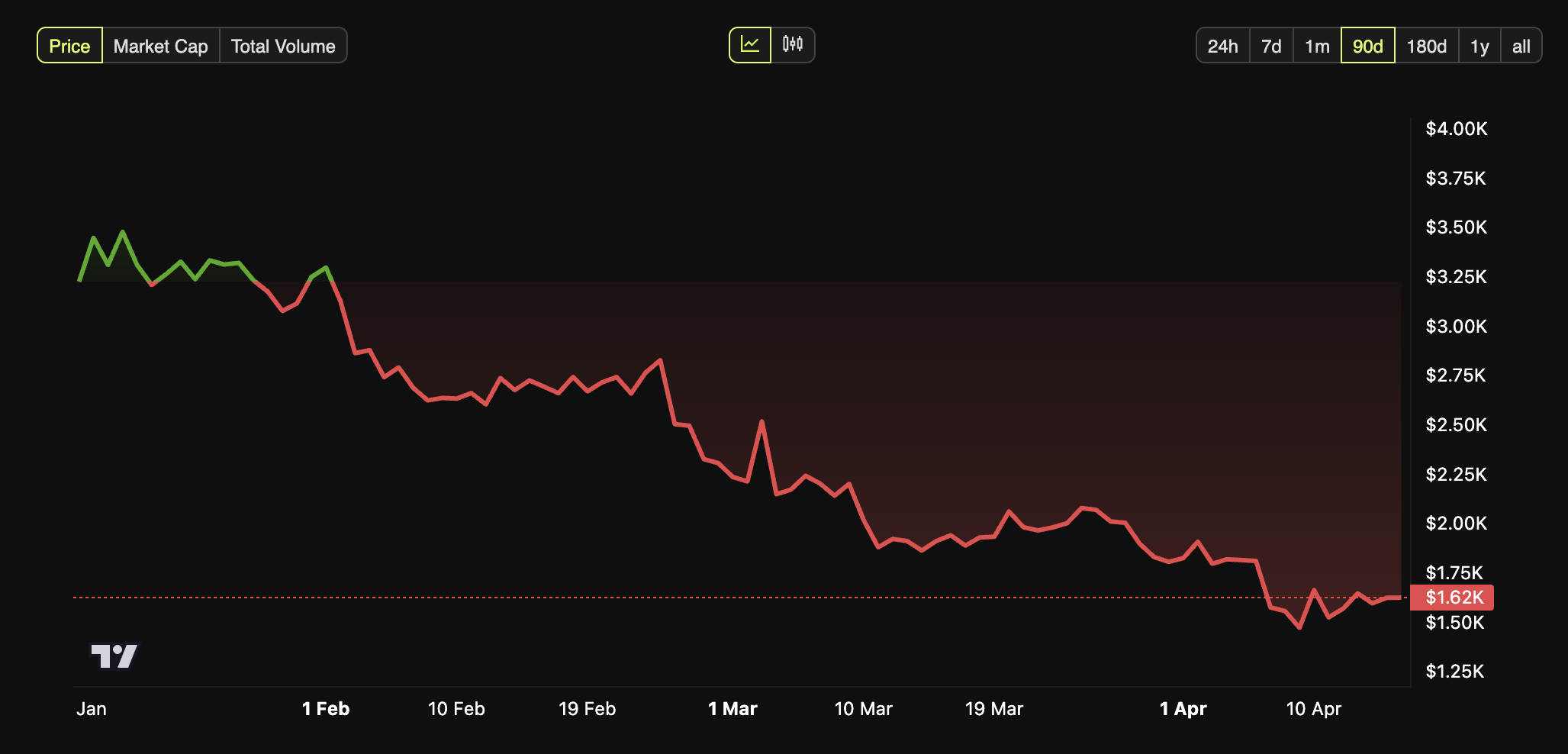

In line with knowledge from BeInCrypto, ETH has depreciated by 51.3% for the reason that starting of the 12 months. Whereas macroeconomic elements have weighed closely on the complete crypto market, Ethereum’s struggles have been particularly pronounced. Actually, final week, the altcoin plunged to lows not seen since March 2023.

Nonetheless, the tariff pause triggered a modest restoration in ETH shortly after. At press time, Ethereum was buying and selling at $1,623, a slight improve of 0.3% over the previous day.

