Trump’s newest tariff hikes on China might shift the worldwide Bitcoin mining business offshore, as home miners face elevated premiums on {hardware} prices.

Bitcoin (BTC) mining might quickly shift additional offshore as U.S. miners face rising {hardware} prices. On Wednesday, April 9, a brand new report from Hashlabs Mining CEO Jaran Mellerud highlighted the financial impression of U.S. tariffs on the home crypto mining business. Based on the report, these tariffs may enhance mining gear prices within the U.S. by no less than 22% in comparison with different nations.

Particularly, U.S. crypto miners rely closely on imported {hardware} from Asian nations equivalent to China, Indonesia, Malaysia, and Thailand — all of which are actually topic to a minimal 24% tariff on all items, together with mining rigs.

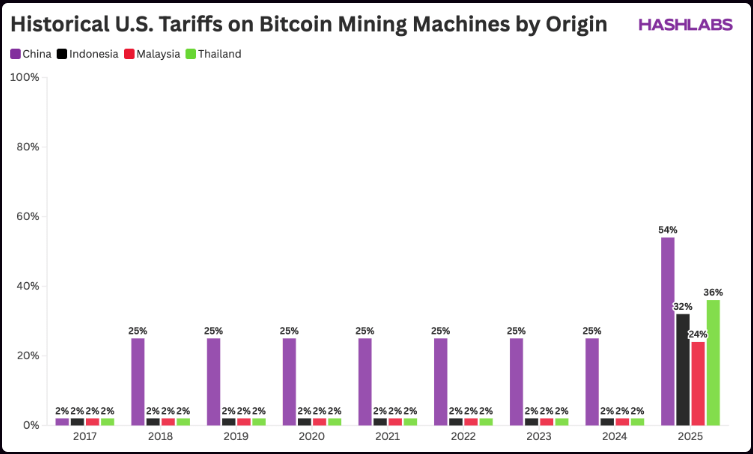

US tariffs on Bitcoin mining gear by nation of origin | Supply: Hashlabs

Even in essentially the most favorable state of affairs — sourcing completely from Malaysia, which faces the bottom charge — gear prices would nonetheless rise by 24%. Nonetheless, this state of affairs is unrealistic, as U.S. imports come from a mixture of suppliers throughout the area. Notably, the figures cited within the report don’t but account for the current 50% tariff hike on Chinese language items, which raises the whole tariff charge to 104%.

Nonetheless, there’s a mining gear stockpile within the U.S., which can drive costs down. As these shares are depleted, miners will probably must pay a premium someplace between 22% and 36% for the gear, in comparison with different nations. These figures come from Ethan Vera, the CEO of Luxor crypto mining firm, and are echoed within the Hashlabs Mining report.

U.S. Miners scrambled to import rigs forward of tariffs

This report is consistent with earlier fears by business insiders. Gadi Glikberg, CEO of CodeStream, said that whereas tariffs will decelerate the expansion of the US mining business. Attributable to the price of gear impacting their return on investments, additional enlargement plans are unlikely.

“The newly imposed tariffs are unlikely to set off a mass exodus. Nonetheless, they could decelerate or redirect future enlargement plans, as miners reassess the long-term cost-efficiency of scaling operations throughout the US,” Gadi Glikberg, CEO of CodeStream.

Taras Kulyk, CEO of mining gear brokerage Synteq Digital, revealed that his agency was working to hurry deliveries earlier than the tariff hike took impact.

You may also like: BTC mining hashrate hits ATH, intensifying stress on U.S. miners squeezed by tariffs