Ethereum Value Efficiency. Supply: BeInCrypto

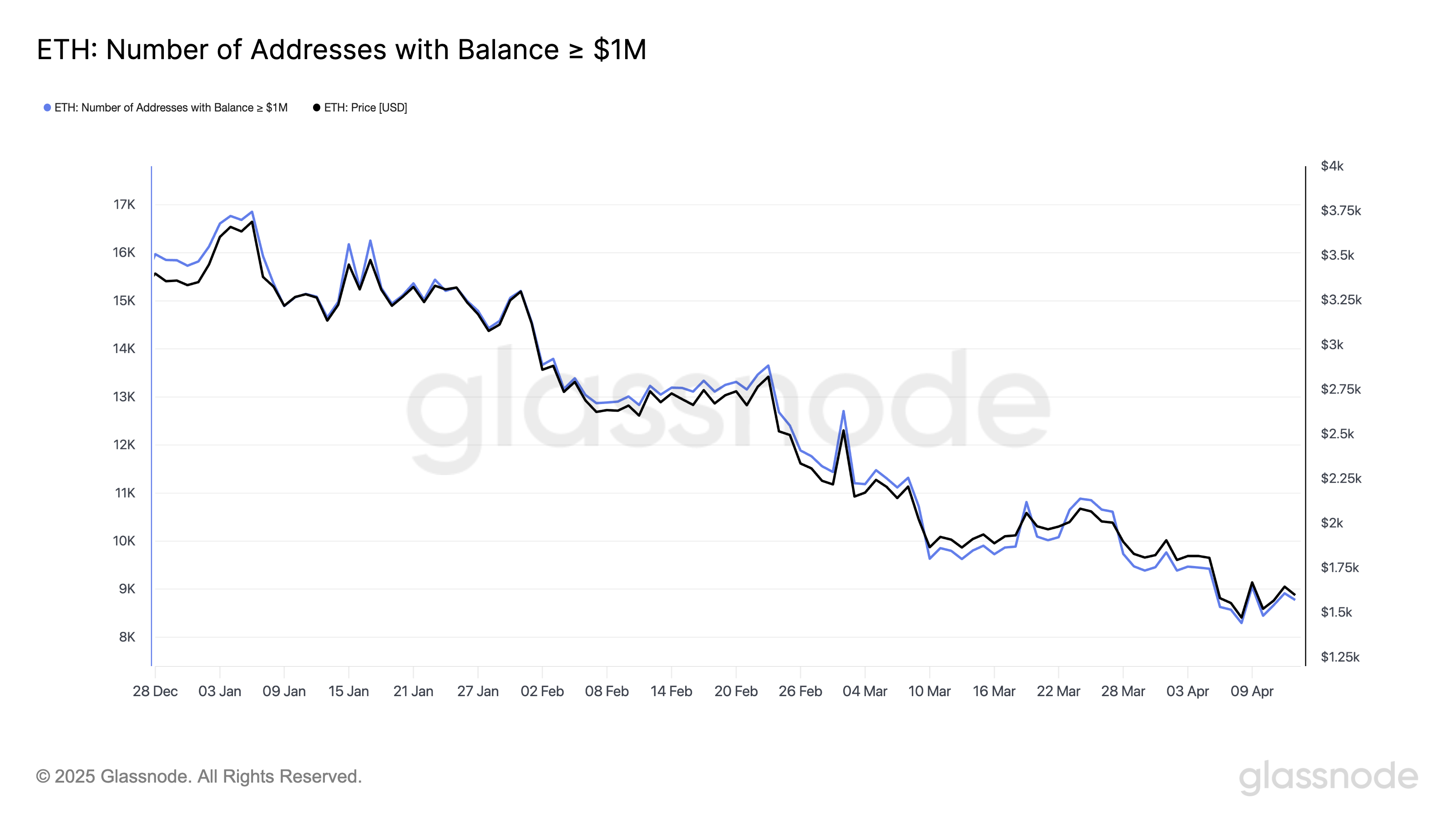

Regardless of this, the underwhelming efficiency has deterred buyers. Glassnode knowledge revealed that the variety of addresses holding at the least $1 million in ETH has decreased sharply year-to-date (YTD). Final week, these addresses dropped to lows not seen since January 2023, reflecting a notable discount in high-net-worth investor confidence.

Holders with at the least $1 million price of ETH. Supply: Glassnode

A more in-depth have a look at the most recent whale exercise corroborated the decline. On April 14, a whale deposited 20,000 ETH price $32.4 million into the Kraken change, doubtless getting ready for additional gross sales.

“The whale nonetheless has 30,874 ETH ($50.7 million) left, with $104M (+52.4%) in estimated whole revenue,” Spot On Chain famous.

As well as, an on-chain analyst revealed that an early 2015 ICO investor has been promoting persistently. On April 13, the whale offloaded 632 ETH, price roughly $1.0 million.

For the reason that starting of April, this investor has bought 4,812 ETH, valued at round $8.0 million. Remarkably, the preliminary funding price was as little as $0.3 per ETH, leaving the whale with a considerable stash of 30,189 ETH nonetheless in its possession.

Furthermore, one other dormant ETH whale, which had been inactive for years, has additionally began promoting. The tackle withdrew 3,019 ETH from HTX between August and December 2020. Then, the investor transferred the property to its present promoting tackle three years in the past.

On April 11, the whale made its first deposit of 1,000 ETH to Binance. On April 13, the whale deposited one other 1,000 ETH, elevating issues of a possible sell-off.

“Thankfully, the whale solely has 1,018 ETH left, so it is not going to trigger an excessive amount of promoting stress in the marketplace,” the analyst said.

The latest rise of dormant whales is noteworthy. Whereas their sell-offs nonetheless yield earnings, their exercise suggests they goal to keep up this pattern. In line with Glassnode, solely 36.1% of Ethereum addresses are presently worthwhile, indicating {that a} main portion of holders face losses.

Ethereum Holders in Revenue. Supply: Glassnode

In the meantime, the present scenario with Ethereum has led an analyst to attract comparisons to Nokia’s fall from dominance within the late 2000s. As BeInCrypto reported, the analyst warned that Ethereum might be headed for a decline, with extra scalable and sooner platforms like Solana (SOL) taking on.

Nonetheless, the pessimism isn’t widespread. Many analysts nonetheless foresee a possible for restoration, citing upcoming technological upgrades and the market’s undervaluation of ETH.